Andrew Petrozzi

Other

Archive for June, 2007

Urban living with green ideals

Friday, June 15th, 2007Posted in Real Estate Related | Comments Off on Urban living with green ideals

Terminal City Club plans update to City tradition

Friday, June 15th, 2007Ian Austin

Province

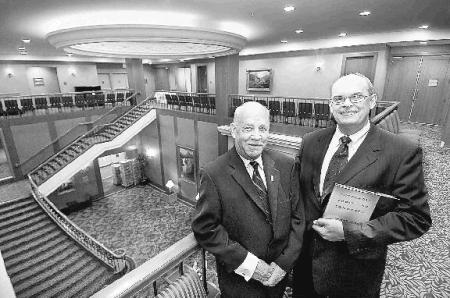

Membership sales manager Bill Massender (left) and club president Bob Pain shared their optimism yesterday about a $10-million plan for a two-year renovation of Vancouver’s Terminal City Club. It is designed to combine an old-world club feeling with modern, state-of-the-art multi-media services. Photograph by : Les Bazso, The Province

The historic Terminal City Club is making a little modern history these days.

Last night, members of the upscale downtown Vancouver private club got a look at their future as plans were unveiled for a $10-million upgrade that embraces both its history and its future.

“It’s a very exciting day,” said CEO David Long, envisioning bold new changes but also efforts to preserve and enhance the club’s storied past. “We’ll keep the old-world feel of the club, but feature the latest in wireless and audio-visual capabilities.”

The billiards room, with the original slate tables, will retain its charm, while a new “old-world library and reading room” will feature the wood-panelled ageless splendour traditionalists crave.

At the same time, it is hoped that an upgraded, expanded fitness facility, wine bar, restaurant, and multi-media capabilities will attract the young up-and-coming crowd.

“We’re not that sleepy old club any more,” said Long.

With that in mind, 750 members and guests gathered last night for the gala “Last Call — Honouring Tradition, Embracing Tomorrow,” getting their first taste of how yesterday and tomorrow can abide in the same club.

In a way, the club has come full circle.

Ten years ago, the old club was razed, with pillars, stone doorways, chandeliers, and a stunning stained-glass dome preserved and incorporated in a new modern hotel/retail complex.

The result was a financial success — the hotel, pub, restaurants and retail rents generate plenty of cash and will pay for the massive project — but along the way some of the swanky club’s charm got lost in the transformation.

“We lost some of the private-club feeling,” concedes president Bob Pain. “Everybody’s quite excited about the changes — we’re getting excellent feedback from our members.”

Membership sales manager Bill Massender figures to be a busy man as prospective members see what will be. “What we’re trying to instill in people is that their membership will increase in value, and it won’t cost them anything. Our focus is how can we do this without reaching in their pockets.”

– – –

MAKING HISTORY

Terminal City Club by the numbers

Founded: 1892

Women first allowed to dine: 1924

Women admitted as full members: 1991

Members: 1,600

Membership fee: $7,500

Monthly dues: $170

Minimum monthly food bill: $25

Current upgrade: $10 million

Estimated completion date: 2009

© The Vancouver Province 2007

Posted in Real Estate Related | Comments Off on Terminal City Club plans update to City tradition

Buyers get squeezed out of housing market

Friday, June 15th, 2007Noelle Knox

USA Today

Higher mortgage rates will be a drag on home sales and prices because higher rates make homes more expensive.

Would-be home buyers, such as James Aberle, have watched with angst as mortgage rates have jumped nearly 10% in just five weeks. The average rate on a 30-year fixed mortgage hit 6.74% this week, Freddie Mac said Thursday, its highest in nearly a year.

The spike in rates — which averaged just 6.15% in mid-May — could have a whiplash effect on the market if they stay high. In the short term, it could force fence-sitting buyers to make an offer. Mortgage applications for purchases, for instance, rose 7% last week. But over the long term, higher rates are likely to depress home sales and prices by making mortgages too expensive for some would-be buyers.

That’s especially true in such states as California, Arizona and Florida, where prices are out of reach for many working families.

“My fingers are hurting from keeping them crossed, hoping the mortgage rates go back down,” says Aberle, 39, a marketing manager. Last weekend, he found a home in Phoenix he wants to buy, but he isn’t allowed to lock in a mortgage rate until next week.

