Laura Payton

Province

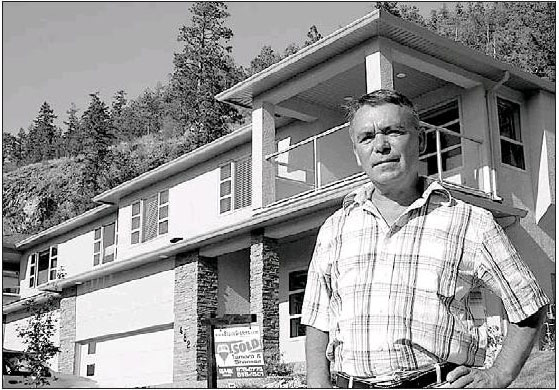

Guy Roxborough, at his new Kelowna home, is typical of many retiring buyers. LORI-ANNE CHARLTON – FOR THE PRIVINCE

Guy Roxborough is the face of the latest trend in real estate.

He’s approaching retirement and has just bought a Kelowna condo.

He’s moving to the Okanagan from Fort St. John, where he works in the oil patch.

“I’m looking for somewhere a little bit warmer, basically,” he said. “A longer summer.”

Roxborough golfs — “well, you could call it that” — and goes boating when he visits his parents, who live in Sicamous, making nearby Kelowna a natural choice.

It’s buyers such as Roxborough who sent residential sales in B.C. shooting up last month, with sales volume up 44 per cent over last July.

The increase was powered in part by baby boomers snapping up recreational properties.

The strongest markets in B.C. are those noted for recreation and retirement living, said Cameron Muir, the chief economist for the B.C. Real Estate Association.

“Many are buying their recreation property in anticipation that that will eventually become their principle place of residence.”

July residential sales were $4.66 billion, up from $3.24 billion last July. The Okanagan accounted for $410 million of this year’s number. Vancouver Island sales hit $729 million.

The Okanagan has always been a lifestyle destination, said Cliff Shillington of Remax in Kelowna.

“[Boomers] have never experienced an economy before like this so they’re now getting to the point where they’re looking at retirement; they have some financial means right now,” said Shillington.

About 25 per cent of buyers he sees are from Alberta, and there are many from the U.K. and Germany.

While U.S. buyers don’t see B.C. property as the steal it was when our dollar was weaker, recreational property in Europe generally costs more than in the Okanagan.

“On a global scale, to find another similar area like the Okanagan, we’re still very much a bargain,” said Shillington.

While boomers can sell their homes to finance retirement properties, first-time buyers are being hurt by high prices, said Muir.

“We’ve seen prices ramp up significantly over the past several years and, combined with increases in mortgage interest rates, it’s eroding the affordability of housing.”

Affordability could force a moderation in housing prices, he said.

“Home-price increases, while still being positive, won’t continue to increase at the rate that we’re seeing today,” said Muir.

“There is a point at which demand will start to fall. . . . at a given price.”

The housing market works in cycles, and Muir said B.C. is closer to the end of the rising-price cycle than to the beginning.

He said housing prices will flatten, although other market-watchers predict prices could drop sharply.

“Typically, the housing market will self-adjust in a very slow, gradual way and return towards more balanced conditions without any kind of external shock,” said Muir.

The housing market crashed in 1982, amid high inflation and soaring mortgage rates, and prices fell 30 to 40 per cent in one year.

A “big market correction” now, Muir said, would need to be triggered by a shock such as a rapid spike in mortgage rates.

Robert Helsley, the senior associate dean of the University of B.C.‘s Sauder School of Business, warned that dramatic changes in the U.S. mortgage market could shake buyer confidence in Canada.

“There are issues that are lurking on the horizon,” he said. “[They] could change people’s expectations in a way that will affect prices more than people would have thought, say, a month ago.”

© The Vancouver Province 2007