Adam Geller

USA Today

Real estate signs are posted in front of houses in the Villages of Queen Creek subdivision in Queen Creek, Ariz., Sept. 26. Seventy-four foreclosures notices have been sent out in the past year, while many more homes are for sale and rent. By Ross D. Franklin, AP

A realty sign stands in front of one of the many homes that are in foreclosure in the Villages of Queen Creek in Queen Creek, Ariz., Sept. 26. So far this year, some 75 homes in Queen Creek housing, southeast of Phoenix, have been reclaimed by banks.

QUEEN CREEK, Ariz. — Out on Phoenix‘s suburban fringes, where cement mixers are fast colonizing what’s left of the hay and cotton fields, the day is winding to a close. The home hour has arrived. But sundown gives away a troubling secret: Behind dark windows and many unanswered doors, it’s clear nobody is coming home.

The ranch home on Via del Palo where the newspaper in the driveway has been sitting unclaimed since April. The house at the corner of 223rd Court with faded fliers stuck in the door. The two-story on Via del Rancho with the phone book on the step.

They’re all empty, left behind by a rising tide of foreclosures.

This neighborhood has a still-unfolding story to tell, and it is not always a comfortable one to hear.

Not long ago, builders were raising home prices here thousands of dollars week after week. Families pitched tents in front of sales offices and waited for Saturday morning lotteries to win the right to buy. Buyers — including more than a few speculators — gambled with loans whose risks were obscured by euphoria.

This is the tale of how America‘s real estate boom came to a seemingly ordinary subdivision called the Villages at Queen Creek, where the whipsaw of easy credit has led to some extraordinary times.

They were the best of times, for a while. The empty homes, though, raise serious doubts about what comes next.

As the nation confronts skyrocketing foreclosures, and policymakers try to contain a symptomatic credit crunch, what is happening here and in scores of similar neighborhoods is worth considering.

Because while the pressures at work in Queen Creek were extreme, the choices people made — and the consequences of those decisions — are not so different from those faced by thousands of other homeowners and their neighbors.

“Honestly,” says Joy Kessler, a mother of three boys standing on the doorstep of the house she and her husband are surrendering to foreclosure, “if you were in this situation, what would you do?”

Skyrocketing prices

In June of 2004, Dave Gustafson took time off from his job as a supermarket produce manager, and the family headed to Arizona to visit relatives. The buzz of construction — and word of low home prices — convinced them to have a look around.

Dave and his wife Maryann liked what they saw.

Back in California, they had contented themselves with less than 1,100 square feet. But salesmen here showed them floor plans that would give them 2 1/2 times the space for half the price.

The place they liked the best was a subdivision called the Villages, a crescent-shaped warren of streets cradling a golf course, quickly filling with sand-colored stucco homes. The local schools had a good reputation. It was affordable. There was an extra-big lot on a cul-de-sac, with enough room in back for a pool.

“The sales person was saying that they (homes) were going up $1,000 a week,” Dave Gustafson recalls. “So when we came to look, we signed right away.”

Builders made it easy. A down payment of $2,000 to $5,000 was all it took to get started. Buyers could borrow at low teaser rates, requiring payments of nothing more than interest.

As promised, home prices were going up faster than the houses themselves.

By the time the family’s new home — a two-story model called The Starling with a cathedral ceiling in the living room — was completed the next spring, the $179,000 base price had climbed to $220,000.

“We were making money while we were waiting,” Dave says.

The Gustafsons picked out Corian counters and maple licorice-finished cabinets at the builder’s design center, and opted for a pool and a whirlpool bath, adding more than $50,000 to their loan. The interest rate was fixed for only two years, but they didn’t worry. With prices rising so fast, they could always refinance. And in five or six years, the Gustafsons figured, they’d sell for $500,000 and downsize.

They hung a plaque over the dining table: “Home is Where Your Story Begins.”

They were hardly the only ones feeling optimistic.

Kris Rowberry was ecstatic when the value of his home in nearby Gilbert started to take off. So he bought a second one in the Villages as an investment.

“I was thinking, man, if I could have 10 properties, I could just kind of retire … and kick back and live off the income,” says Rowberry, a nuclear safety inspector.

But the speculative mind-set confounded buyers like retiree David Pickering. When Pickering and his wife left Pennsylvania in August of 2004 for a new home in the Villages, they’d never heard of interest-only loans and the idea of buying a home as an investment hadn’t occurred to them.

They were simply buying a place to live, hopefully for a good, long time.

Around them, though, such notions began to look very old-fashioned.

Homes as ATMs

The American Dream is a myth overdue for revision.

“There’s been a huge shift in the way people view their houses,” says John Karevoll, who tracks real estate for DataQuick Information Systems. “Your house now can basically be used as an ATM.”