The surge in rates means someone who bought a median-price U.S. home of about $220,000 last week, with a 30-year fixed-rate loan and a 10% down payment, would face a monthly payment $77 higher than someone who bought the same home a month earlier, according to an analysis by Genworth Financial for USA TODAY.

After talking with a broker in Highland Ranch, Colo., this week, Tammy and Cecil Lee decided they can’t afford to buy their first home now. “Part of it is interest rates,” says Tammy, 43. “It just isn’t feasible, and it’s frustrating.”

For each half-point increase in rates, up to 240,000 families in California can no longer afford the state’s median-price home (at $597,640), a 2005 study by the California Association of Realtors found.

“Interest rates have gone up more strongly and more quickly than we had anticipated,” said Frank Nothaft, Freddie Mac’s chief economist. Where they go from here, “depends on upcoming economic news, but I see interest rates moving within a range of no less than 61/2 and as high as 67/8.”

Nothaft largely blames rising international interest rates, which have put pressure on U.S. rates to go higher to attract investors.

Zooming interest rates also make it more expensive for those with adjustable-rate mortgages to refinance into fixed-rate loans.

“Any increase (in rates) will be bringing more people into the danger zone,” says Susan Wachter, a professor of real estate at the University of Pennsylvania.

Buyers who got a typical ARM in June 2005 and face their first payment adjustment now are in for a jolt. On a median-price home, their payment would soar about 40% to $1,929 a month, Genworth found.

Posted in Real Estate Related | Comments Off on Buyers get squeezed out of housing market

Bentall plans to build 22-storey, 400,000 sf office tower across from new Shangri-La Res Tower at Alberni & Thurlow at Liquor Store Location

Friday, June 15th, 2007400,000-square-foot project to fill downtown need for space

Derrick Penner

Sun

Bentall Capital wants to build downtown Vancouver’s first new all-office skyscraper in more than five years, a 22-storey, 400,000-square-foot development at Thurlow and Alberni.

Bentall applied to the city for a development permit for the site this week because “the market needs more office space,” according to Tony Astles, senior vice-president of Bentall Real Estate Services.

Speculation around who would step in to build the next new office building has swirled around Vancouver as downtown’s office vacancy rate dwindled — to an all-time low of 3.5 per cent, according to commercial realtor CB Richard Ellis in its latest report.

Astles said Bentall will build the tower on behalf of the province’s big public-sector pension fund, British Columbia Investment Management Corp (BCiMC).

“It’s a very attractive location,” Astles said, across the street from the 61-storey Shangri-La tower, and the new tower “will be an extraordinarily attractive building.”

Bentall is proceeding with the project without an anchor tenant. But Astles said the company is confident it will be able to find a marquee name to rent space.

“We’ve done it before,” he added.

The office tower will replace a number of restaurants, a liquor store and parking garage. It will also add to BCiMC’s downtown real estate portfolio, which includes the MacMillan Bloedel building and Evergreen building. The project’s architect, Musson Cattell, Mackey, will appear before the City of Vancouver’s urban design panel’s June 20 meeting to discuss the project.

© The Vancouver Sun 2007

Posted in Real Estate Related | Comments Off on Bentall plans to build 22-storey, 400,000 sf office tower across from new Shangri-La Res Tower at Alberni & Thurlow at Liquor Store Location

Office space rents soaring in Vancouver

Friday, June 15th, 2007With space at an all-time low, rents top $40 per square foot for the first time

Michael Kane

Sun

Available Vancouver office space is at an all-time low, forcing rents for top-of-the-line properties above $40 per sq. ft. for the first time.

The downtown vacancy rate dropped to 3.5 per cent in the second quarter, according to CB Richard Ellis, a major commercial realtor. The last time it was close to that level was at the height of the tech boom in late 2000, when it bottomed out at 3.9 per cent.

Space is even tighter along the Broadway corridor, where vacancies have fallen to a record low of 2.6 per cent.

Shrinking supply and steady demand have pushed up downtown rents for Class-A buildings by 17 per cent during the past 12 months, and nearly 30 per cent over the past two years.

