It’s an incredibly ambitious piece of urban planning backed by big dreams and good intentions. But is it achievable?

Frances Bula

Sun

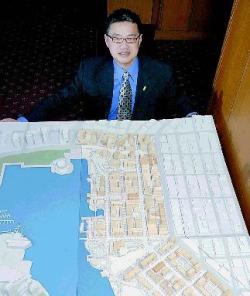

VANCOUVER SUN The proposed redevelopment of the old Woodward’s building (above) includes four buildings, two towers and a central plaza. The building (inset) is currently a derelict site that has been empty since the department store closed down 13 years ago.

It’s the Berlin Wall of Vancouver — a massive, derelict building that for more than a decade has been a black hole in the heart of the city and a barrier that divides the downtown.

Inside the gloom of the empty Woodward’s department store, water drips steadily onto the bare concrete.

But on this particular fall day, a group of a dozen people have gathered in the one small corner of the main floor that’s been made habitable to talk about the transformation of this building.

If their conversation were in a movie, the dilapidated building would fade away behind them to be replaced instantly by their utopian visions: Thousands of Simon Fraser University dance, film and theatre students streaming in and out of a building consisting of two towers set into a European-style rectangular structure around a public plaza. Tens of thousands more Vancouverites surging in for experimental plays, photo exhibits and concerts at SFU, and to community festivals and craft markets in the open plaza in the centre of the development. Another 2,000 people living in the building — a mix of owners, renters, and social housing all co-existing in harmony — bringing normalcy to the area and serving as a customer base for the major grocery store and drug store in the project. A community garden. A rooftop child-care centre. And, the most recent crowning touch, an interpretive mural by Vancouver‘s world-famous photorealist Stan Douglas, who plans to re-create scenes from the Woodward’s of 1958.

If this were any other group of people, they might be suspected of having delusions or ingesting illegal substances from the cafes nearby. But the people around the table in this slightly chilly room include the developer of the city’s tallest towers, the city’s most influential realtor, three program directors from Simon Fraser University, the director of the city’s housing centre, the deputy director of city real-estate services, an award-winning architect and the directors of the Downtown Eastside’s most high-profile social-housing operation. These people are not dreamers. They say those visions will become reality.

It’s that collective vision that the city’s new political party and its mayoral hopeful, Jim Green, have marketed as the symbol of everything he and his party have done right in the past and will carry out in the future.

Their message: They’ve brought people together and created a deal that combines the best of many worlds by having a private developer working with the city, a major university, and non-profit housing groups on a project that will change the economy and social fabric of the Downtown Eastside.

That has in turn prompted a response from their political opponents that the Woodward’s plan is too grandiose, too costly for the city, and could end up failing because perhaps this lovely dream is not workable in the real world. They also point out that it’s not a done deal. The city and developer Ian Gillespie haven’t finalized their contract yet.

For average voters, it’s difficult to figure out. It’s such an ambitious, complex, multi-partnered project with so much potential for both positive change and unknown risk that most don’t know how to assess it.

It’s also a project unlike anything else in North America. It’s a $280-million development being financed and built by a private-sector partner, but with city oversight and an unusual agreement that has the city contributing $13 million to cover costs that any other private developer would be expected to pick up. It’s also a project that incorporates multiple uses. Most developers would think it’s ambitious to incorporate three types of uses. This project has a dozen.

“You get a real village on one superblock” is the way architect Gregory Henriquez describes it.

The latest incarnation of the project, which now includes additional land to the west of the actual department store, is four buildings forming a rectangle around a public plaza. Henriquez’s new design, which is being made public this week, now shows a development that has been pulled apart and allowed to spread out.

“It was an impenetrable fortress before,” says Henriquez. “Now we can open up to Cordova, Hastings and Abbott. It has allowed a real permeability.”

One building, the original Woodward’s store on the corner of Abbott and Hastings, will be restored and used for small retail operations, including a day-care centre on the roof, and 31,500 square feet of city-owned space that will be occupied by a multitude of non-profit groups, still to be selected.

