Derrick Penner

Sun

Lower Mainland real estate markets defied the expectations of analysts last month, posting the second-highest level of sales for July in Greater Vancouver and the third-biggest July in the Fraser Valley.

Projections had sales in Canada‘s highest-priced markets slowing down for the month. However, buyers giving up on the prospects for price corrections and buyers rushing to beat rising mortgage rates helped push sales, and prices, higher.

“I thought we would see some moderation [in sales] as those higher mortgage rates took effect,” Helmut Pastrick, chief economist for Credit Union Central B.C., said in an interview.

Rates started edging up in May and again in June, with the posted rate for a five-year closed mortgage sitting at 7.24 per cent.

Pastrick added that “there is a time lag involved” in the effect of interest rates. Many of July’s buyers locked in pre-approved mortgages obtained before rates rose in May, which could mean a drop in sales is in the offing for August or September.

Regardless, Pastrick said sales have “exceeded my expectations,” and he is now adjusting his Lower Mainland housing forecast upward.

In July, Greater Vancouver recorded 3,873 Multiple-Listing-Service sales, 41.8 per cent more than the same month last year, and five per cent over the record July in 2003.

Greater Vancouver‘s inventory of unsold homes was also up 7.6 per cent to 11,215 units compared with a year ago.

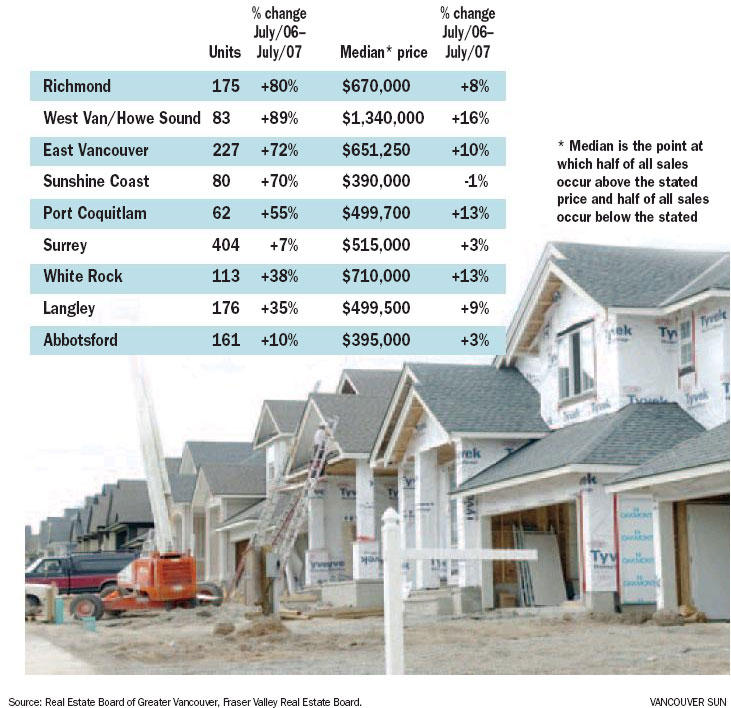

The median price for a single-family home in East Vancouver hit $651,250 in July, a 10-per-cent increase from a year ago. In Port Coquitlam, the median house price was up 13 per cent to $499,700.

Brian Naphtali, president of the Real Estate Board of Greater Vancouver, recalled that sales had slowed last November through the early part of 2007.

“[Buyers] may have been anticipating price corrections,” Naphtali said, “and it became apparent that wasn’t happening, so people got tired of waiting.”

He added that some of the sales boost was due to buyers rushing to buy homes before their pre-approved mortgages, with lower rates, expired.

The Fraser Valley saw 1,984 MLS-recorded sales during July, a 21-per-cent increase from July 2006 and three per cent below the record July of 2005.

Fraser Valley inventory, at 8,376 units, is also up 35 per cent over July of last year.

Jim McCaughan, Fraser Valley Real Estate Board president, said demand is still strong, especially for townhouses and apartments, but “we are seeing price increases start to moderate on a month-to-month basis.”

The median price for a Fraser Valley single-family home hit $472,000 in July, which is six per cent higher than a year ago. However, that price is 3.2 per cent lower than June’s median price.

McCaughan said he considers the month-to-month drop a “statistical aberration” driven by what types of homes sold during the month.

“I’m certainly not seeing indications of prices going down,” he added.

However, Pastrick said high prices continue to hinder first-time buyers, who are increasingly being squeezed out of the market. He added that according to provincial figures, fewer people applied for property-transfer-tax exemptions during government’s fiscal 2007, which ended March 31, than the year before.

© The Vancouver Sun 2007