Businesses find appeals won last year didn’t end issue

Fiona Anderson

Sun

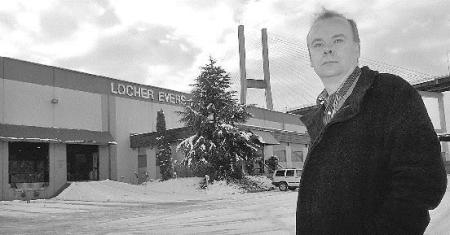

Peter Broerken is the controller for Locher Evers International on Annacis Island. The company is appealing the parking tax. Photograph by : Ward Perrin, Vancouver Sun

Now in its second year, TransLink’s parking tax is creating even more of a stir as taxpayers who fought their assessments last year — and won — are finding they may have to do it all over again.

Drive-in movie operator Jay Daulat was certain that he won his $15,000 parking tax battle last year. And if it wasn’t for a chance phone call this week, he wouldn’t have known the Twilight Drive-in that he operates in Langley was assessed again this year for the same amount as it was last year.

It turned out to be a glitch that could be settled with a phone call to TransLink, but Daulat had already contacted his lawyer.

“TransLink should understand, we small business people just can’t keep bearing these costs year after year after year,” Daulat said.

Many commercial property owners may find they are in the same boat, with property assessments this year not reflecting successful appeals. But not all will be able to resolve them as easily as Daulat was. TransLink’s director of communications Ken Hardie said some notices don’t reflect reductions last year because of a “systems problem” and others may have been decided too late to make it into the new roll. For those cases, a call to TransLink should solve the problem, Hardie said.

But some appeals, which Hardie estimates to number about 100, have not been taken into account because the B.C. Assessment Authority — hired by TransLink to prepare the roll — believes they are wrong. And those taxpayers will have to take their fight back to the assessment review panel.

“In the early days of the property assessment review panel, before any precedents were set, before people knew how the definitions would work in practical terms and before certain global issues went to the property assessment appeal board, some of the property assessment review panel decisions were incorrect,” Hardie said.

Delta freight forwarders Locher Evers International appears to fall into this category. Last year the company was assessed for more than 8,000 square metres of parking space. The company’s controller Peter Broerken appealed that assessment pointing out that some of the area included was actually storage and exempt from tax. The review panel agreed and reduced the area to 6,800 square metres. So when the assessment notice came this year, Broerken barely gave it a glance, being confident it would reflect the review panel’s decision. But not only did the new assessment ignore the reduction, it increased total parking area to over 9,000 square metres. So he’s appealed the assessment again.

Broerken wonders how many people like himself may think they don’t need to review the assessment notice and then end up missing the appeal deadline of Jan. 31.

Hardie encourages all businesses whose assessments do not reflect last year’s appeal to call TransLink to determine whether the matter can be corrected immediately, like Twilight’s situation, or whether they need to file another appeal.

The Park the Tax Coalition, a group of 23,000 businesses and organizations that have joined together to lobby against the tax, are also encouraging commercial property owners to review their tax notices and ensure that the area covered is appropriate.

Laura Jones, co-chair of the coalition and vice-president of the Canadian Federation of Independent Business urges business owners to ask TransLink for the photo that shows what space is included in the assessment.

The coalition wants the tax scrapped “but while it’s in place we have to first make sure that business owners aren’t paying one more penny than they have to,” Jones said.

TransLink raised between $16 million and $17 million last year after costs and expects to raise slightly more this year from the parking tax.

The money will be used to help fund TransLink’s $1.9 billion three-year plan to upgrade roads and transit.

PLAYING THE SLOTS, TRANSLINK STYLE

Last year was the first year for TransLink’s controversial parking tax, which taxes businesses in the Greater Vancouver Regional District on their parking areas. Here are some key numbers:

TOTAL AREA ASSESSED: 26 million square metres

RATE: $0.78 per square metre

TOTAL RAISED AFTER COSTS: $16 million to $17 million

NUMBER OF APPEALS TO REVIEW PANEL: Approximately 4,000

APPEALS THAT WENT FROM REVIEW PANEL TO ASSESSMENT APPEAL BOARD: 797

APPEAL BOARD DECISIONS TO DATE: 32

APPEALS DEALT WITH OTHER THAN BY DECISION AS OF SEPT. 30, 2006: 190

NUMBER OF APPEALS THAT WENT FROM ASSESSMENT APPEAL BOARD TO B.C. SUPREME COURT: Unknown

NUMBER OF DECISIONS OF B.C. SUPREME COURT TO DATE: 1

Sources: TransLink, Property Assessment Appeal Board and Burgess, Cawley, Sullivan & Associates

© The Vancouver Sun 2007