The next building on the Hastings front will be the Simon Fraser University Centre for the Contemporary Arts, which will include two theatre spaces, a film centre, and an exhibition space. A major 18,000-square-foot drugstore will occupy part of the ground floor, and 125 social-housing units for singles will be incorporated into the upper floors.

On the Cordova side of the lot, a 40-storey, 397-foot flatiron tower on the northwest corner — the W building — will be home to most of the project’s market condominiums, priced from $200,000 to $550,000.

On the northeast corner, Abbott and Cordova, a second, 275-foot tower will include a major grocery store, federal government offices, 75 units of social housing for families, and some loft-style market condos.

In the middle, there will be a public plaza, jointly managed by all the occupants, that will be the site of festivals, markets, shows and anything else people dream up to make the development a lively place that attracts people to this now-desolate block.

None of this has come easily: It’s been a slow, steady grind for the participants to work out all the details in such a complex project.

Simon Fraser University‘s board of governors only confirmed its commitment to the project on Sept. 29. The negotiations with the grocery store and drugstore operators are still going on.

At one point, there was a tug-of-war between the city planning department and the developer, backed by the project’s community advisory committee. The planners thought the tower was too high — in fact, in a last-minute surprise that threw everyone for a loop, it was discovered that it would intrude into one of the city’s famous protected view cones if it went over 400 feet — and there was just too much packed into the site.

The committee, with surprising unanimity among the business, non-profit and Downtown Eastside representatives, argued the project needed the height and critical mass of people and activities to make it work. The compromise was to scale down one tower and add a second on the site.

Part of the tough negotiations on the project was the city’s decision to cover some of what would normally be a developer’s costs.

When council agreed to the initial bid going to Westbank Projects/Peterson Investments, the agreement was that the city would charge Westbank the $5.5 million it paid the provincial government for the site, plus its holding costs (currently standing at around $1 million) but no money would actually exchange hands. This was because Westbank would do the renovation and hand back to the city the renovated 31,500 square feet of space that will be given out rent-free to non-profits.

The city has also agreed to put in another $7 million to cover a shortfall in the money given by the provincial government for the first 100 units of social housing, which is now not enough to cover the increased cost of construction.

But, more significantly, city council approved a deal that will see the city pay $13 million for various improvements to the site: demolition costs, soil remediation and asbestos removal, and the removal of underground storage tanks, among others.

The city’s deputy real-estate manager, Mike Flanigan, is frank in saying that those are not costs the city would normally cover when selling a piece of land to a developer.

“Normally, the city tries to have the developer absorb as many of these costs as possible.”

But, he said, the joint steering committee acknowledged that past private developers haven’t been able to make the project’s economics work. In this case, he said, committee members agreed that “you can only push so hard and it doesn’t work any more.”

For many people, it’s considered an investment worth making.

“The Gastown Business Improvement Association asked five or six years ago what was the most important thing for us. We said: ‘To get Woodward’s done,'” says Jon Stovell, the BIA president who also has extensive land holdings in Gastown. “Its physical placement is a kind of dead barrier between the Downtown Eastside and downtown, between us and Chinatown.”

Stovell is not what you’d call a huge fan of government intervention.

But, he says, “even business people think that government has a role. And market forces failed to bring that project to fruition. As a business person, I think it’s an excellent investment. I think they’ll get that investment back 10 times over in increased tax revenues.”

Certainly, there’s general agreement that the Woodward’s development will provide a major push toward improving the whole area, which is now dominated by boarded-up storefronts and the odd, dubious-looking convenience store.

“It’s not going to solve the area’s problems on its own, but it’s going to help because it’s just so big,” says the city’s former head of planning, Ray Spaxman, now an influential urban-planning consultant. “This has enough of a critical mass that it can hold itself together.”

Retail consultant Phil Boname agrees.

“It is already igniting some redevelopment.”

Successful Gastown developer Robert Fung has bought a building on the block, on the corner of Abbott and Hastings, that he’s planning to convert to condos, while the properties across the street from Woodward’s on Hastings have changed hands recently as speculative buyers anticipate prices going up.