Twenty years ago, families celebrated when they got a mortgage and again when they retired the loan. A home meant security. The financial commitment promoted both pride and neighborhood roots.

But Americans have become much more mobile, and looser lending has made it easier to buy a home and to borrow against its value.

Now a home is more — or less — than a place to live. It is an investment — a way to make money and finance a lifestyle, says Robert Manning, an expert in consumer credit and debt at the Rochester Institute of Technology.

The housing and lending industries encouraged that transformation, promoting not just subprime loans but mortgages requiring little or no documentation of income, no money down, and interest-only payments.

When easy borrowing combined with a run-up in prices, speculators joined the fray. In Arizona and other Sun Belt states where foreclosures are rising fast, homes not occupied by their owners account for an outsized portion of foreclosures, according to the Mortgage Bankers Association.

But the rise in interest rates and drop in home prices has put the most pressure on people who live in the homes they own, and who hadn’t counted on the market shift.

It used to be that when things got tough, Americans did everything possible to protect their homes. But now, faced with foreclosure, many have reordered priorities — making payments on things like credit cards while neglecting mortgages, according to the credit scorekeeper Experian.

That is at least partly a matter of psychology. When people who bought almost entirely with borrowed money see that worth disappear, there’s little incentive to hold on, says Stuart A. Feldstein of SMR Research Corp., a Hackettstown, N.J., research firm.

Few players, though, seemed to appreciate the chance they might get caught.

“Lenders never said no,” says Jay Butler, director of realty studies at Arizona State University. “Nobody expected this to continue, but they hoped it would just long enough to get out of it — and they were caught up in the whirlpool.”

‘Drive until you qualify’

By late 2004, the Phoenix real estate market was roaring.

The euphoria reached Queen Creek, so far out the freeway hadn’t arrived yet. If you couldn’t afford something closer in, real estate agents told buyers, “drive until you qualify.”

The town’s population almost quadrupled to 17,000 in just five years.

Buyers lined up for the chance to make a down payment in the new subdivisions. Rowberry joined 200 people one Saturday morning for a chance at 15 lots. He snapped up builders’ price lists. Every week, the homes cost $1,000 to $5,000 more.

Meanwhile, skyrocketing prices in California and Nevada sent investors to greater Phoenix in search of the next great deal.

“I’m just one guy and it wasn’t unusual to get three (calls) a day” from speculators, says John Wake, a real estate agent. “A lot of them weren’t sophisticated. They’d never invested before.”

In the Villages, already half completed, remaining lots looked too good to pass up. One Southern California investor, Alan Jullien, bought three homes. A flight attendant, Angela Nazario, bought a two-story house even though she lived by herself and was frequently on the road. A local real estate agent, Sean Bacon, bought two.

Homeowners who bought earlier were feeling good. The market spike turned the Gustafsons‘ $235,000 home into one worth $380,000.

Across the Valley, homeowners watching their home values shoot up, borrowed against those gains.

“Talking to a lot of co-workers, everyone was doing the same thing — taking out lines of credit, milking it for all it’s worth,” says Matthew Berends, a homeowner in Surprise, another Phoenix suburb where prices soared. His home is now in foreclosure. “In one year for a house to go up $80,000, it’s like too easy.”

But some relatively modest purchases would prove to be risky gambles.

Greg Giniel and his wife moved into a home on East Sanoque Drive bought by a friend, with Giniel as a silent partner. What Giniel hadn’t counted on was that the friend had also bought three other homes around the Valley, all financed with adjustable rate loans that were bound to rise.

One street over, the Kesslers paid $279,000 for a house in the fall of 2005.

With $25,000 down and an interest-only loan, it seemed like a wiser deal than their old rental.

There was a problem, though, obvious only in hindsight. A market that had skyrocketed was about to take a plunge.

Empty houses multiply

It takes time for a homeowner to get into trouble, but sometimes not all that long.

In the summer of 2006, the Gustafsons fell behind on their mortgage payments. Their interest rate was set to jump. In August, their lender started foreclosure.

Meanwhile, problems began to snowball. High gas prices prompted people to rethink the idea of owning a home on the outskirts. Investors rushed to sell.

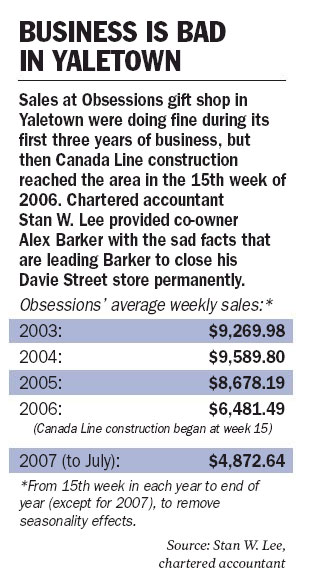

In 2005 — a record-best year for Phoenix real estate — just five homes in the ZIP code containing the Villages were lost to foreclosure, according to Information Market, a Phoenix real estate research firm.

