A tsunami of redevelopment is sweeping from the seedy Downtown East Side to the Fraser River

Other

From the Downtown East Side to the East Fraserlands, the eastern half of Vancouver is seeing renewed interest from developers.

While the excitement surrounding the Woodward’s building at Hastings and Abbott is attracting the most attention, the waves the project is creating are rippling outward through Gastown and Chinatown, down Main Street and Commercial Drive and even to upscale West Georgia.

“The right projects and the right developments can really strengthen this neighbour-hood,” said Robert Fung of Salient Developments Ltd., which is co-ordinating the development of 110 residential units as well as about 80,000 square feet of commercial space in Gastown and the surrounding area from its headquarters in Gaoler’s Mews.

Setting the tone for the developments is 310 Water Street, a 22-unit residential project Salient completed two years ago.

“We took a building that was vacant, derelict, and turned it into some really high-styled, very cool units competitively priced,” Fung said.

His next project promises to do the same with five adjacent properties in the zero-block of Water Street, which will be built out in three phases over the next four years. The first phase of 46 units begins later this summer at 36 Water Street.

Commercial space isn’t being left out of the equation. While Storyeum and other tourist-oriented enterprises are a vital part of the area’s economy, Fung believes other businesses are needed that will both serve and employ local residents.

Construction at Gaoler’s Mews will add 30 commercial live-work units, and Fung is completing a deal for the Copp building at 163 West

Hastings, a 32,855-square-foot property over-looking Victory Square.

“We’re going to bring that back,” he said of the building, most notable now for the bright yellow and red Money Mart canopy adorning its Edwardian-era façade. “I think it’s going to be one of the killer little office buildings in that area.”

The projects require money, however, and despite fluctuating construction costs – a major reason Fung declines to put a price on his total investment in the area – none of what is happening would be possible without greater confidence by lenders and incentives from the city.

“The lenders have seen density transfer hap–pen with some big players, there’s a lot of guys doing it,so it’s more recognized now as a viable way to do things,” Fung said.

Heritage incentives

A greater understanding of the dynamics of redeveloping in the area has fueled a momentum that didn’t exist five years ago, and increased interest in the city’s two-year-old heritage incentives program.

First introduced in 2003, the incentives aimed to facilitate redevelopment of heritage proper-ties in Gastown, Chinatown and along the Hastings Street corridor. They are starting to open doors to opportunities developers had overlooked as too difficult.

“[City staff] have made some stellar moves in how they can realize heritage conservation while encouraging high-quality residents and businesses,” Fung said.

He intends to apply for heritage incentives to support the makeover of 163 West Hastings, just as he has in the current makeover of 528 Beatty Street. That project, set to complete next year, will include the addition of two new storeys to accommodate 36 condos and street-level retail space.

|

| Robert Fung of Salient Developments Ltd., is co-ordinating the development of 110 residential units and 80,000 square feet of Gastown commercial space. |

All told, four applications for the incentives have been approved – three in Gastown and a fourth in Chinatown – and seven more are in process. A further six are expected in the near future. Plans are also afoot to extend the pro-gram in the Hastings corridor through the Victory Square neighbourhood west to Richards Street.

The pattern illustrates the extent to which revitalization in Gastown is spreading through adjacent areas, but the bellwether project for the area’s revival will be Westbank Projects Corp./Peterson Investment Group Inc.’s redevelopment of the former Woodward’s department store at 101 West Hastings Street.

Comprising a total of 850,000 square feet, the project includes 200 units of social housing, over 400 units of market housing as well as 70,000 square feet of retail and 31,500 square feet designated by the city for allocation to community groups.

Site preparation could begin as early as this fall, with construction beginning in earnest next year and wrapping up in 2008. Total cost is projected to be over $149 million.

“We think it’s the right project with the right developer at the right time, but of course, we’re now into the point of fine-tuning and doing value-engineering on the project to make sure we get our costs in line,” said Michael Flanigan, the city’s project manager.

But regardless of the cost, plans for market housing, a grocer and 20,000-square-foot drug–store as part of the retail component promise to draw much-needed pedestrian activity to the area.

“It needs to bring people into that neighbourhood,” said Ian Gillespie, president and CEO of Westbank Projects Corp. “The more market housing we get, the better it is for that neighbourhood. The more retail customers, the better it is for that neighbourhood. The more office tenants, the better it is.”

