With demand remaining strong, a slower pace won’t have any impact on costs

Ashley Ford

Province

Lower Mainland housing starts have dipped for the second month in a row, but there is nothing to be alarmed about, industry insiders say.

And the dip won’t have any impact on housing costs.

The new housing market is tight and will remain that way for the foreseeable future, they say.

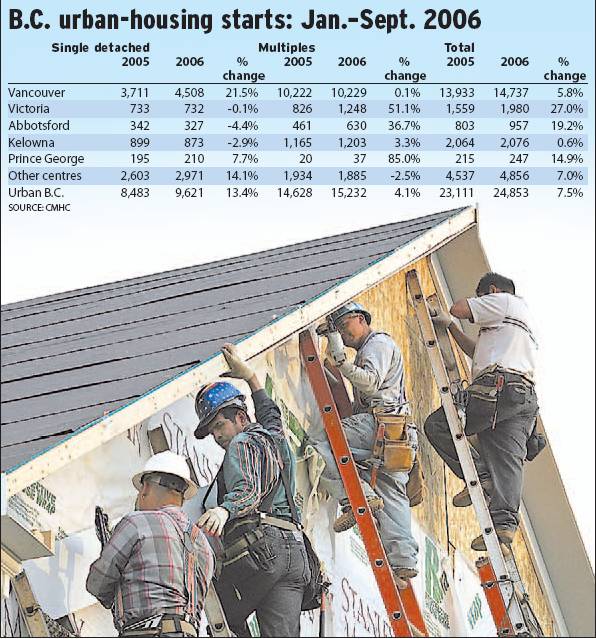

The latest Canada Mortgage and Housing Corp. numbers released yesterday show that Lower Mainland housing starts declined 35 per cent in September to 1,300 from 1,991 a year ago.

Single-family-home starts dropped by six per cent, to 502 units from 532 in 2005, and multiple-family home starts slid 45 per cent, to 798 units from 1,459.

But, so far this year, there have been 14,737 housing starts, up six per cent from 13,933 a year ago.

Total single starts increased by 22 per cent to 4,508 units while multiples are practically the same as they were a year ago at 10,229.

“This dip is actually welcome news to the construction sector and brings a little relief from the hectic pace,” said Peter Simpson, CEO of the Greater Vancouver Home Builders Association.

“The demand for new housing remains very strong and we are still running six per cent ahead of last year’s starts,” he said.

“The current market is turning out exactly as we predicted at the beginning of the year. We projected a slightly slower year and that is what is now happening,” he said. “There’s nothing here I am worried about.”

CMHC senior market analyst Cameron Muir agreed. “In spite of low new-home inventories, builders and developers are hard-pressed to continue increasing the number of housing starts,” Muir said.

Muir said other factors at play include limited developable land, a trend to more complicated mixed-use developments and the ongoing competition for skilled workers.

These are significant constraints to producing more than 21,000 housing starts per year, he said, adding that “these factors may alleviate fears of overbuilding but consumers will continue to be faced with rising new-home prices.”

Across the rest of Canada, housing starts unexpectedly dropped to 211,300 units in September, down slightly from 216,600 in August.

But the new-home market continues to fare better in Canada than south of the border.

Economists said the decline was attributable to the volatile multiple-starts segment — consisting of condominiums, rental apartments and townhouses — which fell to their lowest level since July 2004.

That stood in sharp contrast to single-family units, a more stable housing measure, which edged upward in September for the fourth straight month, reflecting fundamental strength in the housing market, CMHC said.

“Certainly, the singles suggest the game isn’t over yet,” said Bart Melek, senior economist with BMO Capital Markets.

“At the end of the day, anything over 200,000 [units] in Canada is indicative of a very strong housing market.” [email protected]

© The Vancouver Province 2006