House hunters put off by the out-of-reach prices in Vancouver’s overheated neighbourhoods are finding good values in communities outside the buying frenzy

Derrick Penner

Sun

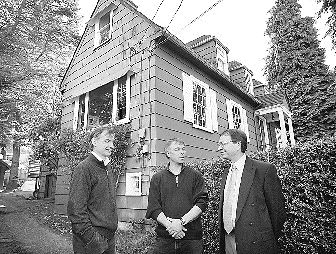

In Maple Ridge’s Albion area, buyers can find new four-bedroom homes like these priced in the $450,000 range. Photograph by : Mark van Manen, Vancouver Sun

Sure, buying a home in 2006 can seem to be a daunting prospect. In Greater Vancouver, appreciation on the value of houses is running 100 per cent since 1999. The average price is now $713,000, and the prospect of any kind of deal seems to be a memory that your parents had.

That picture clouded James and Jennifer Shaw’s expectations in their recent move to Maple Ridge, where James is opening an office for McElhanney Associates, from Penticton.

“We thought we’d probably be buying a shoe box with a blade of grass for more money than we could afford,” James said.

Instead, with young daughter Sam in tow, the Shaw’s are settling into a spacious, spanking new four-bedroom house in the newly developing Albion area priced in the $450,000 range.

It is an example of the values buyers can still find if they’re willing to look beyond the Lower Mainland’s overheated neighbourhoods and consider places that offer the amenities they want, but are off the radar, or are just on the radar but haven’t been noticed yet.

Around the province, look for places that have the community amenities that lifestyle buyers, such as retiring baby boomers, want that are outside of locations that have been caught up in the current real estate frenzy.

Call them the next hot spots.

In the Greater Vancouver market, which has been on a tear for the past five years, finding deals is often a matter of degree. But instead of newly trendy Strathcona, buyers might consider Hastings East — the neighbourhood north of Hastings and east of Nanaimo.

Or, for those with ambitions to really move up, they might look at South Granville instead of Kitsilano or Point Grey.

Or Maple Ridge, which is where the Shaws needed to be. Jennifer Shaw said their new house cost a bit more than they’d hoped to spend, but they couldn’t turn it down for what it offered: new construction, off busy main streets and close to parks and schools. “I like where we’ve bought,” she added.

Ron Antalek, the Shaw’s realtor, said Maple Ridge has really been put on house-hunters’ radar with talk of the province’s Gateway transportation initiative, which will deliver new bridges and road improvements that promise to ease the commute from Greater Vancouver’s northeast region.

Maple Ridge prices for brand new construction, however, are still discounted compared with locations across the Fraser River in Langley.

“Typically, Maple Ridge-Pitt Meadows is the most affordable community in the Greater Vancouver regional district,” Antalek said, which attracts a lot of first-time buyers, and a lot of buyers trading condos in nearby Port Moody, Port Coquitlam and Coquitlam for their first detached homes.

However, Antalek added that Maple Ridge has not been immune to the run up. Activity has heated up over the last 36 months, and current prices reflect the expectations of buyers that the community will become more desirable as transportation improvements are completed.

Cameron Muir, a market analyst for Canada Mortgage and Housing Corp., said Greater Vancouver has seen phenomenal price increases.

The average detached house price, for instance, is up precisely 100.4 per cent from the $377,763 it was in 1999. Townhouses, with a current average price of $415,767, are up 83 per cent. Condominiums, with an average cost of $340,362, are up 93 per cent.

Muir added that the current market cycle did start from an almost depressed state at the end of the 1990s. With low economic growth, thousands of British Columbians left the province looking for work and those who were left were not in a real-estate-buying mood.

Muir added that plunging mortgage rates after 2001 “turned the spigot on” for Lower Mainland real estate, drawing new buyers in.

Muir said lower interest rates made housing more affordable for a lot more potential buyers.

“When affordability increases, all things being equal, prices tend to be bid up until you reach a new equilibrium,” Muir said.

He added that Greater Vancouver is getting close to that equilibrium point today.

Prices have become so high, Muir said, that regardless of mortgage rates, “at the margins, more buyers find that asking prices don’t fit into their budgets,” which has slowed sales over the past year.

The slowing of sales is a sign buyers are sensing uncertainty, “and taking a step back,” said Tsur Somerville, director of the centre for urban economics and real estate at the University of B.C.’s Sauder School of Business.

In the short term, Somerville added that real estate markets might experience some turbulence, such as price declines, once the current construction boom in B.C. ends.