While the average net rent downtown is $20 per square foot, according to CBRE survey results released Thursday, the average is $31.77 for AAA-Class buildings like the Bentall 5 tower on Burrard St. or the Terasen building on West Georgia.

“There are deals now being done in the mid-$40s for the elite, high-view spaces, and that’s a first for this market,” CBRE analyst Chris Clibbon said in an interview. “Two years ago that same class of space was averaging $25.20, and there were no deals being done over $30 at that time.”

Rising rents are encouraging cost-cutting companies like Catalyst Paper to move to cheaper suburban office markets, which also experienced a strong second quarter. Catalyst is relocating its head office from a triple-A building on Howe St. to Lysander Lane in Richmond.

“This is a trend we expect to grow as rental rates continue to increase in the downtown market,” Clibbon said. “Burnaby and Richmond are poised to do well, particularly Burnaby because of the SkyTrain. Both markets will grab some tenants from downtown.”

There are currently three office developments under construction near SkyTrain stations in Burnaby, while Richmond has two developments under way. Vacancy rates decreased in all suburban markets in the second quarter, with the exception of Surrey, CBRE said.

Clibbon expects the downtown vacancy rate to remain tight for the rest of the year. While the second phase of Bentall 5 is nearing completion, the project is fully leased, and there are no other office projects announced to date that are expected to be complete before 2010.

Lack of new supply is the most notable feature of the current downtown market.

“In every office cycle where we have seen vacancy rates drop to new levels, we have always had this bank of new supply that would counter the vacancy drop. We just don’t have it in this cycle, not yet.”

However, there are hints that developers are poised to submit applications to the city for potential new towers.

“There is a little bit of a race right now to put a tower up,” Clibbon said. “Rates are now approaching the level required to build an exclusive office tower and make a profit.”

Meanwhile, the City of Vancouver has managed to stall further conversions of office buildings into condo towers, and forced two condo projects in the core — the Hotel Georgia and the Bay Parkade — to include a small proportion of office space, about 80,000 sq. ft. each. But neither project is due to be complete before the Winter Olympics.

© The Vancouver Sun 2007

Posted in Real Estate Related | Comments Off on Office space rents soaring in Vancouver

Riverbend project called ‘disastrous’ by Supreme Court judge

Friday, June 15th, 2007Pre-sale contract holders won’t get their deals

Derrick Penner

Sun

COQUITLAM – Pre-sale buyers in Coquitlam’s Riverbend condominium complex won’t be able to claim units in the project for prices they agreed to in their original contracts, a B.C. Supreme Court judge ruled Thursday.

However, pre-sale contract holders may be able to claim some of the proceeds from the sale of the 32 homes in Riverbend’s final phase representing equity in the homes they would have earned if they had moved in.

The court will determine at a later date whether or not the pre-sale contracts represent an interest in the property that should take precedence over the project’s main construction lender, CareVest Capital Inc.

Regardless of what is decided, CareVest will lose money on a project built by CB Development 2000 Ltd. in which delays and skyrocketing costs ate up profits.

According to a court-appointed receiver’s report, CareVest’s losses would total about $5 million if pre-sale buyers had been able to stick with their original contracts, or $2.7 million if all proceeds from renegotiated sales go to the project’s current creditors.

“The economic reality is that costs will exceed revenues,” Judge Ian Pitfield said in delivering the reasons for his ruling. “It is regrettable to say the least. One can only have sympathy for all involved in this disastrous project.”

However, Shane Coblin, a lawyer representing six of the pre-sale buyers who sued CB Development seeking delivery of their homes at the contract prices, said Pitfield’s decision represented a victory.

“The judge has decided not to summarily dismiss our claims,” Coblin said.

Coblin added that he also believes the ruling is “a big victory for the pre-sale market, because it identifies that there may actually be rights to these pre-sale contract holders.”

Several of the buyers who bought into the project’s 32 strata-titled single-family homes at prices between $329,000 and $379,000, were still unhappy with the decision.

“I’m not getting my house at the end of the day,” buyer Sunita Chand said. “That’s been my dream for the last year-and-a-half.”

Chand said she sold her apartment in June, 2006, “thinking [the Riverbend house] was going to be my home,” and lost any subsequent appreciation in value on that property.

