Variable rates may look better to some borrowers, but there’s also the worry factor

Fiona Anderson

Sun

Glen Flett chose a variable mortgage as rates may be going down. He trusts his mortgage broker to tell him when to lock in. Photograph by : Bill Keay, Vancouver Sun

Source: Invis Financial

After two years of steady increases in bank rates, economists are now suggesting the next move may be downward. But the real question in most people’s minds is what will this mean for mortgage rates. As well as, what’s better: variable or fixed?

Variable-rate mortgages go up and down along with the Bank of Canada rate. When the rate goes up 25 basis points (or 0.25 percentage points), so does the prime lending rate, and variable mortgage rates are based on prime minus a discount. In the last few years, increased competition among lenders has deepened that discount from 40 basis points to 90, said Paula Siemens, senior mortgage broker with Invis Financial.

So now, with prime at six per cent (calculated as 1.75 percentage points above the Bank of Canada’s current overnight rate of 4.25 per cent) a variable mortgage can be had for 5.1 per cent.

That’s lower than the posted five-year fixed mortgage rates for most banks, two of which lowered their rates this week to 6.75 per cent. But some lenders will go as low as 5.5 per cent for a low-risk borrower, Siemens said.

So at first blush, variable rates look better than their stodgy fixed-rate cousin. And except for a few anomalous situations, that’s true at any particular point in time, Siemens said. But what you need to compare when deciding between a fixed- and a variable-rate mortgage is the current fixed rate and what you expect the variable rate to be in the future.

That takes some guesswork and for some people that’s too uncertain.

“There are two types of people who should probably not be in a variable-rate mortgage,” Siemens said. “One who, based on a five-year fixed mortgage, barely can make those payments so any upward trend in prime rate would put them in a situation that they couldn’t afford their payments. In that case I would suggest stability for them to make sure we are keeping them within a budget they can live with.

“And there might be a person who has an economic profile where they can manage the higher payments [of a fixed-rate mortgage] but they would lose sleep over the fact that they don’t know what their payments are going to be [under a variable mortgage].”

But how scary can a variable-rate mortgage be?

In the last year, the Bank of Canada rate increased 1.75 percentage points, pushing up the variable rate an identical amount, from 3.45 per cent (based on the best discount available at the time which was 80 basis points) to 5.2 per cent, Siemens said.

But if the borrower had chosen a fixed-rate mortgage instead, she or he could have locked in at 4.5 per cent.

On those numbers, it looks like the fixed-rate tortoise beats the variable-rate hare.

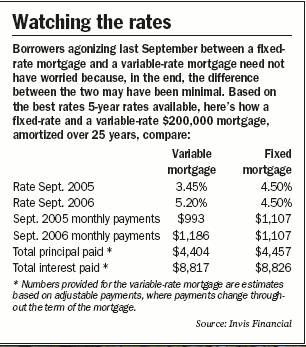

Not so fast, says Siemens. While the variable rate went up in the last year, it turned out not to be any costlier. Comparing two $200,000 mortgages, Siemens estimated that the variable-rater would have paid $4,404 on his mortgage over the past year plus $8,817 in interest while the fixed-rate mortgagor would have paid down $4,456 at a cost of $8,826. So while the variable rate went up and eventually surpassed the fixed rate of last September, the lower payments early in the period offset the higher payments later on.

Glen Flett chose a variable rate last year when he was looking for a mortgage because it could be prepaid without penalty. But he also thought over time the rate would turn out to be better. He’s hanging on because he trusts his mortgage broker to tell him when it’s time to lock in.

“[So] I don’t stay up at night [worrying about the rate],” Flett said. “I don’t know if [my broker] does.”

Catherine Runnals chose the fixed-rate mortgage.

“We liked the security of it,” Runnals said. “Coming from a generation whose parents paid 18 per cent, when I saw that my rate was well under five and I could lock in for 10 years . . . we went for it right away.”

Runnals doesn’t care if she ends up paying more interest in the long run.

“I know what my commitments are for the next 10 years and that comes with a great sense of security. And I would rather have that than live at the whim of the world markets,” she said.

There is a wide range of variable mortgages, some that keep payments at a set level attributing more or less to interest depending on the prevailing rate of the day, and others that alter payments along with the changing rates, Siemens said. Some variable mortgages compound interest monthly rather than semi-annually and others provide a deeper discount up front and a smaller one later on. So Siemens recommends using a mortgage broker to crunch the numbers to determine which is best.

ING DIRECT offers a one-size-fits-all variable-rate mortgage as well as a one-size-fits all fixed-rate mortgage that can be applied for online, the company’s senior manager Fredrick Kreutlein said.

The online banking company’s variable rate is 5.2 per cent, which is 80 basis points below prime, while it offers a fixed-rate mortgage of 5.35 per cent.

With one rate a borrower doesn’t have “to go through the hassle of negotiating with the bank and going back and forth and threatening to leave” to get the best rate, Kreutlein said.

Whether to go fixed or variable is a personal choice, he said.

“Some people are more risk-takers and they enjoy having control over that aspect,” he said. “Others just want to know this is what I’m going to be paying no matter what happens in the future.”

© The Vancouver Sun 2006