Bank of Canada seen as welcoming price moderation

Jim Jamieson

Province

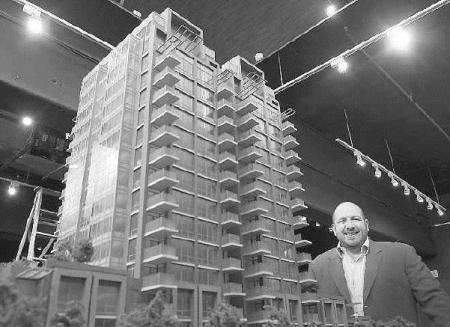

Mac Marketing Solutions’ Jason Craik doesn’t expect to see new high-rise condo developments, such as downtown Vancouver’s Donovan, sell out over a weekend anymore. Photograph by : Gerry Kahrmann, The Province

New house prices in Canada stayed the same from November to December — the first time in 61/2 years that month-to-month prices didn’t rise, Statistics Canada said yesterday.

They were also flat in Greater Vancouver, but real-estate industry insiders don’t see the lull as a sign that the bubble is about to burst in the region’s red-hot market.

“We’re just taking a breather right now,” said Peter Simpson of the Greater Vancouver Home Builders Association.

“It’s going to be more of a minor correction and a return to a more balanced market.”

Simpson said his association is forecasting price increases of between seven and nine per cent in the Lower Mainland this year for new homes, from single-detached to multi-family.

He said high land prices and development costs combined with a possible interest-rate reduction may fuel more activity. “A builder is like any other manufacturer,” he said.

“Any extra costs they incur have to be passed along to the buyer.”

StatsCan said Vancouver was one of six metropolitan areas that registered no monthly change.

The others included Halifax, Charlottetown, Quebec, Montreal and Ottawa-Gatineau.

Among those showing decreases were Victoria, which saw prices fall 0.4 per cent, and Calgary, where they dropped half a percentage point.

Vancouver last had a zero price increase for new houses in March 2006, but the last time it occurred for Canada as a whole was in June 2000.

With prices for single-family detached homes straining affordability, buyers have increasingly migrated to multi-family properties — whose market segment has now doubled to about 80 per cent of new home sales.

Jason Craik of Mac Marketing Solutions, which markets multi-family projects in Vancouver, said he sees a levelling off in that segment, although circumstances can vary.

“Demand will be good, but I just don’t think you’ll see buildings selling out on weekends anymore,” he said. “I don’t think we’re going to see any crazy increases.

“It’ll be four or five per cent. We’re into more of a normalized market situation.”

Craik said affordability will be more of an issue, “which is why the government needs to be more creative in terms of density.”

Canada Mortgage and Housing Corp. reported that housing starts in the Vancouver area were up 22 per cent in January, to 1,327 units, compared to the same month last year — including a 51-per-cent increase in multi-family unit construction and a 36-per-cent decline in single-detached units.

Year over year, Vancouver prices were up 8.2 per cent — well below Calgary (up 42.2 per cent), followed closely by Edmonton (41.5) and Saskatoon (16.1).

The moderation in new housing prices should put less upward pressure on inflation in the coming months, analysts said.

That would be welcomed by the Bank of Canada, which has warned that soaring housing prices, especially in Western Canada, are one of the major inflation threats.

© The Vancouver Province 2007