‘Orient Express’ trip led to inspiration

Ashley Ford

Province

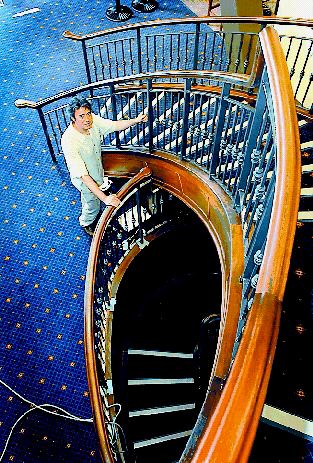

Eli Gershkovitch is proud of the sweeping staircases in his new TransContinental Heritage Restaurant and Railway Lounge. Photograph by : Jon Murray, The Province

A section of the historic Waterfront Station that has been sealed off from the public for 30 years is being reborn as a restaurant evoking the golden age of rail.

Owner Eli Gershkovitch got the idea of breathing new life into the station a few years ago while riding on “the” icon of rail travel, The Orient Express, from Paris to Istanbul.

“Canada has just as an impressive rail history and there was this magnificent space available that had been closed to the public for 30 years, to do it in one of the original grand railway stations in North America,” he said.

His TransContinental Heritage Restaurant and Railway Lounge, built in the east end of the station in the former “women’s waiting area,” will open this weekend.

Gershkovitch signed a long-term lease with the Ontario Teachers Pension Fund, the building’s owner, and started transforming the 7,000-square-foot space a year ago into a mid-priced seafood/steak restaurant and bar.

He won’t divulge how much he has invested except to say “gobs and gobs of money.”

The eatery will have a strong Canadian theme, including train art and Group of Seven pictures producing memories of a gentler, more peaceful time.

“The goal is to capture the drama, elegance and romance of the period and it will feature many touches of that,” he said.

“This was the era of when the journey was itself more important than the destination.”

“We want to integrate the elegance, grandeur, history and lore of this place into a dining experience.

“But it is also our goal to make it a totally inclusionary venue where Vancouver locals, the business crowd and tourists can easily rub shoulders in comfort,” he said.

The restaurant will officially open this weekend and is spread over three storeys with impressive, curving grand staircases.

There will be seating for more than 250 customers and even the dishes and cutlery are designed in the art-deco mode of the 1930s.

Gershkovitch also operates the nearby Steamworks Brewing Company.

The latest project was designed by Soren Rasmussen, a Vancouver architect who has won awards for previous heritage restoration work.

The venture is creating 100 new jobs.

The station, which was originally the western terminus for the Canadian Pacific Railway, opened in 1917. It was used by generations of railway travellers until the last passenger train left the station in 1976.

Today, thousands of commuters flow daily through the building and it is again one of the most important transportation hubs in Vancouver, linking SkyTrain, Seabus and West Coast Express.

The final touch will be the long-awaited clean-up of the much-admired CP veterans statue outside the restaurant.

Gershkovitch is holding to his early promise of cleaning it but says many other parties are involved and have yet to reach agreement on how it should be done.

© The Vancouver Province 2007