Other

Archive for March, 2002

The GST – What you need to know

Thursday, March 28th, 2002Liquor Reforms: It’s up to municipalities

Monday, March 11th, 2002Reaction is mixed to later closing hours

BRIAN MORTON and ALAN DANIELS

Province

Vancouver Mayor Philip Owen isn’t in favour of extending the operating hours of pubs and restaurants but he’d like to examine allowing cabarets to stay open until 6 a.m.

“I’d prefer to study the possibility of [cabarets] staying open to 6 a.m., so [patrons] would leave when it’s light and they can use public transit,” Owen said. “But I don’t think I’d be in favour of pubs and restaurants. I’m not sure if that’s a good idea.”

The provincial government has announced a number of sweeping reforms to B.C.’s liquor laws, including a two-hour extension in drinking hours – from 2 a.m. to 4 a.m. – but municipalities must first approve it.

Owen said municipalities may be restricted in what they can do to control hours of operation, because liquor regulations are a provincial responsibility. “We have persuasive power, not legal power.”

However, Surrey Mayor Doug McCallum said that he understands municipalities would retain the right to set hours for pubs and cabarets.

“Most of our places are open until 12:30 or 2 o’clock. And the control mechanism, as I understand it, is with the city.”

McCallum said he doesn’t believe council would want the hours changed, although much depends on where the pubs and cabarets are located. “I don’t think council would support that [later hours].”

Meanwhile, Vancouver resident Emily Goetz isn’t too pleased about the new regulations, which could see her neighbourhood pub stay open until 4 a.m.

“The noise in that lane [echoes] like a canyon,” Goetz said of the alley that her home and Jeremiah’s Neighbourhood Pub, in the 3600-block of West Fourth, share. “I don’t want to be woken up at 4 a.m.”

Neighbour Neale Currie agrees, saying the pub’s current closing time of 1 a.m. on weekends and midnight on other days, is fine. “It’s a nice balance, the way it is now, so I’d be against [later hours]. You can hear cars going up our lane and it gets louder when it’s later. There’s a lot of spillover.”

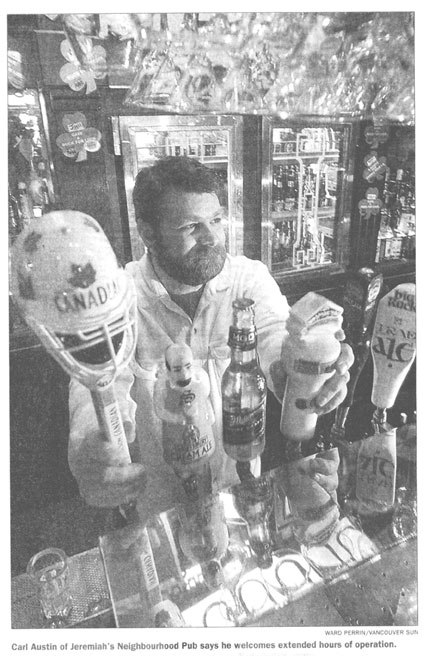

However, Jeremiah’s manager Carl Austin says the new liquor rules are timely, although he doesn’t know if the pub will decide to stay open later.

“Any change is good. But whether we have extended hours, we’ll have to look at that.”

Austin said more customers could show up at their pub if it stays open later, though he thinks existing clientele would simply stay longer.

“But I don’t think we’ll have problems with the neighbourhood. It’s better they [customers] are in here than out on the street.”

Jennifer Crawford, owner of the Raven Pub in North Vancouver, said she looks forward to possibly staying open later. “We now close at 12:30 a.m. It would be excellent if we can stay open until 2 a.m.”

Juanita Giroux, a bartender with the Billy Miner Neighbourhood Pub in Maple Ridge, agreed that later hours would be great for business. “Cool, that’s what I say. I don’t think anybody would have a problem with that.”

While many residents are concerned about the effect on neighbourhoods, Mark Schindler, who lives near Darby D. Dawes Pub in Vancouver, isn’t one of them.

“I think it [the prospect of later hours] is wonderful. I haven’t had a problem with the noise when they close.”

West End Residents’ Association director Marie Claire Seebohm said West End pubs and restaurants are generally considerate of residents, but later hours could mean more partyers coming downtown and more drunk drivers on local streets.