“You don’t normally see a market tank unless there’s some kind of negative shock,” he added. “Interest rate hikes or a recession.”

In the long run, however, he noted Greater Vancouver has had historically steady population growth, which should bode well for real estate as well.

“The long-run historical performance of B.C. real estate has been very strong,” Somerville said.

“It depends on your time horizon for investing. If your time horizon is long, even if you buy when prices are high and they fall, that’s going to work itself out over time.”

Muir added that in the immediate short term, B.C. has a robust enough economy, unemployment rates are low enough and incomes have risen enough that there’s no sign of a shock that could cause price corrections.

It is getting to be late in the real estate market’s cycle, added CMHC regional economist Carol Frketich.

She added that the current run up of prices in the Lower Mainland has pushed out into desirable locations where those sellers who have cashed in like to move — such as Kelowna, the Kootenays, Victoria and other Vancouver Island resort spots.

Somerville added that a community’s amenities, whether urban or rural, is the important factor.

THE UP-AND-COMING AREAS TO INVEST YOUR MONEY IN. . .

They may have once had a not-so-favourable reputation, but the following places are all being redeveloped and offer great value to potential buyers

Hastings East/Burrard View

The neighbourhood east of Commercial Drive and north of Hastings bordering Burrard Inlet is a spot buyers who missed out on Main Street and Strathcona might consider.

The area is still a gritty part of the city, says realtor Rob Chipman of Legend Coronet Realty, but some spots are being redeveloped into multi-family housing, there’s shopping on Hastings, the schools are good — despite what people might think — and the people coming in are reviving it.

Chipman said buyers might find 50-year-old homes for the mid-$400,000 range to fix up and apartments from the high $100,000s to mid $200,000s.

Hastings East might not be so vibrant now, but Chipman adds that, once more people move into the multi-family developments, the produce shops and other stores start doing better business and “all of a sudden Commercial drive isn’t the only cool place to walk up and down the street.”

Granville, south of 41st Avenue

Homeowners with significant equity to trade can look at spending $1 million to get into a house on a 33-foot lot in Kitsilano, or realtor Lorne Goldman thinks they might want to consider spending a bit more to get more room in the pocket between Arbutus and Granville streets from 41st Avenue to 57th Avenue.

“Between $1 million and $1.5 million, there are definitely deals out there,” Goldman, of MacDonald Realtors Lorne Goldman, says.

The neighbourhood might not have as many trendy restaurants or shops as Kitsilano or Point Grey, and there might not be a lot of families with young children around anymore, Goldman adds, but it has the same quiet, tree-shaded streets and good schools. Plus, for the price, Goldman says they’ll wind up with a lot twice the size.

“Interestingly, there are quite a number of realtors who have moved into the area,” Goldman notes.

Central City, Surrey

What used to be called Whalley is being re-branded as Central City. And, as all of Surrey is undergoing phenomenal growth, Central City’s redevelopment is starting to hop, says Scott MacDonald at Re/Max 2000 Realty.

Simon Fraser University has a new campus there, new condominium towers are being built and new residents are starting to buy the old houses to tear them down and start over again, MacDonald adds, which is a relatively new phenomenon for the city.

“The city centre market is evolving the most from what it used to be, to a much more modern-style living,” MacDonald says.

Buyers will start finding condominiums on resale in the low $100,000s on the Multiple Listing Service. The older teardown homes can be had starting from around $300,000.

Albion-Maple Ridge

More than just the Fraser-crossing ferry, Albion is one of high-growth Maple Ridge’s fastest-growing neighbourhoods with new schools and plenty of retained green space, says Ron Antalek at Re/Max Ridge Meadows.

And, comparatively speaking, new residents can find good values. Antalek estimates first-time buyers can find new studio condominiums starting in the $149,000 range, new townhouses in the $339,000 range. Buyers who want to move up to their first house start looking in the $375,000 range, Antalek adds, for which they can expect a 2,300-square-foot house, albeit on a small lot.

Albion might have been off the radar because of its distance from bigger urban centres to the west, but Antalek adds that the province’s Gateway transportation improvements — the new Golden Ears and Pitt River bridges in particular — have put it on.

Abbotsford

It might be a long commute from the central Fraser Valley to Vancouver, but Geraldine Santiago of Re/Max Crest Realty (Westside) encourages the first-time buyers she works with not to think of it that way.

“They shouldn’t think of the commute as a hindrance, because [they are] getting a piece of real estate and becoming homeowners,” Santiago says. The Abbotsford buy is about value.

