Sun

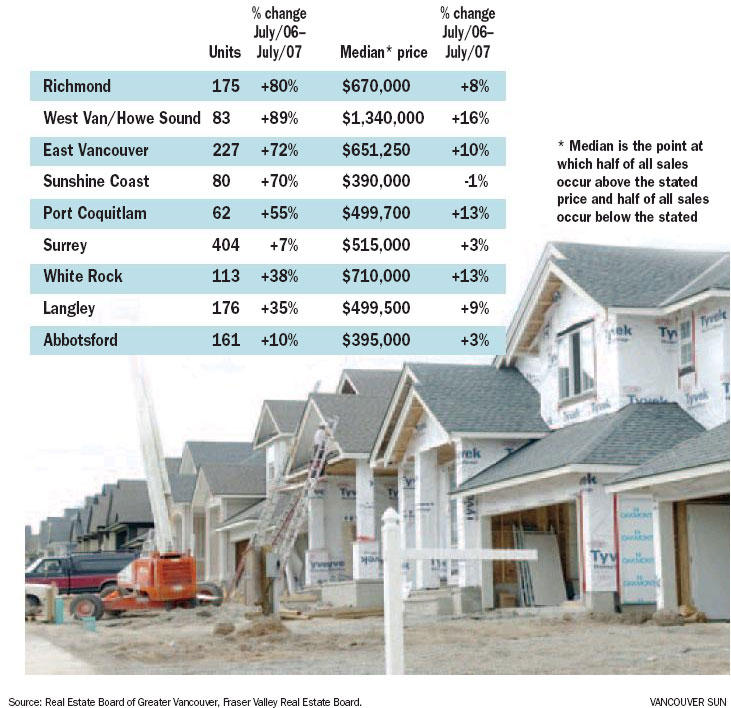

Condominiums continued to be the most saleable new home type in the Greater Vancouver Regional District in the first six months of 2007, with 76 per cent of all products being sold, reports MPC Intelligence Inc., which tracks trends in the housing industry.

The market absorbed 3,369 new concrete condos and 2,965 new wood-frame condominiums in the first six months of the year. New townhomes and duplexes accounted for 17.8 per cent of the sold inventory, while single-family homes accounted for five per cent of all new sold product in the first half of 2007.

As the affordability of single-family homes deteriorates, more buyers are beginning to choose the relative affordability of condominiums where price point, not size, is the driver, says MPC Intelligence.

KITCHENS NEW HUB

Want to know the future role of the kitchen?

According to the KitchenAid Kitchens for Cooks Institute Kitchen Trend Report, the kitchen is no longer merely the room in which meals are prepared and eaten, but the home’s social hub, where people work, entertain and relax.

Before long, says the report, it will also be the site of technological innovation. It says we can expect to see such things as appliances that continuously monitor freshness and inventory levels, touch-screen computers that control heating, lighting and entertainment systems, and even floors that recognize the walker and adjust the temperature to the preference of that person.

With environmental responsibility on the top of everyone’s mind, we can also expect to see more energy-efficient appliances and edible food packaging.

CARBON CREDIT

Macdonald Realty has launched the MacGreen Carbon Offset Program, which will enable the company’s 800-plus real estate agents in B.C .and Alberta to offer homebuyers and sellers “carbon neutral” transactions.

“The fact is, real estate agents drive a lot and are perceived to drive a lot,” said Macdonald Realty CEO Lynn Hsu in a prepared release. “As this is a necessary function of a real estate agent’s job, reducing all carbon dioxide emissions is difficult. However, for every one tonne of carbon that is released driving clients from house to house, an agent can compensate for emitting that tonne through offsetting.”

Macdonald Realty has teamed up with carbon offset provider Offsetters Climate Neutral Society of Vancouver.

© The Vancouver Sun 2007