Businesspeople in Whistler are starting to look to China for buyers for their luxury properties

Joanne Lee-Young

Sun

Frank Fletcher is taking Whistler to Shanghai in search of new high-net-worth clients. Photograph by : Vancouver Sun, Handout photo

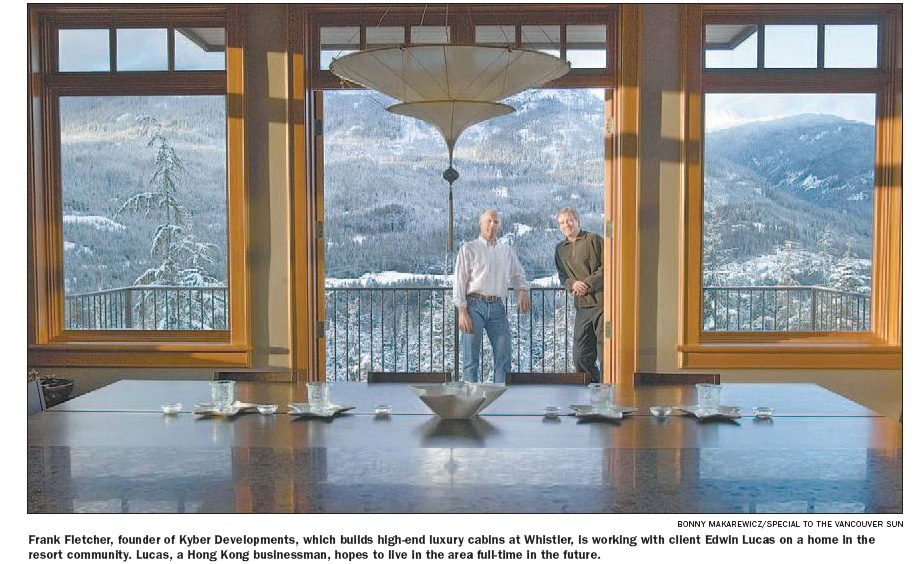

Frank Fletcher has been building high-end homes at Whistler for about a decade. His company, Kyber Developments, specializes in completely over-the-top, luxury homes of the multi-million-dollar, 5,000-square-feet-plus kind.

Many of Kyber’s sales have been to a small group of Hong Kong-based clients. Over the years, this little coterie has been so enamoured of Whistler that it has invested in some 80 properties there, according to Fletcher.

Now, he is taking Whistler to Shanghai in search of new high-net-worth clients.

Fletcher recently attended a luxury property trade show in Shanghai. For three days, islands, villas, yachts and resorts from around the world were on display. Fletcher and a few Whistler realtors and other developers collected business cards, passed out Maple Leaf lapel pins and fielded questions.

Interest in China by Whistler businesspeople comes, ironically, just as Intrawest ULC, owner of the Whistler Blackcomb resort, has abruptly aborted its China expansion plans.

Last spring, the company courted press inquiries into its China plans, telling reporters it had developed “extremely good” relations with local governments and businesses in the Chinese provinces of Jilin and Heilongjiang.

Forbes magazine ran stories about “Hugh Smythe’s China Adventure,” describing the pioneer and president of Whistler opting out of a trip to the Turin Olympics so he could visit 13 Chinese ski areas in 14 days. Smythe told Forbes the company was in talks to manage up to 10 ski areas and property developments involving up to $500 million in equity investment.

However, with the purchase of Intrawest by New York-based Fortress Investment Group in October, the company has dropped its China team and put the entire project on hold so it can focus on North America.

But that hasn’t discouraged Frank Fletcher and his colleagues from testing the mainland Chinese waters themselves.

“There are two types of nouveau money [in China],” Fletcher said. “One is less knowledgeable about foreign environments. The other is better travelled, western-educated and understands the overseas property business,” said Fletcher.

The Shanghai show yielded some active inquiries, but no specific sales have been made yet. “Down the road, it will happen,” said Fletcher.

He added that skiing is very popular in China even though the facilities are rudimentary. “There is a strong appetite for recreational activity that is emerging among the generation of Chinese people who have been educated during a time when there was sufficient disposable income to consider recreation.”

Fletcher’s insights come, in part, from a long association with Asia. He is American by birth, but lived most of his adult life in Hong Kong from 1971 to 1999 before relocating his family permanently to Whistler and becoming a Canadian. He continued buying and developing lots at Whistler, filling them with grand homes.

In fact, the story of this Whistler business really starts in Hong Kong. There, Fletcher worked in construction, contributing to major capital projects, commercial buildings and other property developments across Asia.

After work, he played squash at the exclusive Hong Kong Country Club. Some of his teammates got interested in Whistler and started buying single-family lots and income properties requiring various levels of development. Fletcher helped them.

Since then, Kyber has constructed some very high-end homes (one can take up to four years to build) for several of Fletcher’s old squash contacts, a group of well-heeled, long-time expatriates and local residents who came of age and made their money as Hong Kong transformed itself in the 1970s and 1980s. The company is currently constructing a home for Edwin Lucas, a businessman in the financial sector who spent nearly 19 years in Hong Kong and is now planning to move permanently to Whistler.

Being in Hong Kong during those years also allowed Fletcher a close-up look at how a new class of high net worth individuals were emerging in mainland China.

“A lot of originally state-owned companies privatized or did initial public offerings, facilitating the accumulation of wealth. That new emerging wealth in China is becoming more aware of investment opportunities abroad,” said Fletcher.

Indeed, the world’s top private bankers are eager to engage this somewhat elusive group. In March 2006, Citigroup Private Bank opened its first office in Shanghai, targeting rich people with at least $10 million in net worth.

“In the long term, we expect the China market to rank as the single largest in the Asia-Pacific region for our wealth management businesses,” according to Money K., a Singapore-based spokesperson for Citigroup Private Bank.

One third of Asia’s so-called ultra high-net-worth individuals with net worth exceeding $30 million are in China, mainly in the coastal cities, according to the most recent Merrill Lynch and Capgemini World Wealth Report released last June.

Despite these projections and statistics, some of these private bankers quietly acknowledge that there are many challenges. State regulations cap foreign investment by Chinese citizens. Some of these are loosening, but the process has been slow. In an atmosphere of fluid guidelines, many rich Chinese have preferred to be extremely low key with their wealth, making it hard to track and manage their assets.

Back at Whistler, Fletcher said: “I know there are potential clients in China. It was a matter of generating enthusiasm amongst local realtors to encourage their marketing to that area.”

So far, at least, some are keen. Denise Brown of ReMax Sea to Sky Real Estate Whistler represents Kyber and was on the recent trip to Shanghai.

Ann Chiasson of Sea to Sky Premier Properties also attended and is now looking to open an office in Hong Kong this spring.

She cautioned, however, that “this is a tester, so it will be quite small. When you open a new market, you have to walk, not charge in.”

© The Vancouver Sun 2007