Last year, lenders claimed 15, nearly all in the final two months of the year.

So far this year, 75 homes have been claimed by banks. But with the market so soft and more adjustable rate mortgages about to reset, that could be just the beginning.

In the Villages, many of the homes where foreclosure is pending are already empty, a sign owners have given up.

In a big subdivision — about 1,400 homes — the problems aren’t always obvious. The golf course remains carefully watered, the playgrounds neatly swept. Many streets, particularly in areas built before prices spiked, are filled with families who take walks with strollers in the evening or grill burgers in backyards overlooking the greens.

But on other streets, the presence of homes without curtains in the windows, with dirt and cobwebs collecting in doorways, is almost eerie.

Even when the market was good, some Villagers were troubled by the large number of investor-owned homes, empty or filled with renters.

Then late last year, moving vans began to pull up to some homes at odd hours. Auction notices were posted on front doors. The oleander and mesquite trees that do so well here in the desert sun turned brown in yards left without water.

In May, the house to the left of the Pickerings‘ on Calle de Flores went to foreclosure. Two weeks later, the house on the right followed. Both had been empty for months. It made David Pickering vaguely uneasy. He couldn’t help wondering whether empty houses might attract vandals.

“The weeds in the back are getting so tall now that they are growing over the separating wall into my yard,” he e-mailed, alerting the homeowners association to one of the vacancies. “Something must be done about this. … The property must be under financial responsibility of someone.”

For a couple of months, landscaper Nick Bourque — who lives next door to three foreclosed homes in a row on Via del Palo — made a point of keeping the abandoned yard bordering his free of nutsage and old newspapers.

“I just figured after a while, the heck with it,” he says. A real estate agent scheduled an auction of the home, but found no takers.

On Via del Rancho, Christelle Palmire watched as the home next door was abandoned to foreclosure. It stayed empty, too.

This Halloween, Palmire plans to take her son trick or treating in a friend’s subdivision where she knows most doors will be answered.

“You drive around this subdivision and there are ‘For Sale’ signs everywhere,” she says.

The problems become self-perpetuating. Researchers say that each foreclosure chips away at neighbors’ property values. But foreclosures here compound a larger problem.

Builders continue adding homes to the market at reduced prices. Investors are trying to sell. Lenders are seeking buyers for foreclosures. Homeowners whose financial troubles might be solved by selling can’t compete, real estate agents say.

“Sometimes the neighbors don’t like you so much because you’re one of the reasons the values are declining,” says Kim Gordon, a real estate agent specializing in foreclosures who is listing two homes in the neighborhood. “But everyone has got their part in it. The homeowners overextended themselves.”

In many ways, the Villages is lucky because so much was built before the market soared, says Amanda Shaw, president of Associated Asset Management, which administers it and 300 other Arizona subdivisions. The company, which once saw two foreclosure notices a month in its communities, now fields three to five each day, and some of its subdivisions have been hit much worse.

But it can be difficult to know when homeowners are in trouble.

“There are people who think they don’t have an alternative … other than to turn the lights off at 1 in the morning, hop in the U-Haul and just leave,” Shaw says.

Now, says Ed Stutz, who lives in the subdivision and pastors the nearby Family of Faith Fellowship church, at least three Queen Creek homeowners call each week asking for help paying their bills. That never used to happen. In September, the church decided to offer budgeting advice.

“They saw a lot of home for a pretty decent price and I don’t think they saw the handwriting on the wall,” Stutz says of his neighbors. “People took a gamble and now it’s hurting.”

Stay or walk away?

It’s worth much less than it used to be, but it’s home, Dave and Maryann Gustafson decided.

In May, their lender agreed.

The company modified their loan, temporarily trimming the $1,000 a month increase in their payment to $400. It’s a stretch, but will keep the Gustafsons in their home at least until the modified terms expire in two years.

Greg Giniel is not so sure. His home, owned by his investment partner, is scheduled for a foreclosure auction in November.

“I’ve got to figure out how to buy my own home back,” Giniel says. “If God doesn’t pull me out of this one, I don’t know where else I’m going to go.”

Things looked just as uncertain to Joy and Paul Kessler, until they did the math.

They could fight to save their house. But what was the point? It’s worth at least $40,000 less than they paid. They can rent in this depressed market for a fraction of their monthly payment.

“It’s sad to say but honestly, we don’t feel like there’s anything worth saving in this house,” Joy says. “Financially, we’ve got nothing to show for it.”

So the couple decided to let the place go. Everyone said it was the right thing to do.

Still, it doesn’t sit right with her husband, a painter and construction worker. When times were good they made a commitment, Paul tells Joy. Somehow, it doesn’t feel right to just walk away.