Fraser Valley rises 24% as spring spurs market

Bruce Constantineau

Sun

Spring home-buying activity kicked into high gear last month with Greater Vancouver housing sales increasing by 37 per cent over February, while sales in the Fraser Valley rose 24 per cent, real estate boards in the two regions reported Tuesday.

“The number of listings has gone up, but our inventory is still too low and we’re still getting multi-offer situations on some properties in certain areas,” Real Estate Board of Greater Vancouver president Rick Valouche said in an interview.

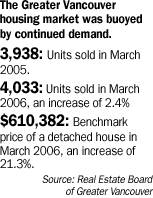

The board said 4,033 home sales were recorded on the Multiple Listing Service in March, a 2.4-per-cent increase over March 2005, and 37 per cent higher than February sales. Fraser Valley MLS sales increased by eight per cent over March 2005 to 2,072 sales — 24 per cent higher than February sales.

Valouche noted the number of MLS properties for sale in March rose to 5,767 units, a 13-per-cent increase over March 2005, but still not enough to create a balanced market and give buyers more time to make decisions.

“There’s more balance happening on the west side [of Vancouver], but multi-offers are still happening in outlying areas like Burnaby, Coquitlam and Maple Ridge because prices are more affordable,” he said. “It’s not necessarily the best market to work in. If I have a buyer and see a listing, by the time I get them an appointment, it probably has four other buyers looking at it. It can be a rushed market and that’s not good for everybody.”

The Greater Vancouver board said the benchmark price of a detached home has increased by 21.3 per cent during the past year to $610,382. The price of a benchmark attached property rose by 17.6 per cent to $375,919, while the price of an apartment increased by 22.6 per cent to $305,002.

Fraser Valley board president David Rishel said the number of new listings in March fell by 10 per cent to 2,540, creating a situation where demand outpaced supply. The board said the average selling price of a detached Fraser Valley home has increased by 19.4 per cent in the past year to $442,726.

“Sales are going up and listings are going down, but the market is holding its own, so there’s no need to panic,” Rishel said.

He said price increases have levelled off in recent months so future annual price growth figures could drop from current levels.

© The Vancouver Sun 2006