Price index records biggest drop since 1991

Annette Haddad

Sun

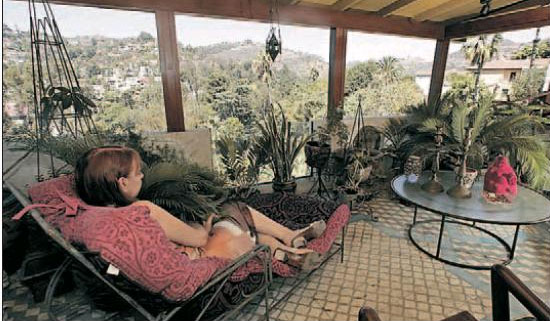

Laurie Frank’s Hollywood Hills home was built in the 1920s and was once owned by the French entertainer and actor, Maurice Chevalier. What she has wrought, post fire, defies definition, just like the woman friends say.

Reports this week signalled worsening conditions for the distressed U.S. housing market.

The supply of unsold homes in the United States ballooned to an 18-year high in August as demand for existing homes fell to a five-year low, according to a report by the National Association of Realtors.

The Washington-based trade group blamed the onset of the global credit crisis last month for the drop in sales.

“The unusual disruptions in the mortgage market resulted in a fairly high number of postponed or cancelled sales,” said Lawrence Yun, the group’s chief economist.

Also this week, a separate report indicated that home prices were falling at an increasing rate.

The S&P/Case-Shiller home prices index, which tracks results in metropolitan areas and is considered a leading measure of U.S. single-family home prices, showed an annual decline of 4.5 per cent for the 12 months ended in July, representing the biggest drop since 1991.

Sales are expected to continue their descent, further weighing down prices, as the effects of the credit crisis continue to play out, other analysts said. Mortgage rates rose in the last month, and lenders have tightened their standards for qualifying borrowers, affecting the ability of the most creditworthy consumers to obtain loans.

“August’s sales do not reflect the full impact of the credit crunch, which hit financial markets in mid-month, since most sales were financed with loans approved weeks beforehand,” said Patrick Newport, an economist with research firm Global Insight.

What’s more, the supply of unsold homes is expected to grow.

In August, almost 4.6 million houses were for sale, a supply that would take 10 months to sell if no additional houses came on the market.

But that’s unlikely, in part because more and more homeowners who face onerous monthly payments on their adjustable-rate mortgages, or ARMs, will put their homes up for sale or fall into foreclosure.

“Unfortunately, we think inventory is likely to rise even higher in the coming months as the sales pace slows further and upcoming ARM resets add to the inventory,” said Daniel Oppenheim, a housing analyst with Banc of America Securities.

Adding to the inventory woes are builders who have their own supply of newly built houses to unload.

Despite the use of deep discounts and incentives to woo buyers, Lennar Corp., the country’s largest builder by revenue, Tuesday reported a worse-than-expected third-quarter loss.

“Heavy discounting by builders, and now the existing-home market as well, has continued to drive pricing downward,” chief executive Stuart Miller said. The Miami-based builder took another huge writedown on its land holdings and said it would continue to trim its work force to control costs.

The company reported a net loss of $513.9 million in the three months ended Aug. 31, far worse than analysts expected, after having earned $206.7 million in the year-earlier period. Revenue fell 44 per cent.

“Consumer confidence in housing has remained low, while the mortgage market has continued to redefine itself, creating higher cancellation rates,” Miller said.

In August, total existing-home sales fell 4.3 per cent to an annual 5.50 million units in August, the realtors trade group said. That was down from 5.75 million in July and a 13-per-cent drop from the pace of sales in August 2006.

Los Angeles Times

© The Vancouver Sun 2007