She added that she is leery about the prospect of buying into the Riverbend project again because of the lengthy delays, but will continue with a claim to some of the proceeds. And her experience has soured Chand to the whole concept of real estate pre-sales.

“And I’m not sure if any consumers are going to have the appetite for [pre-sales],” Chand said. “Definitely not us, I know that.”

CB Development caused controversy in mid-May when it tried to cancel the 32 pre-sale buyers in the 128-unit Riverbend project’s third phase.

CB Development was put into receivership at the end of May after its main construction lender, CareVest Capital Ltd., started foreclosure proceedings.

Earlier, CB Development cancelled the 32 contracts and returned deposits, saying that it needed to sell the homes at current market prices because of construction-cost overruns and CareVest’s refusal to discharge its loan.

The receiver, David Bowra, sought an order allowing him to eliminate the contracts so he could borrow the $3.8 million needed to finish building the homes and sell them free and clear at current market prices, which should average $435,000, to new buyers.

Instead, Pitfield’s order tried to strike a balance.

The judge authorized Bowra to borrow the $3.8 million that will be needed to complete construction of the 32 units, then sell them for current market value.

However, the judge refused to clear away the pre-sale contracts. Instead, he ordered that Bowra set aside the difference between the pre-sale contract prices and the final proceeds in a trust account.

In an interview on the courthouse steps, Bowra said Pitfield’s judgement was a way to try and recognize everyone’s interests, but enacting the order will prove difficult.

“The order allowing the receiver to complete the project is subject to someone lending them the money to complete it,” Bowra said.

He hopes CareVest will advance the money, because many of Riverbend’s last units are close enough to completion that it would make no sense not to finish them, and “the most economic approach is to complete [construction].

“But that’s [Carevest’s] decision.”

Finding another lender, Bowra said, would be difficult and take time.

“I don’t think there were any winners here today.”

© The Vancouver Sun 2007

Posted in Real Estate Related | Comments Off on Riverbend project called ‘disastrous’ by Supreme Court judge

‘Not your granddaddy’s Osoyoos any more’

Friday, June 15th, 2007High-end developments draw well-heeled to sun-and-fun town

Bruce Constantineau

Sun

The town of Osoyoos will see more than $200 million in investment over the next few years, with high-end projects such as the Spirit Ridge hotel-condo development.

The Spirit Ridge hotel/condo project by Calgary-based Bellstar Hotels and Resorts (in partnership with the Osoyoos native Indian band) is part of the Osoyoos building boom.

With a quarter-billion dollars worth of new developments slated for completion by early 2010, tourism spending in Osoyoos should sizzle like a Canada Day long weekend.

Destination Osoyoos executive director Glenn Mandziuk said Thursday the south Okanagan town expects annual tourism revenues will shoot up to $126 million by 2015 from $65 million this year. The number of visitors is forecast to jump to about 500,000 from 350,000.

“We’re going to attract higher-yield visitors with more money to spend on things that will create a premium quality experience,” Mandziuk said in an interview.

Wineries, golf courses, restaurants, retailers and others will benefit from the investment boom dominating the local economy, he said.

A total of four tourism-related projects near Osoyoos Lake — either planned or underway — will transform the area into one of the most popular getaway destinations in B.C.

The four projects include:

– The $75-million Spirit Ridge Vineyard Resort & Spa being developed by Bellstar Hotels & Resorts. The first phase of 30 villas and 64 suites is next to the Osoyoos Indian Band’s Nk’Mip Cellars, Canada’s first aboriginal winery. The 124-suite second phase is due for completion by late 2009 or early 2010.

– The $65-million Watermark Beach Resort being developed on almost two hectares (4.3 acres) of waterfront formerly occupied by a fruit-packing plant. Osoyoos Shoreline Development Ltd. expects to complete 30 townhomes and 123 other units by March 2009.

– The $45-million Walnut Beach Resort, with 112 units on a 1.3-hectare (3.2-acre) site. The Lakeshore Development Corp. project is expected to be completed by the spring or summer of 2008.

