Province

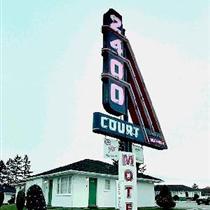

The venerable 2400 Motel on Kingsway finds itself sitting in prime development territory. Photograph by : Arlen Redekop, The Province

Renfrew fire hall No. 15 isn’t the only building in Vancouver whose uncertain fate has residents up in arms.

Here are a few others that the advocacy group Heritage Vancouver — which featured the fire hall on its endangered list last year — is currently defending:

Burrard Bridge

Date of birth: 1932

The issue: Featuring cool concrete towers, Art Deco touches and an endless debate about its future. Open the outer lanes to bikes and walkers? Or widen the sidewalks — which means widening the bridge?

Says Heritage Vancouver: “Cantilevered outrigger sidewalks would radically alter the bridge’s appearance — adding bulky appendages that slice across the bridge’s architectural features.”

St. Paul‘s Hospital

Date of birth: 1913, with expansions in the 1930s

Address: 1081 Burrard Street

The issue: The red-brick hospital never escapes controversy. Should it be knocked down? Should a new St. Paul’s be built in East Vancouver — on a large plot of land just east of Main Street? While the building is on Vancouver’s Heritage Register, it could still be altered or demolished.

Says Heritage Vancouver: “We only need to look up Burrard Street at what will remain of the YMCA — a partial facade — to see what could await St. Paul’s, even with a sympathetic private developer.”

Vogue Theatre

Date of birth: 1940

The issue: The Granville Street fixture — a former movie theatre and National Historic Site — could become a supper club/cabaret. Among potential plans: replacing the seats with tables and turning the existing stage into kitchen space.

Says Heritage Vancouver: “The City needs a new medium-sized performance venue.

“Why can’t the City use the money earmarked for a new facility to acquire and rehabilitate the Vogue as a civic theatre instead?”

The 2400 Motel

Date of birth: 1946

Address: 2400 Kingsway

The issue: The City has been looking to develop this entire stretch of Kingsway to encourage higher density residential/commercial developments and now owns this venerable motor court. These post-war modernism structures are still common in many parts of the U.S., but increasingly rare in Canada.

Says Heritage Vancouver: “The 2400 Motel has been scrupulously maintained over the years and is virtually unchanged. With savvy management, it could continue as such into the future, marketed internationally as a unique travel experience.”

Salsbury Garden and Cottages

Date of birth: 1907

Address: 1117 and 1121 Napier Street

The issue: Two historic B.C. Mills workers’ cottages, examples of early prefabricated construction, now sit empty beside a unique heritage garden. With no heritage protection, the new owner wishes to knock down the cottages.

Says Heritage Vancouver: “Little cottages such as those on the site are a fast-disappearing element of our historical record.

“Even more significant is the potential loss of a unique, intentional development configuration that might be termed a historic ‘vernacular’ landscape.”

Hastings Mill Store Museum

Date of birth: 1865

Address: 1575 Alma Road

The issue: Once the company store for Hastings Mill down at Burrard Inlet, Vancouver’s oldest building survived the Great Fire of 1886 and was moved west in 1930. And while it’s open to the public in summer, it’s also been neglected.

Says Heritage Vancouver: “This historic site suffers from low public profile and meagre funding which, over the long term, could have negative consequences for maintenance and heritage conservation standards.”

© The Vancouver Province 2006