Edward C. Baig

USA Today

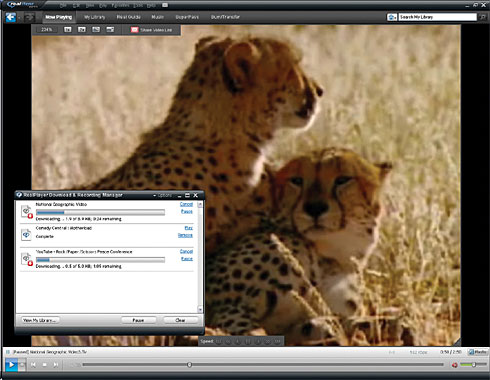

The RealPlayer update simplifies capturing video off Web.

There’s a ton of terrific video on the Web, and a lot more stuff that’s plain goofy. (For evidence, look no further than some of the homegrown videos on YouTube.) You’d love to save clips on your computer to share a laugh with friends or watch off-line. Only the process, at least for non-techies, is too darn complicated.

On Tuesday, with the “beta” arrival of the latest RealPlayer software, RealNetworks hopes to simplify things. RealPlayer 11 is billed as the first media player to let you record and download videos from thousands of websites with a single click. The free software was unveiled this month at the D: All Things Digital conference in Carlsbad, Calif.

The pre-release version I’ve been testing is buggy. But for the most part, the program’s chief bragging point — making it a cinch for you to capture unprotected video — works as promised. And RealPlayer 11 is less bloated and not as intrusive as earlier versions of the software.

Here’s what getting Real is all about:

How it works

After installing the software, a “Download This Video” button pops up whenever you move your mouse pointer over a video anywhere in cyberspace. Just click on the button to start downloading clips. It’s as simple as that; you do not have to separately launch the new RealPlayer.

What’s more, you can choose to download a clip at any point during the video, and the scene will be captured from the start. The download will proceed in the background even if you pause or stop watching. And you can download more than one video at the same time.

It’s addictive. At YouTube, Grouper, Metacafe, ESPN and USATODAY.com, among other sites, I fetched videos just because I could, covering everything from make-believe iPhone commercials to highlights of Bobby Nystrom’s Stanley Cup winning goal for the 1980 New York Islanders.

Videos are stored in the Downloads & Recording section of your RealPlayer library. The clip name is displayed, along with the date you imported it, the length and the Web address of the video source.

You can watch videos full-screen or burn copies to a disc. You’ll have to spring for a $29.99 RealPlayer Plus version to burn to a DVD; the free version lets you burn videos to a CD, where storage is more limited. The Plus version sports advanced video controls, among other features.

You can easily share the video link via e-mail with friends by clicking on a button that appears when you move the pointer over the screen. You can also place videos in automatic playlists (“one hour of favorites” or “clips I haven’t played for a while”).

Real says future versions of the player will let you transfer footage to portable devices such as an iPod. How easy that proves to be remains to be seen.

The player can also serve as a repository for music files. But it is not integrated with Real’s Rhapsody music service.

Restrictions

You cannot grab just any video. Clips that are embedded with digital rights management (DRM) copy restrictions are a no-no. So when I moved the mouse over a clip from the TV show House at Fox.com, a “Video Cannot Be Downloaded” button appeared in place of the Download This Video button. Confusingly, I often couldn’t grab a video even when the Download button showed up.

Real won’t prevent you from downloading copyrighted material that isn’t protected by DRM. It’s kind of a “don’t ask, don’t tell” policy. As Real CEO Rob Glaser said onstage at D, “We’re like a video recorder. We are a piece of utility software that has no specific knowledge of anything about the copyright.”

Real is trying to be a responsible corporate citizen. If any videos you wish to download are accompanied by advertisements, the player will fetch the ads, too.

The new player is compatible with most major video formats, including Real, Windows Media, Flash and QuickTime. For now, it works only on Windows PCs through the Internet Explorer or Mozilla Firefox browsers. A Macintosh version is due later this year.

Hiccups

I ran into a few snags, which are probably attributed to the unfinished version I was testing. The player crashed when I attempted to transfer a couple of clips to a newly created playlist.

Post-crash, I received a message that my library may have gotten corrupted. Fortunately, I was able to repair the database.

The software crashed again after I’d downloaded a clip from Comedy Central of Steve Carell joining Jon Stewart on The Daily Show.

RealPlayer 11 is worth having for video downloads alone. Assuming RealNetworks successfully eliminates the bugs, it will be even more of the real deal.