Wayne Holm, president of Spectra Inc., a group of restaurants that includes Milestones, The Boathouse and Macaroni Grill, said the new rules are long overdue, especially one that

allows restaurants to serve alcohol without ordering food. “This brings us into the proper century.

“In the bar area of our restaurants, it will allow us to be on an equal footing with pubs and hotel bars.”

Holm said some of their restaurants may stay decide to stay open later. “If we’re in a strong urban market, we may stay open late. Possibly for an [extra] hour or two.”

Tourism Vancouver spokesman Walt Judas said the new rules will be good for tourism. “Visitors have certain expectations and this gives them a choice. These changes will be welcomed by many in the tourism industry.”

B.C. proposes sweeping liberalization of liquor laws

By JIM BEATTY

VICTORIA – British Columbians may soon be able to drink until 4 a.m. in bars and buy spirits in private liquor stores as the B.C. government expands the rules governing the sale and consumption of alcohol.

In what may be the most sweeping reform of B.C.’s liquor laws since prohibition was lifted in 1921, the provincial government is extending drinking hours by two hours, allowing the sale of hard liquor n beer and wine stores, cutting liquor laws by 25 per cent and expanding the availability of booze in rural B.C.

In addition, the province will lift the moratorium on the number of cold beer and wine stores, which was capped at 290, and will allow existing stores to expand.

Solicitor General Rich Coleman said the changes will simplify and modernize B.C. s complex liquor laws while making the province more attractive to tourists.

“These changes will provide more consumer choice for beverage alcohol purchases,” Coleman said Friday after receiving unanimous support at an open cabinet meeting.

“By having the restrictions we’ve had, we have actually turned an industry into dinosaurs over a number of years,” Coleman said, citing the incremental increase in liquor laws over 80 years.

“It is time to rethink the [licensing] scheme in the context of today’s world and eliminate those rules not clearly focused on public safety or community standards.”

Beer and wine stores will be allowed to sell hard liquor as of April 2, which will generate another $15 million for the province. Most of the other changes will take place in the next few months once new regulations are written.

Coleman said municipalities will have to approve of many of the changes that would allow for more drinking establishments, more liquor sale outlets, fewer rules and extended drinking hours.

For example, the province will allow a two-hour extension in drinking hours – from 2 a.m. to 4 a.m. – but municipalities, such as Vancouver, must first approve it.

“There is no reason to believe that a large number of [new] licences will occur,” Coleman said. “Licences will not be granted where there is evidence the market is already saturated.”

At present, a complex tangle of 19 licensing categories define which establishments can serve liquor, including hotels, bars, pubs and cabarets.

We have actually turned an industry into dinosaurs over a number of years.

RICH COLEMAN B.C.’S SOLICITOR-GENERAL

The changes introduced Friday will reduce the number of categories to two: Establishments will either be “food primary,” such as cafes and restaurants, or “liquor primary,” for bars, pubs and lounges.

The government plans to cut more than 25 per cent of B.C.’s 5,800 liquor regulations, which have long been a source of irritation for the hospitality industry.

The regulations control everything from the positioning of walls and the colour of paint to the type of furniture and the advertising on coasters.

“We’re not going to be in the business of having silly rules on liquor. We’re going to be in the business of public safety.”

By cutting “oddball” regulations, as many as 14 licensing inspectors will be freed up to enforce underage drinking laws and rules on over consumption and overcrowding. In addition, there will be increased enforcement on illegal booze cans, operating primarily in Vancouver, which serve alcohol after the legal bars close their doors.

Competition Minister Rick Thorpe said the changes, particularly the expansion of spirits to cold beer and wine stores, will increase customer convenience and selection.

“There is overwhelming support from the public to have spirits available in cold beer and wine stores,” he said.

The changes may open the door to privatizing B.C. s 222 government liquor stores, but Thorpe said the province is several months away from a decision.

The B.C. government is also changing the rules affecting liquor sales in rural British Columbia, where booze is sold from 144 rural agency stores, such as general stores.

The government is cutting regulation to allow for more rural outlets to sell liquor.

“Why should somebody that lives in a rural community have to drive 20 kilometres to buy a bottle of wine for dinner or a six pack of beer to watch the hockey game?” Thorpe said. “Why shouldn’t they have the same access in rural British Columbia that all other British Columbians have in major markets?”