– The $80-million Indigo development on a 1.5-hectare (3.8-acre) beachfront site being developed by the Kingsway Group. The project still requires final approval but developers plan a 150-unit, six-storey concrete building that could be completed by the spring of 2009.

Mandziuk said Osoyoos has long been known as a summer “sun and fun” destination, but the new facilities should spread visitation over a longer period, as wine festivals now draw a lot of visitors to the region in the spring and fall.

He noted Tourism BC recently opened a new $2.5-million visitor information centre in the area to address “growing and emerging markets.”

Vince Taylor, who is marketing the Indigo project, said Osoyoos is changing to appeal to well-heeled visitors. Prices at Indigo are expected to range from about $349,000 to $1.4 million.

“Osoyoos used to be about bad motels and guys in Fortrel pants with big bellies and hibachis,” he said. “But this isn’t your granddaddy’s Osoyoos anymore. You’re looking at prices of $1.4 million now. Heck, you could have bought the whole town for that 10 years ago.”

Taylor said development around Osoyoos is going “crazy” because people have finally figured out all it has to offer — including great weather, a long golf season, the warmest lake in Canada, and the country’s top wine region.

Indigo has attracted the interest of several sports personalities — like former NHL player Ray Ferraro and B.C. Lions quarterback Dave Dickenson — and Taylor said 1,400 people have already registered as potential buyers of the 150 units expected to go on sale in late August or early September.

He said the target market is people from ages 43 to 70, and about 70 per cent of buyers are expected to come from Greater Vancouver, with 20 per cent from Alberta and the rest from elsewhere.

Osoyoos town Coun. Alan Carswell said some locals don’t like all the new development.

“They moved here because it’s a teeny little town [with just under 5,000 people] and they want it to stay that way,” he said. “It’s a pretty busy place in the middle of summer, no question about it. But people adjust after a while.”

Carswell said Osoyoos is running out of developable waterfront sites and doesn’t expect population growth will ever outpace the area’s infrastructure capacity. The official community plan calls for the population to eventually grow to about 6,000, a level the current infrastructure can handle.

“I love the tax revenue we get [from the developments], but we have to make sure the community gets something out of it,” Carswell said. “I’m all for beautiful developments, but I don’t want to see the taxpayers pay for them.”

© The Vancouver Sun 2007

Posted in Real Estate Related | Comments Off on ‘Not your granddaddy’s Osoyoos any more’

Terminal City Club plans update to City tradition

Friday, June 15th, 2007Ian Austin

Province

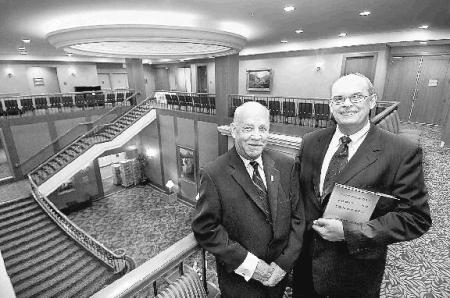

Membership sales manager Bill Massender (left) and club president Bob Pain shared their optimism yesterday about a $10-million plan for a two-year renovation of Vancouver’s Terminal City Club. It is designed to combine an old-world club feeling with modern, state-of-the-art multi-media services. Photograph by : Les Bazso, The Province

The historic Terminal City Club is making a little modern history these days.

Last night, members of the upscale downtown Vancouver private club got a look at their future as plans were unveiled for a $10-million upgrade that embraces both its history and its future.

“It’s a very exciting day,” said CEO David Long, envisioning bold new changes but also efforts to preserve and enhance the club’s storied past. “We’ll keep the old-world feel of the club, but feature the latest in wireless and audio-visual capabilities.”

The billiards room, with the original slate tables, will retain its charm, while a new “old-world library and reading room” will feature the wood-panelled ageless splendour traditionalists crave.

At the same time, it is hoped that an upgraded, expanded fitness facility, wine bar, restaurant, and multi-media capabilities will attract the young up-and-coming crowd.

“We’re not that sleepy old club any more,” said Long.

With that in mind, 750 members and guests gathered last night for the gala “Last Call — Honouring Tradition, Embracing Tomorrow,” getting their first taste of how yesterday and tomorrow can abide in the same club.

In a way, the club has come full circle.

