Boutique-style developer maintains hands-on control of every aspect

Ashley Ford

Sun

Architect Harvey Hatch (left) confers with independent developer George Kwong. TODD DUNCAN — THE PROVINCE

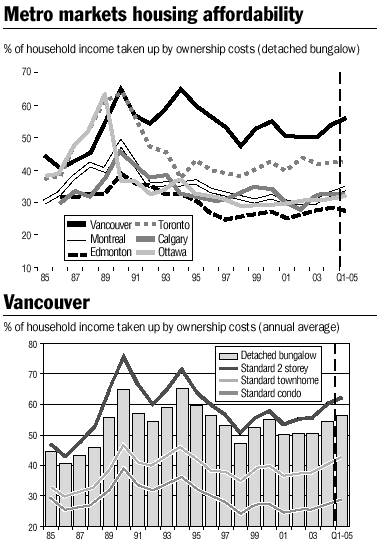

Vancouver‘s claim to having the most expensive housing in the land remains unassailable. An RBC Economics housing affordability index released yesterday simply confirmed what every house hunter in the province has known for years — affordability is getting worse.

But Vancouver developer George Kwong is proving there are niche markets where more reasonably-priced — but not cheap — housing can be developed. Kwong, who runs privately-owned Homeward Bound Development Inc., is successfully putting his reputation where his mouth is and offering homebuyers what he calls “west-side quality construction at east-side prices.”

He focuses on an area in the Grandview-Woodlands area near Commercial Drive, bringing townhouse and duplexes to market for an average $300 a square foot, compared with $450 a square foot-plus downtown.

For that, he offers buyers all the goodies and baubles commonplace in downtown and west-side developments. You get a 1,250-square-foot, two-bedroom-and-den unit with hardwood floors, granite countertops, fireplace, stainless steel appliances and hot water radiant heating.

Kwong starting dabbling in the development business in the 1980s and admits there have been ups and downs along the way. He went full-time in 2001 and currently has 18 townhouses under construction in the 1600-block of East Georgia. Buyers run the range from first-timers to empty-nesters downsizing.

Now, Kwong is launching his latest project, called Georgia Court — a five-unit character townhome project offering two- and three-bedroom homes from 1,346 to 1,718 square feet that start at $412,000, or $305 a square foot.

So how does he do it?

“We are an independent, boutique-style firm and maintain absolute hands-on control of every aspect, from land acquisition, construction, financing, architectural design and marketing,” he says.

It also helps that he knows the area like the back of his hand. “I’m a small guy, focusing exclusively on an area I know and grew up in.”

And it is not all bad news for Greater Vancouver homebuyers. RBC says that while B.C. is expensive, the pricing gap with the rest of Canada is considerably narrower when it comes to condos.

In Vancouver, condos are now the only option for many homebuyers, RBC said. The average condo costs “only $215,000 in the first quarter, only half the $427,000 price tag for the average bungalow,” RBC said.

“Higher house prices, slower income growth and increased utilities costs slightly eroded Canada‘s housing affordability despite lower borrowing costs in the first quarter of 2005,” RBC said.

But by historical standards, affordability is still good overall across Canada, thanks to low interest rates, RBC economist Allan Seychuk said.

– – –

CALCULATING COSTS

How the RBC housing affordability index works:

– It is based on the costs of owning a home. For example, a reading of 50 per cent means that home-ownership costs, including mortgage payments, utilities and property taxes, take up 50 per cent of a typical household’s monthly pre-tax income.

– A standard bungalow, seen as the standard starter home, is used as a measure.

– B.C.’s reading of 53.7 is up from 52.7 three months earlier.

– The Canadian average is 36.6 per cent.

© The Vancouver Province 2005