Buying a condo needn’t be complicated

Saturday, March 9th, 2002Relax: Daryl Simpson of Bosa Ventures puts buyers’ minds at rest.

STEVE WHYSALL

Sun

So you’re keen to buy a new condo instead of paying rent, but you’re not sure you can afford it.

Perhaps you’re a first-time buyer and nervous about taking the leap and eager to know more about the financial complexities of buying a new home.

Daryl Simpson, sales and marketing executive at Bosa Ventures, one of B.C. s biggest new homebuilders, knows plenty about condo financing.

“First-time buyers have a lot of important questions they need to get answered,” he says. “They want to know exactly how much mortgage they qualify for, what happens to the money they put down as a down payment, and they want to make sure they are aware of any hidden costs.”

Developers have different down payment requirements, says Simpson. Some ask for five per cent of the total purchase price when you buy and then a further series of five per cent payments to make a total 25 per cent by the time the new home is complete.

This is good in one respect because it means buyers have a sizeable equity by the time they move in, but it also tends to keep some first-time buyers from getting into the market.

Other developers require a $1,000 deposit at the time of purchase and then another payment to bring the total to five per cent of the purchase price when all subjects are removed and the contract becomes firm and binding. In most cases, this takes less than a week.

“The down-payment money doesn’t go into the developer’s pocket. That’s a popular misconception,” says Simpson. “The deposit is designed to shift some of the risk to the purchaser. What the developer is looking for is a show of commitment from buyers that they are going to see the project through.”

Other provinces allow developers to post a bond and insure deposited funds so they can withdraw them and put them to use. “But in B.C. you can’t touch these funds. Provided the necessary safeguards were in place for consumers, I don’t think it would be a bad things, but most developers don’t find it necessary anyway.”

Deposited down payments do allow a developer to get financing, so in a sense they are used to advance a project, he says.

“For instance, a lending institution will look at the trust account and see all the people who have purchased. This translates into confidence in the project. It is an indication that there is sufficient equity.”

Another misconception is that if you take out a mortgage on a condo that hasn’t been built yet, you start making mortgage payments before you move in.

“This scares a lot of people off. But the fact is that when you get pre-approved for a mortgage, you don’t start making your monthly mortgage payments until the building is complete and you actually move in to your new home.”

As for how much mortgage a person qualifies for, Simpson says the formula for calculating

the amount is straightforward. “What a mortgage broker will do is take a person’s gross annual income and multiply it by.32 (the gross debt service ratio) and divide the result by 12 to get the monthly payments. That gives the lender an idea of how much mortgage a buyer can afford.”

Simpson recommends that all buyers should visit their bank or credit union before going condo shopping. This is simply to avoid disappointment, but many developers have representatives of a lending institution at their presentation centre to provide immediate assistance and advice.

Some developers offer a mortgage buy-down or a mortgage cap. This means the developer and the lending institutions have got together and worked out a financial package where the developer either agrees to pay the difference to “buy down” mortgage payments to a more affordable monthly payment or the financial institution agrees to freeze a certain interest rate for a number of years in exchange for the opportunity to represent buyers.

This arrangement gives buyers confidence that once they get into their new home, they will be able to afford the payments for the next two or three years. With a buy-down, mortgage interest rates can be cut as low as 2.9 or 3.9 per cent.

One of the most creative ideas in condo financing at the moment is a product called Equity Edge; says Simpson.

“‘this is sold by London Guarantee, the leading warranty insurance provider in B.C. It allows a buyer to purchase a bond to the value of the down

payment instead of coming up with cash.”

The price is 2.5 per cent of the value of the bond plus $100 application. Which for $10,000 would be $350.

Not all developers will accept the bond as part of a down payment, but it is worth asking about, Simpson says.

As for closing costs, there is GST, which is reduced from seven per cent to 4.8 per cent on a new home priced through a government rebate and the property transfer tax (PTT) which is one per cent of the price of homes under $250,000.

“Lawyers fees are usually about $600 but a lot of banks and credit unions will take care of these if you take a mortgage out with them,” Simpson says.

Simpson says buyers have 72 hours to change their mind from the moment all subjects are removed and the contract is signed and becomes firm and binding.

