Sun

Archive for October, 2005

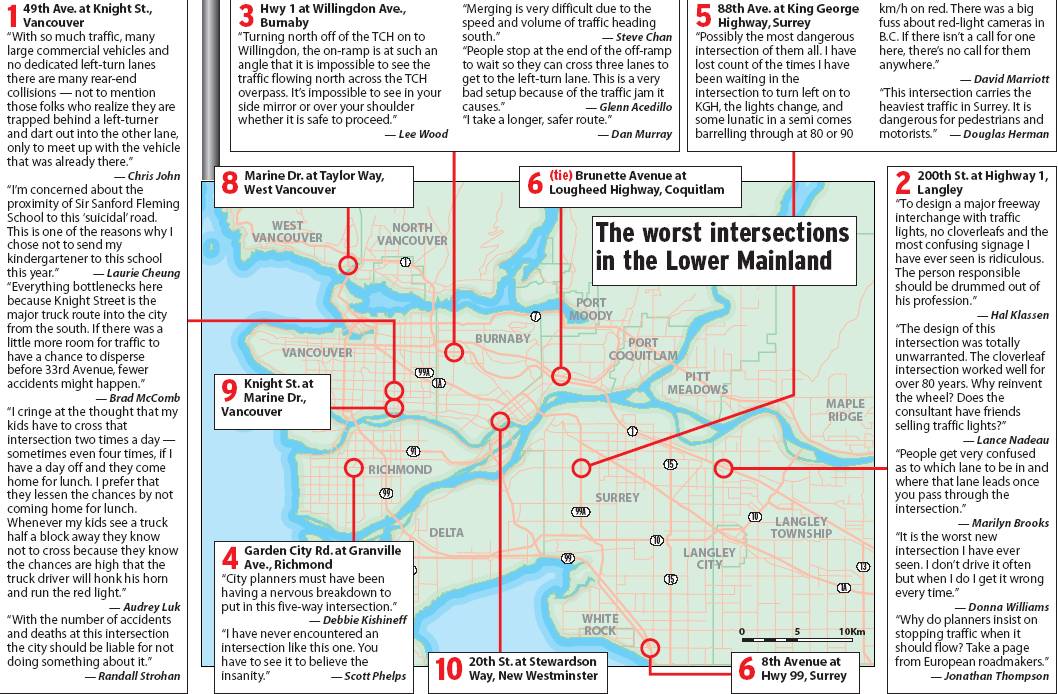

The worst intersections in BC

Sunday, October 30th, 2005BCAA/PROVINCE SURVEY: Readers hate Vancouver intersection — and many, many others

Frank Luba

Province

Lynn Siddaway and all the drivers of B.C., we feel your pain.

Siddaway was one of the 2,569 frustrated, fuming and flummoxed motorists who responded to a B.C. Automobile Association/ Province poll about B.C.’s worst intersections.

Her complaint was about the Vancouver junction of 49th Avenue and Knight Street, which was top of the tops in the province with 54 mentions.

Siddaway admitted to being a little surprised her choice turned out to be the worst in the province, “but I guess I shouldn’t be. I’ve never personally seen an accident there but it’s an accident in the making, all the time, waiting to happen.

“I try to avoid it all costs,” she added.

Like so many other dysfunctional junctions, traffic volume and congestion afflict 49th and Knight.

But the biggest issue there was the lack of advanced left-hand turning.

“Basically, it turns into a one-lane highway because everyone stays in the right lane to avoid these people turning left at 49th,” said Siddaway.

“It slows everything down. When people get slowed down they get impatient and they do silly things.”

Similar congestion and left-turn lane issues make Cooper Road and Highway 97 in Kelowna the second-worst in the province.

The issue there is access to the Okanagan community’s Orchard Park mall. Gwen McPhee wrote that she is “tired of waiting for up to a half-hour or longer to turn.”

Third on the list is the new freeway interchange of 200th Street and Highway 1 in Langley.

“In this day and age, to design a major freeway interchange with traffic lights, no cloverleafs, and the most confusing signage I have ever encountered is ridiculous,” wrote Hal Klassen of Coquitlam.

“The person responsible for this should be drummed out of his profession,” continued Klassen, who has travelled extensively but never seen a design like 200th and the Trans-Canada.

In all, seven of the 10 worst intersections are in the Lower Mainland, with one in the Okanagan and two in Victoria — including Douglas Street at Hillside Avenue, where five roads converge.

BCAA spokesman Trace Acres said the survey is ammunition to take to the city, province or authority in charge to get changes made.

He said the plan now is to bring the 10 most complained-about intersections in each region to the politicians’ attention.

“We want to say, ‘What can you do about it, what are you doing about it or if you have no intention of doing anything about it,'” said Acres.

BCAA plans to follow up on the responses and then tell its members the result.

“This is not a scientific survey but I think it is representative,” said Acres. “We’ve seen in each of the regions people come forward and say, ‘This intersection in our community is a problem.'”

Working all the angles to get the best possible mortgage

Friday, October 28th, 2005Michael Kane

Sun

CREDIT: Ward Perrin, Vancouver Sun Vancouver mortgage broker Rob Regan-Pollock of Invis Inc. helps clients shorten the length of their mortgage by using smart management. We turned to Regan-Pollack to show how a buyer of a $300,000 home could potentially save $154,386 in interest on their mortgage.