| Buzz surrounds Woodward’s dealings. A curious twist is developing in the Woodward’s saga. When Westbank Projects Corp. and Peterson Investment Group Inc. won the opportunity to redevelop the former department store at 101 West Hastings, it did so over a competing bid by Concert Properties Ltd. and Holborn Holdings Ltd. that proposed using excess density from the site in the redevelopment of another site on West Georgia Street. The existing Woodward’s structure comprises 656,000 square feet, but Concert/Holborn proposed transferring 266,000 square feet of density from Woodward’s to other projects they had planned, including a 600-foot tower at 1133 West Georgia Street. But that transfer was a sticking point for the city, including councillor Raymond Louie, who singled it out last September when he voted in favour of Westbank/Peterson’s bid over Concert/Holborn’s. Disscussions then began with the city on a complex deal that could see Holborn receive the density it needs to build its highrise at 1133 West Georgia as compensation for Westbank incorporating Holborn lands to the west of the Woodward’s site to accommodate Simon Fraser University’s School of Contemporary Arts. “Putting together a deal with the Holborn guys has allowed the project to have a little more breathing room,” said Ian Gillespie, president and CEO of Westbank. In early June, the city agreed to a revised proposal for the tower, which will now be designed by Arthur Erickson as a slim 45-storey high-rise twisting 45 degrees between its base and the roof. The new tower will be the second tallest in the city, next to Westbank’s Shangri-La, which is being built directly across the steet.” |

|

But Gillespie knows Woodward’s can’t stand alone. “Its impact is only as good as the rebirth of Gastown, Chinatown and everything else,” he said.

“It’s all part of the solution of fixing some of the issues that are there.”

Greenway project

Gillespie believes the successful redevelopment of Woodward’s will herald a larger revival in East Vancouver. He is amply confident in the area’s prospects that he’s already planning new projects in the area.

He’s not the only one.

Purchasers and tenants are taking a new look at surrounding areas such as Carrall Street, where a city-sponsored greenway from Chinatown to the harbour promises to integrate the east side of downtown.

Jessica Chen-Adams, a city planner actively participating in the greenway’s development as well as the revitalization initiative for Chinatown, doesn’t expect change to happen overnight, but she said new projects are first steps in the area’s overall renewal.

“The community is a lot more cohesive compared to four years ago,” she said. “That’s very critical because that makes investment possible.”

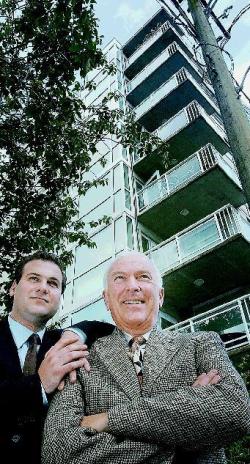

Arthur Griffiths and Lorne Milne of GMC Projects Ltd. are already building on the strength of the greenway’s promise for the area. GMC is redeveloping 1 Alexander at the greenway’s north end. Over the next year, Griffiths and Milne will upgrade and renovate the 35,000-square-foot building with an eye to securing design firms and other tenants looking for heritage office space.

Robert Tham, managing broker with Archer Realty Ltd., said many investors are willing to spend the money now in anticipation of the area’s revival. They’re not buying with a view to tomorrow, but 2010.

“They’re looking at five years down the road, then doing something,” he said.

That hasn’t stopped net rents in areas such as Railway Street from rising to $10 and $12 a square foot, a trend also seen in the South Main area. The resurgence of the area began two years ago as trendy new restaurants, hip fashion retailers and new condo developments attracted attention to the area as the next neighbourhood to watch.

Referbishing the old Woodward’s Building (proposal at centre) is seen as a key to salvaging the still-seedy Downtown East Side.

Mount Pleasant

Today, with con-dos rising rapidly on the slopes of Mount Pleasant and south along Kingsway, strata-titled retail units have been selling for close to $400 a square foot and commercial space east of Cambie has been commanding higher rents.

New tenants are capitalizing on the neighbourhood’s growing residential population as well as the prospect of the two

major retail developments in the 2200 and 2300 blocks of Cambie, said J.J. Barnicke Vancouver Ltd. broker Ryan Saunders.

Bill Goold, an apartment building specialist with Re/Max, sees long-term potential: “East of Main Street and south of 12th is the new West Side.”

Retail rates

This is prompting turnover. Rainmaker Entertainment Group Ltd., architects and other design professionals are moving in, taking up warehouse space formerly occupied by garment factories and light industrial users.

“They’ve been paying $6 a foot, but the owners want $8,” Saunders said. “The area is cleaning up and it’s kind of a funky, cool area to be in.”

Typical retail lease rates vary widely across the East Side, Saunders explained. Space on the Downtown East Side ranges from $12 to $18 per square foot; Gastown is in the $12 to $25 per square foot range and Main Street space goes from $10 per square foot to as high as $35 per square foot in prime areas near 17th Ave.

Industrial space

East Vancouver also has a selection of industrial properties and prices for the land has sky-rocketed in the past year. Sale prices for industrial buildings sit between $85 and $130 per square foot, but typically average $95 a square foot.

For prime commercial buildings the price can be as high as $180 per square foot and, according to a survey taken earlier this year, $1 million an acre for East Vancouver industrial land is not uncommon.

Industrial lease rates are in the $5.57 to $7.00 per square foot zone for existing buildings. Like most of Greater Vancouver there is pressure for rezoning of industrial land to residential and retail space.

With projects such as the 78-home Brix by Pacific Rim Property Developments Ltd. springing up on Commercial Drive and planning underway for the $400 million redevelopment of the East Fraserlands, the gentrication of the blue-collar East Side appears set to continue for years to come.~