Finally, buyers could be responsible for a share of property taxes and water levy. “If the seller has prepaid the property taxes, the statement of adjustments will make you assume the balance of the property taxes for the year.”

When do realtors get paid? Not a big concern for buyers, but commissions are something paid in full at the time of purchase and sometimes half is paid at time of purchase and the rest when the buyer takes occupancy.

Regardless, the fee for a realtor’s services is always paid by the seller, never by the buyer, Simpson points out.

Ins & Outs about buying a condo

Saturday, March 9th, 2002Buying a condo needn’t be complicated

Sun

|

Relax: Daryl Simpson of Bosa Ventures puts buyers’ minds at rest. By STEVE WHYSALL So you’re keen to buy a new condo instead of paying rent, but you’re not sure you can afford it. Perhaps you’re a first-time buyer and nervous about taking the leap and eager to know more about the financial complexities of buying a new home. Daryl Simpson, sales and marketing executive at Bosa Ventures, one of B.C. s biggest new homebuilders, knows plenty about condo financing. “First-time buyers have a lot of important questions they need to get answered,” he says. “They want to know exactly how much mortgage they qualify for, what happens to the money they put down as a down payment, and they want to make sure they are aware of any hidden costs.” Developers have different down payment requirements, says Simpson. Some ask for five per cent of the total purchase price when you buy and then a further series of five per cent payments to make a total 25 per cent by the time the new home is complete. This is good in one respect because it means buyers have a sizeable equity by the time they move in, but it also tends to keep some first-time buyers from getting into the market. Other developers require a $1,000 deposit at the time of purchase and then another payment to bring the total to five per cent of the purchase price when all subjects are removed and the contract becomes firm and binding. In most cases, this takes less than a week. “The down-payment money doesn’t go into the developer’s pocket. That’s a popular misconception,” says Simpson. “The deposit is designed to shift some of the risk to the purchaser. What the developer is looking for is a show of commitment from buyers that they are going to see the project through.” Other provinces allow developers to post a bond and insure deposited funds so they can withdraw them and put them to use. “But in B.C. you can’t touch these funds. Provided the necessary safeguards were in place for consumers, I don’t think it would be a bad things, but most developers don’t find it necessary anyway.” Deposited down payments do allow a developer to get financing, so in a sense they are used to advance a project, he says. “For instance, a lending institution will look at the trust account and see all the people who have purchased. This translates into confidence in the project. It is an indication that there is sufficient equity.” Another misconception is that if you take out a mortgage on a condo that hasn’t been built yet, you start making mortgage payments before you move in. “This scares a lot of people off. But the fact is that when you get pre-approved for a mortgage, you don’t start making your monthly mortgage payments until the building is complete and you actually move in to your new home.” As for how much mortgage a person qualifies for, Simpson says the formula for calculating the amount is straightforward. “What a mortgage broker will do is take a person’s gross annual income and multiply it by.32 (the gross debt service ratio) and divide the result by 12 to get the monthly payments. That gives the lender an idea of how much mortgage a buyer can afford.” Simpson recommends that all buyers should visit their bank or credit union before going condo shopping. This is simply to avoid disappointment, but many developers have representatives of a lending institution at their presentation centre to provide immediate assistance and advice. Some developers offer a mortgage buy-down or a mortgage cap. This means the developer and the lending institutions have got together and worked out a financial package where the developer either agrees to pay the difference to “buy down” mortgage payments to a more affordable monthly payment or the financial institution agrees to freeze a certain interest rate for a number of years in exchange for the opportunity to represent buyers. This arrangement gives buyers confidence that once they get into their new home, they will be able to afford the payments for the next two or three years. With a buy-down, mortgage interest rates can be cut as low as 2.9 or 3.9 per cent. One of the most creative ideas in condo financing at the moment is a product called Equity Edge; says Simpson. “‘this is sold by London Guarantee, the leading warranty insurance provider in B.C. It allows a buyer to purchase a bond to the value of the down payment instead of coming up with cash.” The price is 2.5 per cent of the value of the bond plus $100 application. Which for $10,000 would be $350. Not all developers will accept the bond as part of a down payment, but it is worth asking about, Simpson says. As for closing costs, there is GST, which is reduced from seven per cent to 4.8 per cent on a new home priced through a government rebate and the property transfer tax (PTT) which is one per cent of the price of homes under $250,000. “Lawyers fees are usually about $600 but a lot of banks and credit unions will take care of these if you take a mortgage out with them,” Simpson says. Simpson says buyers have 72 hours to change their mind from the moment all subjects are removed and the contract is signed and becomes firm and binding. Finally, buyers could be responsible for a share of property taxes and water levy. “If the seller has prepaid the property taxes, the statement of adjustments will make you assume the balance of the property taxes for the year.” When do realtors get paid? Not a big concern for buyers, but commissions are something paid in full at the time of purchase and sometimes half is paid at time of purchase and the rest when the buyer takes occupancy. Regardless, the fee for a realtor’s services is always paid by the seller, never by the buyer, Simpson points out. West Coast Homes Editor swhysall(ti)pacpress.southam.ca |