Both Spaxman and Boname say the SFU component is one of the most significant elements, because it will bring in a new demographic to the area — students — along with people attending theatre, film, music and art events.

Martin Gotfrit, director of SFU’s contemporary-arts school, estimates the centre will attract a minimum of 100,000 students and visitors a year, and up to 300,000 when all the venues are running full-tilt — something SFU is aiming for as part of its longtime goal of being a New York University-style institution that breaks down the wall between the city outside and the university inside.

“I always thought our purpose in this development would be to do what Woodward’s used to do, which was to bring the community to and fro,” says SFU vice-president Warren Gill, who has had SFU at the table for every development proposal pitched since the store closed 13 years ago.

Boname says that kind of cultural attraction is what will make Woodward’s function more like the city’s successful central library project than the struggling Tinseltown development in Chinatown.

While the $163-million city-built library project has pulled thousands of people to a part of the downtown formerly considered to be a no man’s land and attracted development around it, the Tinseltown development turned into a bizarre empty shell except for its popular movie theatre.

“Tinseltown wasn’t designed to act as a catalyst for change. It’s totally introverted,” says Boname. The library, on the other hand, has proven far more successful than anyone expected — especially once nearby businesses acknowledged who was using the library, which is people who generally don’t have a lot of disposable cash to buy books. Once they learned to cater to those people, rather than to imaginary big spenders, they thrived.

With Woodward’s, the two major retail operations — a grocery store and drugstore — are exactly the kinds of businesses that are least income-sensitive.

“I think it’s a fine example of urban planning at its best,” says Bob Rennie, the powerhouse realtor who has done as much to make the project a reality as any of the other partners. “I think this model’s going to be watched and dissected by urban planners.”

His enthusiasm and conviction that people in Vancouver are ready to invest their cash in this gritty area has carried along the developers. Rennie, who has mastered the art of selling a condo as social identity, is convinced a certain niche group of Vancouverites will be interested in buying into what he has labelled “an intellectual property.” That group of people are attracted to buying near a university, know the area for what it is, and also understand its possibilities.

Rennie says he can’t understand why everyone isn’t 100-per-cent behind such an innovative project.

“It shouldn’t be made into a political issue.”

But it is, thanks to both Vision Vancouver’s Green, who refers to it constantly as his achievement, and to Non-Partisan Association councillors Sam Sullivan — now seeking the mayor’s chair for the NPA — and Peter Ladner.

The latter two have been cautious about how they criticize Woodward’s. Although both voted against it originally, they’ve toned down any direct attacks on it since then, after advice from inside their own party that attacking a project that many see as a sign of hope in the Downtown Eastside isn’t a winning campaign strategy.

But while both now say they support the project, they do raise concerns about whether it’s actually doable.

“I really want this thing to work. I think it’s a fabulous project,” says Ladner. “But it is still a great risk to the city. The developer has not signed off on the deal yet and there’s no deposit down. We have to ask ‘Are we making it more difficult to work?’ Is there a risk that this project as presently configured cannot raise the necessary financing?”

Developer Ian Gillespie is perplexed that doubts are being raised about his commitment. He has spent millions of dollars so far on design and planning work, is tendering the demolition contract, and is starting work this week to build the sales centre.

He expects to sign the final documents on the deal in February, once the development permit is approved. That’s a process that people in the development industry say is fairly common. They also say it would be unprecedented for a major developer to bail at this stage of the game.

In the meantime, he says, “I think we’re pretty much pregnant, to tell you the truth.”

The only thing he could see shaking him off course is some cataclysmic world event — or if a new city council started making changes that threw timelines and budgeting off course.

“That could make it implode,” he said. But he doubts the city would want to do that either. “They would be putting themselves in a really bad situation. We’ve spent a lot of money based on their assurances.”

In the meantime, the advertising campaign to sell Woodward’s condos will begin this week. The last week of the civic election campaign, as it turns out.

Coincidence? You decide.

© The Vancouver Sun 2005