Once they have a foot in the market, Santiago adds, buyers can work toward moving to the community they would prefer to live in on their second move, or their third.

Randy Dyck, a realtor with Re/Max in Abbotsford, noted that the city’s market has boomed along with the whole Lower Mainland. However, buyers can still get into two-bedroom condos starting at $160,000, townhouses in the low $200,000s, and a decent family home in the low $300,000s. The region’s economy is growing so fast, commuter buyers might find it more convenient to move their careers to the Valley as well.

Saltair

Tucked between Chemainus and Ladysmith, Saltair offers bucolic beauty, ocean views and room to move for a lot less than busier resort areas on Vancouver Islands, according to Darrell Paysen of Sutton Group realtors in Duncan.

Paysen says Saltair’s mean sales price is $330,000. That is less expensive than Nanaimo, he adds.

It is primarily a residential, rural community without a lot of new development, but Paysen says that median price will buy a homeowner a not-too-old house of about 2,000 square feet on one-third of an acre.

Part of the Cowichan Valley regional district, Paysen notes that Saltair isn’t big enough to attract a lot of its own services, but it does have its own beach. An excellent marina is close by in Ladysmith, and the nearest major commercial centre, Nanaimo, is about a half-hour drive away.

“It’s off the beaten track, but close to everything,” Paysen says.

Squamish

Squamish is definitely on the radar of B.C.’s real estate market and has been since about 2002, says Lisa Bjornson, managing broker of Re/Max Black Tusk realty, but it is still a beacon that keeps getting brighter.

Vancouver realtor Robert Chipman is still bullish about Squamish because, with Sea to Sky Highway improvements continuing apace, it becomes a closer commute to Vancouver every day. And, unlike the Fraser Valley, it is a commute with a view.

Bjornson adds that prices have skyrocketed, particularly on the new construction side. On resale, however, buyers might find a detached home starting in the $450,000s. Townhouses, when available, can be had in the $290,000 to $350,000 range.

Bjornson notes that Squamish is starting to attract major commercial development, yet it will always be a small town. Even when it fills out its current community plan, Squamish will top out at 40,000 residents.

Campbell River

A few years ago, the Comox Valley was on the radar, but now maybe it’s Campbell River.

Vancouver real estate investing consultant Ozzie Jurock likes Campbell River for quality of seaside life, at a lower price than desirable spots in the Courtenay/Comox area.

Bob Clarke, managing broker of Coast Realty Group, says, like everywhere else, the city has seen a considerable run up of real estate over the past couple of years. But more retirees are looking to Campbell River.

Campbell River’s average sales price is around $267,000. Or buyers can get into patio-home developments for about $175,000, which would get them 1,000 square feet on a single level, Clarke adds. Put that patio home on a golf course and it’s about $270,000.

The Mount Washington ski resort is nearby, it is right on the water and hiking opportunities abound.

“You could probably go golfing, fishing and skiing all in the same day,” Clarke adds.

Kicking Horse Mountain Resort

Think Whistler Blackcomb resort quality at not-quite-yet Whistler Blackcomb prices, boasts Michael Dalzell, the resort’s director of sales and marketing.

Located just north of Golden, Kicking Horse is heading into only its sixth season — its third with full resort services — and the U.S. men’s magazine Esquire has already ordained it “ski resort of the future,” for its “thigh-decimating” 4,133 feet of vertical drop from mountain top to its village.

Dalzell admits the real estate, at $300 to the mid $400s per square foot for condos in Palliser Lodge, is pricier than, say, Big White near Kelowna. But buyers are getting in near the beginning. Kicking Horse is only one-third of its way to building out the 3,500 resort beds in its plan.

“It embodies the spirit of the

surveyors and engineers who founded this area of British Columbia,” Dalzell says.

Prince Rupert

The northwestern port town popped onto the real estate radar in 2005 with news of major port developments, a cruise-ship dock and container terminal, then kind of just dropped off, says Ted Shepherd.

Shepherd, with Royal LePage in Prince Rupert, says a flurry of investor buyers rushed in,

starting within minutes of the announced container terminal pushing up long-depressed prices.

Then they just stopped. That has left Prince Rupert slightly behind the rest of the booming north, so buyers can find comfortable family homes for $134,000, which is currently the median price in the city. For $300,000, Shepherd says you get 3,000 square feet of house less than five years old with panoramic harbour views, though Shepherd admits those listings are rare.

© The Vancouver Sun 2006