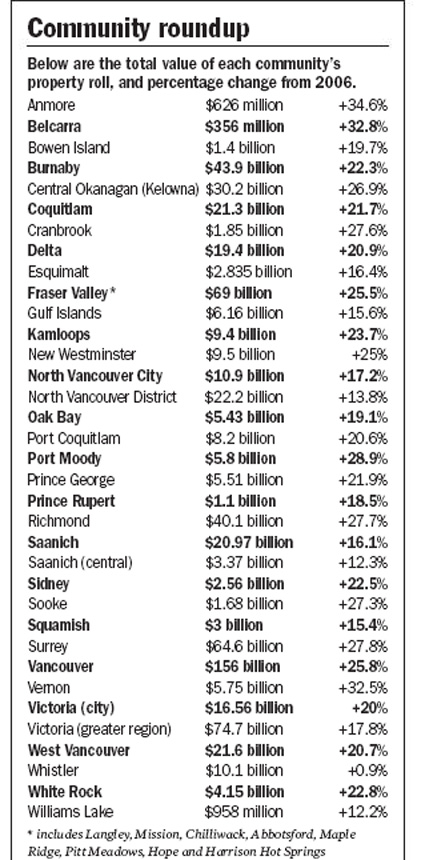

New construction added 106,734 new properties to the roll and pumped $19 billion into assessments

Derrick Penner

Sun

A record amount of new construction and the sixth year of a hot real estate market pushed the value of British Columbia real estate to $808 billion, according to BC Assessment’s 2007 property roll. Photograph by : Mark van Manen, Vancouver Sun file

A record amount of new construction and the sixth year of a hot real estate market pushed the value of British Columbia real estate to $808 billion, according to BC Assessment’s 2007 property roll.

That is a 23-per-cent increase from 2006.

New construction added 106,734 new properties to the roll and pumped $19 billion into assessments, the authority reported Tuesday.

However, $131 billion of the $150-billion gain was driven by hot property markets in communities around the province.

“It’s crazy in B.C. all over the place,” said Bill Levis, BC Assessment’s manager of audit and research.

“[Assessment increases] are not just isolated to the Lower Mainland or Victoria. We’ve had increases in Dawson Creek, Prince George, Terrace: Places that historically are more level.

“B.C. seems to be the place people want to live.”

The Vernon assessment region, which includes Vernon, Armstrong, Salmon Arm and surrounding communities, had the biggest assessment gain at just over 30 per cent to $21.3 billion.

The Penticton assessment area was another big gainer, with its roll increasing just more than 27 per cent to almost $18 billion.

The Vancouver assessment area’s property roll increased 25.5 per cent to almost $164 billion. Most of that was within the city of Vancouver itself.

Whistler is the only municipality to buck the trend. Although the resort community’s assessment is up 0.9 per cent to just over $10 billion, area assessor Jason Grant said many homes on the 2007 roll are worth a little less than they were in 2006.

Levis added that even commercial property markets have seen more significant gains than they have in previous years, which served to give 2007 assessment increases an additional push.

Helmut Pastrick, Credit Union Central B.C.’s chief economist, said the dramatic increase in assessments is “fairly consistent with what we’ve seen in price [increases].”

With the pace of new development that the province has seen, Pastrick added that the dramatic rise in assessed values was no surprise.

Generally, Pastrick said that low mortgage interest rates, as well as stronger economic growth and income growth, continued to fuel real estate markets — especially in communities outside the Lower Mainland that lagged behind Greater Vancouver’s economic boom.

The caveat, however, is that the authority’s assessment period is from July 1 to July 1. So the 2007 property assessments are based on values as of July 1, 2006, compared with the same date a year ago.

Pastrick said that period certainly captures the hottest part of 2006 real estate markets, but markets have cooled and sales have slowed since then.

He still expects to see increases in 2008 property assessments, but nowhere near the 23-per-cent increase this year.

The dramatic rise in assessments makes setting tax rates a challenge for municipalities, which use the assessed value of property to set property tax rates.

However, Richard Taylor, executive director of the Union of B.C. Municipalities, said homeowners shouldn’t automatically assume a big assessment will translate into an equally large tax increase.

“Municipalities are not in the habit of attempting to capitalize on increases in assessment,” Taylor said.

He added that typically when there are large assessment increases, municipal governments will reduce rates by the average increase for each property class.

So, as long as a property owner’s assessment increase falls within the average, he shouldn’t pay a tax increase that is any larger than the general tax increase his city or town levies with its 2007 budget.

However, property owners whose assessments increase by more than the average will see their taxes go up.

Owners whose assessments rise by less than the average for their class will see tax cuts.

The province is also considering whether to increase the threshold for the provincial homeowner’s grant, the B.C. government’s main tax assistance plan.

Finance Ministry spokesman Robert Pauliszyn said the program was designed so that 95 per cent of homeowners would qualify for the $570 homeowner’s grant to offset property taxes. Seniors, veterans and other pensioners qualify for a further $275 in assistance.

The current threshold to qualify for the grant is $780,000. Pauliszyn added that the threshold has been increased over the past several years, and in 2006 Finance Minister Carole Taylor increased the grant by $100. That, he added, cost $95 million.

“The Ministry of Finance reviews [the homeowner’s grant] every year as part of the budget process,” Pauliszyn said.

B.C.’s 2007 property assessments topped $808 billion, $150 billion more than 2006. Vancouver accounts for the largest single slice, with total values of $156 billion. The Fraser Valley and Surrey combined are a close second at $134 billion. West Vancouver is at $21.6 billion.

– – –

BC Assessment sent 1,924,750 assessment notices to British Columbia property owners, an increase from last year’s total of 1,818,016.

– – –

Check your property assessment using the BC Assessment Web site: http://www.bcassessment.bc.ca

© The Vancouver Sun 2007