Whether it’s a cottage or raw land, you’ll pay for having a second home, including surprises

Fiona Anderson

Sun

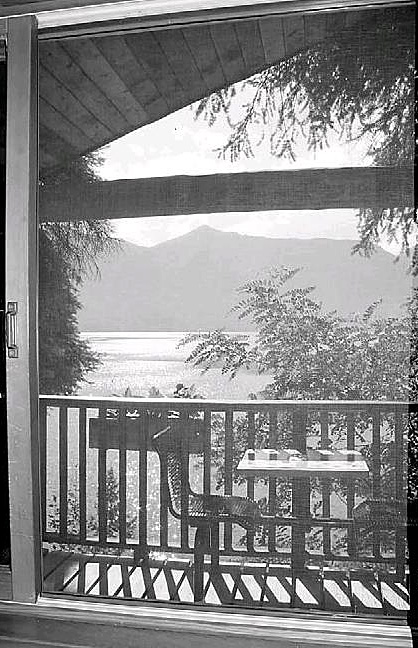

The thrill of owning a log cabin, like this one looking out over Kootenay Lake and the Selkirk mountains, shouldn’t eclipse financial preparation for the costs. KATHY LUKOVICH/VANCOUVER SUN FILES

Boomers are getting into recreational property in a big way, pushing up prices and starting a feeding frenzy. But before you jump onto the cabin-buying bandwagon, make sure you know what you’re getting into and how much it’s really going to cost.

The good news is that while prices have gone up astronomically in the last few years — with Royal LePage reporting this week that the average price of a waterfront cabin in British Columbia now tops $1 million — there are a lot more financing options available.

Not long ago, financing a recreational property was considered sub-prime so rates were higher, and often a larger down payment was needed. Not so now, says Gord Dahlen, vice-president for Western Canada with Invis.

Now there are many options including a low-rate mortgage with five per-cent down, he said.

“So you can obtain second properties now at first property rates,” Dahlen said.

As a result, from a financing perspective, buying a second home should be no different than a first home. If you qualify — which means your gross income can service the total amount of debt you are taking on, including heating costs and taxes — then you should be able to go ahead and live your dream.

But the buck doesn’t stop there. While some cabins are easily accessible, many dream vacation homes are a boat ride away. So add the regular cost of the ferry ride, if there is a ferry, or a boat and motor if there isn’t. And some islands have private marinas that can cost as much to buy into as a lot did a few years ago.

If you can’t afford the already-built $1-million lakeside or oceanside retreat, buying raw land may be your only alternative. But take out a pencil and paper, and a chequebook, because the costs to build can add up.

First, without a plan to build immediately, and a building contract in place, financing is going to be harder to get, Dahlen said. And that translates into a higher-cost mortgage and a larger down payment.

Susan McGougan, a realtor with Remax of Nanaimo, has sold recreational properties on nearby islands, many of which don’t have public water or sewage. So drilling a well and adding a septic field are two immediate expenses to add to the bottom line. And if the island isn’t ferry-accessible, all materials, including the trucks to haul the material, will have to be barged in, the cost of which can add up, she said.

But most people on those islands love the remoteness and the limited access makes the cabin that much more enjoyable, McGougan said.

Jim Doyle, a senior financial consultant with Investors Group, says insurance may be hard to get for some recreational properties.

“Vacant possession sends up alarm bells with a lot of insurance carriers,” Doyle said.

And a piece of raw land with a trailer on it many not be insurable at all, he added.

Doyle advises his clients that even if the bank says yes to the financing, make sure they have some breathing room to adapt to changes in their circumstances. Because if they need to suddenly sell the cabin in the middle of winter, people may not be lining up to buy it, he said.

None of these cost concerns scared off Danny Ransom, who bought a cabin near Princeton five years ago. Ransom chose to remortgage his house to pay for the property outright, back in the days when prices were still affordable and banks were still reticent about providing financing.

But he bought a no-hassle property — the cabin was fairly new, it was accessible by road so he didn’t have to worry about ferry lineups, and it was near a town so it had all the amenities. The only big expense was putting in baseboard heating so he could keep the cabin heated all winter rather than risking the pipes freezing up, he said.

But now, with prices out of many people’s reach, certified financial planner Anthony Windeyer with Coast Capital Savings suggests renting out the property when you aren’t using it. That way you can write off a percentage of the interest and have some added capital to pay off the mortgage.

Many areas, like the ones McGougan sells in, don’t allow short-term rentals. And those that do may have special licensing requirements that need to be considered.

But if you are investing a huge chunk of change in a recreational property, Windeyer recommends you at least look into the possibility of renting.

“Because otherwise you would have to be exceedingly well-heeled to have that capital sitting and doing nothing for you,” Windeyer said.