Ten years ago, the old club was razed, with pillars, stone doorways, chandeliers, and a stunning stained-glass dome preserved and incorporated in a new modern hotel/retail complex.

The result was a financial success — the hotel, pub, restaurants and retail rents generate plenty of cash and will pay for the massive project — but along the way some of the swanky club’s charm got lost in the transformation.

“We lost some of the private-club feeling,” concedes president Bob Pain. “Everybody’s quite excited about the changes — we’re getting excellent feedback from our members.”

Membership sales manager Bill Massender figures to be a busy man as prospective members see what will be. “What we’re trying to instill in people is that their membership will increase in value, and it won’t cost them anything. Our focus is how can we do this without reaching in their pockets.”

– – –

MAKING HISTORY

Terminal City Club by the numbers

Founded: 1892

Women first allowed to dine: 1924

Women admitted as full members: 1991

Members: 1,600

Membership fee: $7,500

Monthly dues: $170

Minimum monthly food bill: $25

Current upgrade: $10 million

Estimated completion date: 2009

© The Vancouver Province 2007

Posted in Other News Articles | Comments Off on Terminal City Club plans update to City tradition

Important news from the MLS & Technology Council

Thursday, June 14th, 2007Other

Posted in Technology Related Articles | Comments Off on Important news from the MLS & Technology Council

Make your renovation pay

Thursday, June 14th, 2007Almost any renovation will add to, or at least protect, the equity in your home but kitchen and bathroom renovations and painting top the list.

Sun

Be clear about your renovation expectations. Learn when to draw the line between what’s desirable and what’s essential.

Everyone has a different reason for wanting to renovate. Sometimes it’s the simple need for a change. Other times, the motivation is more practical. If you wake up one day with a puddle in the basement and a water-stained ceiling, you know you have to act fast.

In general, there are three types of renovation: lifestyle, retrofit, and maintenance and repair.

– Lifestyle renovations improve your home and your way of life. They might involve building a sun room for pleasure, or converting unused attic space into living quarters to meet your changing needs.

– Retrofit projects usually focus on your home’s shell or mechanical systems. Examples are upgrading your insulation, replacing your furnace, or putting on new siding.

– Maintenance and repair renovations protect the investment you have made in your house through activities such as caulking windows, reshingling your roof, or replacing your eavestroughs.

While maintenance renovations aren’t really a choice — they’re part of owning a home and protecting your investment — lifestyle renovations and even some retrofit plans may not be practical or do-able.

Be clear about your expectations. Learn when to draw the line between what’s desirable and what’s essential.

Almost any renovation will add to, or at least protect, the equity in your home, but kitchen and bathroom renovations and painting normally provide the greatest payback when you sell. If your property taxes and insurance premiums go up, the increase is usually small.

Over time, the money you save on heat, light and water by making your home more energy efficient may actually pay for the upgrades. Safety also pays. Insurance companies often decrease premiums when you improve wiring or fire prevention and improve or add a security system.

On the other hand, you can overdo a good thing. If you plan to move within a few years, is the renovation worth it? Will it pay to put on an expensive new addition when your house is in an area of more modest homes?

The Appraisal Institute of Canada has developed RENOVA, an interactive web-based guide to the value of home improvements.

RENOVA is designed to give consumers a better idea of the return on investment they can expect for a variety of home improvements. Homeowners can choose from among the 20 most popular renovation improvements, identified by a survey of AIC members.

Consumers should be aware that RENOVA is a guide, which provides ranges. Home values and returns on renovation investments are dependent on so many factors such as the location of the property, i.e. province, rural/urban, the neighbourhood and notably important is the quality of workmanship and materials.

An AIC valuator can identify the value of your home prior to the renovations being undertaken and provide a projected valuation based on your anticipated renovation plans.

Homeowners could save themselves a lot of time, expense and heartache by calling an appraiser first, even before the designer, contractor and architect.

CMHC offers an extensive library of valuable information for home renovators. Visit www.cmhc.ca and click on the Consumers section.

To find out more about RENOVA visit the Appraisal Institute of Canada’s website at www.aicanada.com and click on Resource Centre.

© The Vancouver Sun 2007

Posted in Real Estate Related | Comments Off on Make your renovation pay