Bruce Constantineau

Sun

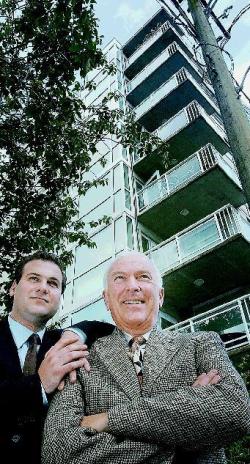

CREDIT: Mark van Manen, Vancouver Sun Mark Goodman (left) and father David at a Vancouver apartment building they recently sold at 1150 Bute. Population growth is spurring demand for rental units.

The value of apartment building sales in Greater Vancouver shot up by 58 per cent during the first half of 2005 as low-cost financing fuelled investor interest in rental buildings, according to Vancouver realtor and apartment specialist David Goodman.

He said 66 Greater Vancouver apartment buildings were sold during the first six months of 2005 — the same number as last year — but the total value of the sales rose by 58 per cent to $258.4 million and the total number of units sold increased by 51 per cent to 2,512.

“A lot of positive economic factors are going on now that are sustaining the rental market and building investor interest,” Goodman said in an interview.

He said Lower Mainland population growth continues to support a strong demand for rental units, as the apartment rental vacancy rate has remained at or below two per cent for the past four years — even though many new condominium units have been added to the rental pool.

“People are moving back to B.C. and the Lower Mainland and many of them are in the construction industry,” Goodman said. “They need a place to live and can’t afford to spend $300,000 or $400,000 now to buy their own home. A rental unit is more affordable.”

He said financing costs of four to 4.5 per cent create positive cash flow for investors as the annual return on apartment investments now is typically higher than that — ranging from about 3.75 per cent to 6.5 per cent. Several years ago, financing costs were higher than the annual returns that investors could expect.

Goodman said that because of the improved conditions, buyers who got out of the apartment market several years ago have decided to return.

One such buyer was Grosvenor Capital Corp., which recently paid $12.9 million for a 67-unit apartment building on Balsam Street in Kerrisdale.

Goodman said at least 90 per cent of buyers today are local groups because Asian investors no longer plop down millions of dollars to buy three or four apartment buildings sight unseen, as they did in the late 1980s and early 1990s. He said many of those Asian buyers are now selling their buildings to take advantage of big capital gains.

Goodman said seven of the 66 apartment sales so far this year were for buildings priced at more than $10 million.

A major sale of eight buildings with a total of 550 suites is expected to close in a few weeks. A Toronto-based buyer is expected to pay around $50 million for the buildings, located in Vancouver, Burnaby and Richmond.

“The buyer has thousands of rental units across Canada but this will be their first venture in B.C.,” Goodman said.

While the apartment market is improving, annual sales are still less than half of what they were during the early 1990s, when about 350 buildings were sold every year. Goodman said the 1990s market was fuelled by speculators who bought properties for the sole purpose of reselling them for a quick profit as soon as possible.

“Speculation fever dominated the market back then,” he said. “Everyone thought they could get in and out for a quick profit but there’s not a lot of that going on now. It’s a more solid, legitimate market based on economic fundamentals.”

Goodman said a few new rental apartment buildings are being developed now — including one in Richmond and two in Surrey — but it’s still more profitable for most developers today to build condominiums. Builders of new apartment buildings today will probably get annual returns of four to 4.5 per cent, he said.

“That’s actually considered okay by some people today. Three years ago, you’d have to go to a psychiatrist if you accepted a return like that.”

STATS TELL THE STORY

Sales of apartment buildings in the Lower Mainland in the first six months of 2005.

Buildings sold: 66 (the same as in the first half of 2004)

Housing units in buildings sold: 2,512 (up 51 per cent over same period last year)

Dollar value of buildings sold: $258.39 million (up 58 per cent over same period last year)

Source: Goodman Report

© The Vancouver Sun 2005