In the first of a series on consumer decisions, Michael Kane explains how you could be home free in 16 years and save more than $150,000 on the ultimate cost of a $300,000 home.

– – –

It would be nice if you could buy your dream home with cash, but most of us need a mortgage to bridge the chasm between our downpayment and the asking price. We call it taking out a mortgage, but really we’re taking out a loan. The lender holds the mortgage which provides various legal remedies if we don’t make the payments.

WHAT YOU’RE PAYING FOR

Interest rates determine the real cost of your home. By the time you burn your mortgage, you may have paid more in interest than you did for the property itself. For example, that little place listed for $300,000 will ultimately cost $533,876 if you put $50,000 down and spread monthly payments of $1,627 on a $250,000 mortgage at today’s posted five-year rate of six per cent over 25 years.

To keep that in perspective, you will pay a lot of interest many years from now when the dollar will be worth less because of inflation. Meanwhile, your take-home pay and the value of your property should be rising.

For the sake of illustration, we’re also pretending mortgage rates stay constant for 25 years, the standard amortization period in Canada. Mortgage rates fluctuate frequently and are more likely to rise than fall in the coming months.

FINE PRINT

Amortization is just a calculation to determine the time it would take to fully repay the loan given the three other components of a mortgage:

– The principal (the amount being borrowed)

– The interest rate

– The payment

WHAT YOU NEED TO KNOW

Of most pressing concern is the “term,” or how long the mortgage has to run before it matures. Standard terms are between six months and 10 years, although they can be longer. Generally speaking, the longer the term, the higher the interest rate and payment.

When the term is up, the balance of the mortgage is payable. Typically the lender will offer to roll the mortgage over into a new term with the remaining amortization.

We asked Vancouver mortgage broker Rob Regan-Pollock of Invis Inc. to show how buyers in our $300,000 example could potentially save $154,386 in interest by varying each component of the mortgage.

PUT MORE DOWN

First let’s assume a homeowner increases the downpayment to $75,000, perhaps with help from the Bank of Mom and Dad. That’s 25 per cent of the purchase price, which means they won’t be required to buy mortgage loan insurance to protect the lender against default.

The insurance is provided by the federal Canada Mortgage and Housing Corp., or privately run Genworth Financial Canada, which is owned by G.E. Capital. The cost is on a sliding scale up to 2.75 per cent of your loan, depending on how much of the home’s value is financed. There is also an application fee, typically $165. The minimum downpayment is five per cent of the purchase price.

In our example, mortgage loan insurance adds 1.75 per cent or $4,375 to the cost of the home. If that’s not paid up front, it is added to the mortgage, which makes it even more expensive since the buyers will pay interest on a bigger balance.

TRADE SECRET

Ask for a better interest rate. If you have a good credit history, you can shave at least one percentage point off posted rates by shopping around, or threatening to do so unless your bank or credit union offers a deal. A provincially licensed mortgage broker will get you the best available rate for your situation, but if we assume you’re getting today’s best widely available five-year rate of 4.74 per cent on a $225,000 mortgage, the ultimate cost of the home is reduced by $76,224 to $457,652.

HOW TO SAVE MORE

By making payments every two weeks rather than monthly, you can make one extra month’s payment each year.

The average monthly cost goes up from $1,275 to $1,381, but you will own your home free and clear 3.5 years sooner. And your total interest cost will be $132,947, for an additional saving of $24,705.

Next let’s assume that every year you use a $2,000 refund from your RRSP contribution to reduce your principal. That lowers the amortization to 17.92 years and saves another $23,984 in interest.

Finally, if you choose a variable-rate mortgage, you’ve got what is historically the cheapest route to home ownership, but you have to be able to handle sudden spikes in interest rates. Typically the interest on a variable rate mortgage moves up and down with bank prime rate, currently 4.75 per cent, while the payment remains constant. For those with an adjustable rate mortgage, payments would be adjusted on a monthly or quarterly basis depending on the lender.

If you were taking all the steps outlined above, and making the same $1,381 average monthly payment ($637 every two weeks) with today’s best widely available variable or adjustable rate mortgage at 3.90 per cent, you would be home free in 16.42 years, for a total cost of $379,490 — only $79,490 more than the original purchase amount.

THE CATCH

Mortgage rates fluctuate, so make the deal that lets you sleep soundly. Lock in if you can’t handle rising rates. With the gap between fixed and variable rates being so close, Regan-Pollock says it’s important for consumers to understand the pros and cons of each strategy, including repayment options, pre-payment penalties, conversion terms, blended rates and early renewal. This is where a mortgage professional comes in.

RESOURCES

For information on mortgage brokers visit www.cimbl.ca or www.mba.bc.ca

CUTTING COSTS:

How to bring down the long-term cost of your mortgage:

CONVENTIONAL APPROACH

Home price: $300,000

Deposit: $50,000

Fixed-rate mortgage:

$250,000 at 6.0%

Payments: $1,627 monthly

Home free: 25 years

Total cost: $533,876.

AGGRESSIVE APPROACH

Home price: $300,000

Deposit: $75,000

Floating-rate mortgage:

$225,000 at 3.90%

Payments:

$637 every two weeks

Annual lump sum payment: $2,000 (RRSP refund)

Home free: 16.42 years

Total cost: $379,490

Savings: $154,386

© The Vancouver Sun 2005