Vancouver area close to levels last reached before previous downturns

Michael Kane

Sun

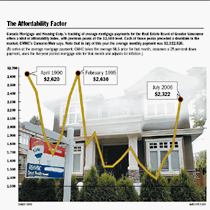

The Affordability Factor Canada Mortgage and Housing Corp.’s tracking of average mortgage payments for the Real Estate Board of Greater Vancouver offers a kind of affordability index, with previous peaks at the $2,600 level. Each of those peaks preceded a downturn in the market, CMHC’s Cameron Muir says. Note that in July of this year the average monthly payment was $2,322.526. (To arrive at the average mortgage payment, CMHC takes the average MLS price for that month, assumes a 25-per-cent down Photograph by : VANCOUVER SUN

The cost of carrying the average mortgage is nudging levels that preceded the last two significant downturns in the greater Vancouver housing market, a study by Canada Mortgage and Housing Corp. says

While Lower Mainland home prices have risen dramatically in recent years, the federal agency says the monthly cost of carrying a five-year mortgage at posted interest rates, when adjusted for inflation, has yet to top $2,600 as it did in 1990 and again in early 1995.

However, in July, the average mortgage sat at $2,322, its highest level in 12 years, thanks to a combination of higher interest rates and rising prices.

“We haven’t been where we are today since 1994 and 1989 which were both peak years in their respective cycles,” Cameron Muir, senior market analyst with CMHC, said in an interview.

The study supports other surveys that suggest real estate prices will level off as homes become less affordable, although Muir doesn’t expect that to happen before next year.

“We’ve had a marginal increase in the number of listings over the last couple of months, but not enough to be indicative of a return yet to more balanced conditions,” he said. “The affordability measures that we look at indicate that sometime going into 2007 the market will trend to more balance as more and more households who are looking to buy a home are squeezed out because of affordability issues.”

Statistics Canada released numbers Tuesday showing new housing prices in Vancouver were up 0.5 per cent over June, compared with 1.1 per cent nationally, and decreased 0.6 per cent in Victoria, the only one of 21 metropolitan areas other than Kitchener, Ont. (minus 0.1 per cent) to show a decline.

StatsCan said the booming economy in Alberta continues to drive the national average price — Calgary led the way with a monthly increase of 4.6 per cent — along with strong demand and increasing costs for construction materials and labour.

“People have been looking for an overall housing slowdown but it hasn’t really happened yet,” StatsCan analyst Randy Stearns said in an interview.

Hints of a slowdown are contained in the latest housing report from Clayton Research, a Toronto firm of urban and real estate economists, which shows a drop in home buying intentions across the country in June, compared with the same time last year, and an increase in plans to renovate.

“Obviously there is an issue of affordability creeping into the market in B.C. as we’ve seen prices really accelerate over the past year and a half or so,” Clayton vice-president Peter Norman said in an interview.

However, he expects the strong B.C. economy and infrastructure spending to continue to drive in-migration and keep prices buoyant. “We think the B.C. housing market will remain relatively solid.”

CMHC’s average monthly mortgage calculation is based on paying the average MLS price in greater Vancouver and assumes a 25-per-cent down payment and a 25-year amortization. It also assumes that buyers pay the posted five-year mortgage rate because of the difficulty in ascertaining an average discounted interest rate which depends on the buyer’s risk, collateral and other factors.

© The Vancouver Sun 2006