‘People were expecting things were going to slow down,’ real estate expert says of PricewaterhouseCoopers report

Michael Kane

Sun

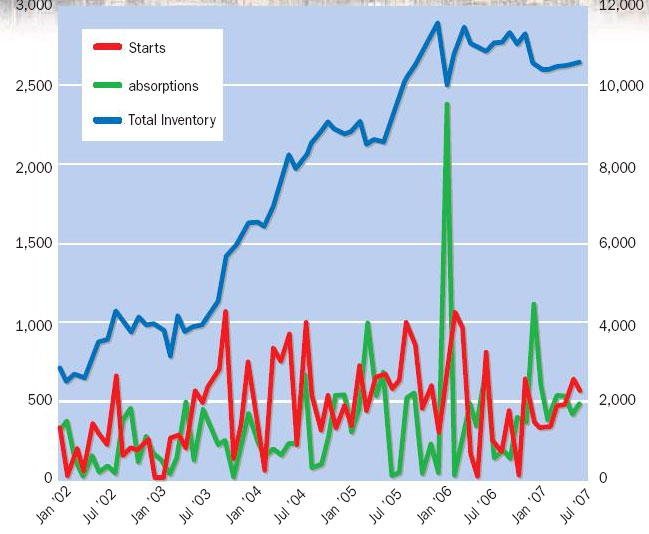

The Metro Vancouver market is absorbing high- rise condos faster than developers can start them, according to PricewaterhouseCoopers Greater Vancouver Condominium Quarterly Sales Update. Over the first seven months of 2007, developers started about 1,000 fewer units than were absorbed. Absorptions averaged 565 units per month and starts averaged 430 units per month. This chart shows highrise condo inventory down significantly from the start of 2007, but creeping upward again as starts begin to overtake sales heading into the third quarter.

Condominium sales in Metro Vancouver slumped by a third between July and September as developers poured new product into the marketplace, according to report by PricewaterhouseCoopers.

However, the market is pretty well balanced and sales are expected to pick up, Neil Atchison, a real estate specialist with the consulting firm, said Wednesday. “But we’re not clear on whether it will be at the torrid rate that they have been in the past.”

PwC released its third-quarter condo sales update on the same day as Re/Max Canada reported that unit sales for the region are up seven per cent over the first nine months of the year, compared to the same period last year.

Re/Max says 50 per cent of all sales activity in downtown Vancouver can be linked to investors, suggesting that demand and prices in Metro’s heartland will remain strong in the absence of an economic downturn.

Developers in Metro Vancouver began marketing 3,765 new apartment and townhouse condos during the third quarter, an increase of 29 per cent from the previous three months, according to PwC.

However, “demand slumped,” with preliminary figures showing condo sales dipped by 33 per cent from the previous quarter, Atchison said.

“I think developers held off putting in new product until the third quarter of this year because they weren’t sure where the market was going. People were expecting that things were going to slow down this year,” he said.

“I think the developers have managed their inventory well, and now they have more confidence that demand seems to be more sustained than the pundits had expected.”

While unsold inventory increased in Burnaby-New Westminster, sales in downtown Vancouver and the West End area kept pace with new product coming on the market.

Metro Vancouver remains the strongest condo market in the country, with 60 per cent of all sales falling into that category, according to the Re/Max Condominium Report.

Year-to-date, average prices are up 14 per cent for townhouses and 11 per cent for apartments while Vancouver set a new $18-million benchmark for the most expensive apartment-style condominium unit ever sold through the Multiple Listing Service.

In addition to investors, demand for condos is being driven by both first-time buyers looking for a foothold in the market and baby boomers looking for a lifestyle change as they move toward retirement, said Elton Ash, regional vice-president for Re/Max Western Canada.

He said the impact of “quick-flip” speculation in Canada‘s largest condominium markets has yet to be determined but investors who are looking to hold their properties for one to five years are helping to drive construction activity.

“Investors are anticipating demand will continue, which we certainly also feel, and they are looking for a good return on their investment,” Ash said in an interview. “So they are affecting the market by simply absorbing the available inventory and thereby keeping prices strong.”

He said the market is also being supported by consumer confidence, affordable interest rates and B.C.’s robust economy.

© The Vancouver Sun 2007