REAL ESTATE I The value of sales shot up 51 per cent to $91 million in a year

Derrick Penner

Sun

Real estate markets in British Columbia’s resource-rich North are continuing to boom with rocketing sales and prices, which defy the slowing trend across the rest of the province.

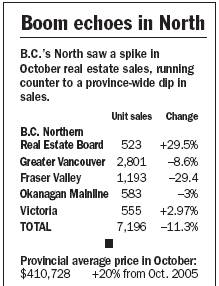

The B.C. Northern Real Estate Board saw a 29.5-per-cent jump in Multiple-Listing-Service-recorded sales during October compared with a year ago, the B.C. Real Estate Association reported Friday.

The value of those sales also shot up 50.5 per cent to $91 million compared with $60.5 million a year ago.

The North’s 523 transactions in October represent only seven per cent of the 7,196 sales across B.C., but Northern Board president Ted Shepherd said the dramatic rise reflects the optimism of communities witnessing a resurgence of forestry, oil and gas drilling, mining and port construction in Prince Rupert.

“You have to realize, when the boom started down south, the North was still lagging behind,” Shepherd said.

Shepherd added that in Prince Rupert, where he works as a realtor, prices declined from 1999 to the spring of 2005.

“So the increase [in sales and prices] is a recent thing,” he added. “We’re just playing catch up.”

Buyers in the newly resurgent North include investors from bigger cities, Shepherd said, but improved economic prospects are also drawing regional expatriates back home and spurring northerners to buy recreational property.

The B.C. Northern Real Estate Board stretches from Prince Rupert through Prince George to the Alberta border including Fort St. John and Fort Nelson, but excluding Dawson Creek.

Cameron Muir, chief economist for the B.C. Real Estate Association, said there is typically a lag between the rise in demand and growth in supply to satisfy it.

In the meantime, buyers, especially people moving into the markets, bid up prices to make sure they can secure homes.

“It’s been a few years since we’ve been able to look at the North as the [top growth market] in the province,” Muir said. “And that’s a result of those factors in their regional economy around resources.”

New-housing construction in the United States has cooled, which will be of concern to northern forest-industry communities, but Muir added that demand in other commodity sectors, such as coal, oil and gas and other minerals, remains strong.

Provincially, however, sales slid by 11 per cent in October to 7,196 units compared with 8,112 in October 2005, the fourth straight month of decline.

A lot of the decline, Muir added, has to do with the average house price rising 20 per cent to $410,728 in October compared with a year ago.

Overall, Muir said the economy is doing well with solid gross-domestic-product growth, strong employment growth and wage increases that are outpacing inflation. “That underpins the housing market,” Muir added.

“The difference now is that we’ve seen such a run up of prices . . . now, we’re reaching the point at which consumers’ affordability limits are being reached.”

However, as long as interest rates remain relatively low and the economy holds, Muir doesn’t believe there will be any significant correction in real estate prices.

© The Vancouver Sun 2006