But prices won’t drop as in the U.S., economist says

Fiona Anderson

Sun

House prices in British Columbia will continue their march upward over the next two years, albeit at a slower rate, according to the Canada Mortgage and Housing Corp.

“The housing market is still very strong in 2007 and 2008, but we’re seeing moderation in some areas,” CMHC’s regional economist for B.C., Carol Frketich said in an interview.

Rising mortgage rates and higher prices will dampen demand, putting less upward pressure on prices as more houses are listed for sale, CMHC’s Housing Market Outlook predicted. So while demand for resale houses will still exceed supply, the hot market of the past few years — with an average home price increase of 17.7 per cent in 2006 — will be replaced by more moderate growth of 11.7 per cent in 2007, and 6.3 per cent in 2008.

That translates into an average home price in the province of $464,000 in 2008, up from $390,963 at the end of 2006.

“So it’s quite a slowdown in the pace of price growth in existing homes,” Frketich said.

But while the market cools from hot to warm, it is unlikely to experience what’s happening in the United States, where some markets have seen prices drop.

Prices in nominal terms — not adjusted for inflation — don’t go down very often, Frketich said. But when they do, it’s usually because of a big drop in consumer confidence.

For example, prices fell in 1996 through 1998 when the Asian financial markets flopped.

Prices also dropped in 2001 after the tech bubble burst and terrorists attacked the World Trade Center.

“You need that kind of event to have an impact on home prices,” Frketich said. “And you can’t forecast that.”

Consumer confidence in B.C. waned a bit last fall when the slowdown in the U.S. housing market began, she said. And resale activity slowed as a result. But Frketich says the strength of the B.C. economy will counteract any negative impact on consumer confidence caused by what’s happening in the U.S.

“That’s because we do have a very strong employment rate and growth in incomes in B.C., above the national average,” Frketich said.

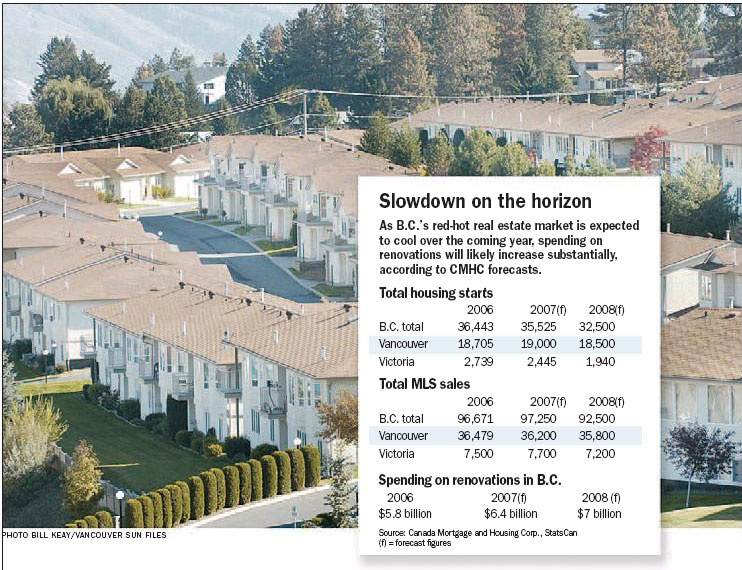

As a result, the number of sales of existing homes is expected to increase in 2007 compared to 2006, before dropping in 2008.

At the same time, the number of new single-detached home starts is expected to fall in 2007 and 2008, while the number of new multiple-unit homes, which are more affordable, increases in 2007 before dropping as well in 2008.

And while less money is put into constructing new homes, as much as $7 billion will be going into home renovations by 2008.

A variety of factors is fuelling the renovation trend, including people fixing up their homes for resale, or personalizing a newly purchased home. The rising cost of housing may also encourage people to upgrade their current home rather than buying up. And increased equity in the home from rising prices will make renovations possible.

And with the aging population, many people would rather renovate than move, said Peter Simpson, CEO of the Greater Vancouver Home Builders’ Association.

The leading edge of baby boomers coming through the market has a lot of disposable income, and perhaps their children have left home, or their homes are getting a little tired, Simpson said. But they don’t want to move, so they fix up what they have instead.

And because of where we live, we have some spectacular views that some of these families might not be able to replicate somewhere else,” Simpson said.

Boomers may also be looking to make their homes more age-friendly, by lowering cupboards, or raising electrical outlets that are hard to reach, he said.

© The Vancouver Sun 2007