Tips to keep more money from the taxman

Friday, March 8th, 2002While banks are pros at paying low taxes, regular folks can learn a few tricks, too

JAMES DALZIEL

Sun

|

TORONTO – George Harrison couldn’t match CIBC when it came to tax planning. The late Beatle, who skewered Britain’s heavy 1960s taxation with, “There’s one for you, 19 for me, ’cause I’m the taxman,” would have been impressed by the Canadian bank’s minuscule income tax bill in 2001. By earning most of its $1.69billion profit in low-tax jurisdictions in the Caribbean, CIBC paid just $51 million in income tax — leaving many observers amazed. Most taxpayers can only dream of such a scenario, but there are ways to ensure we pay only our fair share – and nothing more – without stashing money in the Cayman Islands. “I encourage people to do their own tax return because it gives them a greater sense of control. That’s important, no matter what age you are,” says Kurt Rosentreter, financial author, chartered accountant and tax specialist at Berkshire Securities in Toronto. “At the same time, I encourage them to get a qualified tax specialist to review it.” It takes smart planning to minimize the tax you must pay, Rosentreter says. “Tax planning is the act of seeking out someone who is competent in understanding the Income Tax Act, who can relate that to your personal situation and – in talking to you about how you live your life – can come up with strategies, deductions and credits that can save you money.” So, while April 30 is the filing deadline, Rosentreter considers Dec. 31 the key date for 2002. “You should have a meeting with a tax planner by mid December at the latest,” he says. Here are some of Rosentreter’s tips to reduce the tax bite: Pay attention to your tax bracket: “If you’re making $32,000 a year and you know there’s a big jump in the tax bracket at around $30,000, it’s quite smart to take a $2,000 deduction.” Plan RRSP deductions: If you’re permitted to contribute, say, $6,000 into a registered retirement savings plan in one year, consider doing so but spreading the deduction over two or three years. “The reason you do that is if you have an up and-down income stream in the next couple of years,” Rosentreter says. “For example, if you’re making $25,000 this year but next year you’re making $33,000, you may want to defer taking the full deduction so you get a deduction against higher-taxed income next year.” Combine charitable claims: Spouses should combine their claims to maximize the credit. There is a bigger tax credit if the claim on one form exceeds $200. Donations can move between spouses and can be carried over to later years. Use stock-market losses to recover tax paid on past capital gains: “If you have a capital loss in 2001, you can effectively carry it back all the way to 1998 – three years – and if you had gains in 1998, 1999 or 2000 you can go back and recoup the tax you paid at that time. Just fill out a Tl Adjust, it’s one page.” “You can basically go and get that high-taxed income back. Not only that, but the government will pay you interest on the money they’ve owed you since back then.” Rosentreter notes that the tax inclusion rate on capital gains changed three times last year: from 75 per cent to 66 per cent, then to 50 per cent. Capital losses can be carried forward “forever” if there are no gains in the past three years. Track the adjusted cost of investments to avoid double taxation: “Probably the worst offenders are mutual funds where people do a terrible job of tracking their purchase price.” “The government gives you credit for the fact that you’re paying tax on the distributions all along, and if you’re reinvesting them, you’ve got to add that to the original purchase price. It’s just messy accounting.” The T3 slip carries the annual declaration on reinvested distributions. Rosentreter adds a warning about one common misconception. Money paid for a tax return’s preparation is not deductible. “The reality is, it’s not allowed,” he says. “Under the Income Tax Act, the only time you can write off an expense is when it’s incurred to earn income.” Canadian Press |