More Metro Vancouver neighbourhoods join the $1-million club

Randy Shore

Sun

A $2-million home, typical of pricey Tsawwassen Beach Road, faces the ferry terminal with stunning views across the Strait of Georgia. Photograph by : Steve Bosch, Vancouver Sun

Morgan Creek was among the fastest appreciating neighbourhoods in Surrey, with an 18-per-cent increase in assessed property values. Photograph by : Mark van Manen, Vancouver Sun

Seven neighbourhoods in Metro Vancouver have joined the exclusive one-million-dollar club, according to the B.C. Assessment Authority.

A typical home on a 33-foot lot on Vancouver‘s west side is now worth $1 million, achieved on the strength of a 20-per-cent average increase in the assessed value of homes in that neighbourhood.

Overall, the assessed value of B.C. real estate climbed by 16 per cent to top $940 billion, according to assessment authority figures released Wednesday.

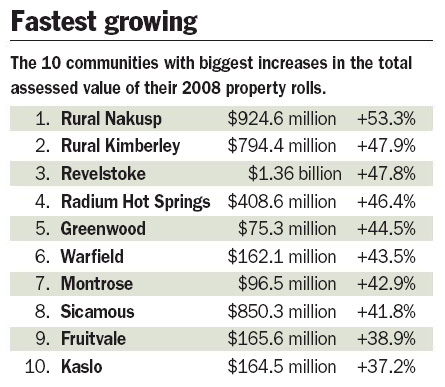

Some of the biggest increases in property values came in the Kootenays, where retirees and cash-rich Albertans are buying up land.

In Metro Vancouver, a handful of neighbourhoods in Surrey, White Rock and Burnaby joined Vancouver‘s west side in passing the $1-million threshold for a typical home, once the exclusive domain of West Vancouver and Whistler.

The newcomers to the club include Morgan Creek and Fraser Heights in Surrey, Central West End and South Slope in White Rock, and Kensington and Deer Lake in Burnaby.

The tiny neighbourhood of Tsawwassen Beach is in even more exclusive territory. A typical home on the beach facing the Tsawwassen ferry terminal averages more than $2 million.

British Columbia now boasts 49,729 million-dollar-plus homes, compared with 38,027 last year.

Assessed values are based on recent sales in the area and the size, age and condition of the building as well as characteristics such as location and view. Values are stated as of July 1, 2007.

The assessed value is used to determine property taxes based on local municipal tax rates. If your assessment increase is close to the average in your municipality, your taxes should remain stable.

Higher than average increases can lead to higher taxes.

“Ten to 20 per cent are the goalposts for residential property increases in Vancouver, the North Shore and across the province,” said Vancouver area assessor Jason Grant.

As in the past few years, Whistler bucked the big-gains trend, though that market is now showing signs of life. Pemberton posted an increase of 2.4 per cent and Whistler 4.1 per cent. By contrast, residential values in Squamish rose 15 per cent.

“Whistler and Pemberton for the first time in four years have shown an increase in assessed value,” said Grant, who noted that both towns posted huge price gains in the late ’90s and the early part of this decade.

Waterfront continues to be one of the most sought-after characteristics in a home, Grant said.

“Waterfront has proven to be a valuable commodity for the past several years and prices generally lead the higher end of the range,” he said.

Surrey-White Rock assessor Mark Katz adds golf courses as a potential price-driver.

“Sometimes in south Surrey if a home is on an acreage and prices are going up 10 to 20 per cent per year, it doesn’t take much to get you over the million-dollar mark,” Katz said. “Morgan Creek has always been a strong market with a nice setting and it surrounds a golf course.”

Morgan Creek was among the fastest appreciating neighbourhoods in Surrey, with an 18-per-cent increase.

“There’s only so much waterfront and a lot of people are competing for it,” he said. But whether it is proximity to a golf course or the ocean, “location continues to be a primary price driver.”

Katz said developers trying to maintain an inventory of land are bidding prices up in Surrey so they can build compact housing like condos, which compete well in price with similar homes in Vancouver. “There’s a lot of townhouse development and small-lot homes being built,” he said.

Vancouver‘s commercial real estate values are a noticeable blip in an otherwise unremarkable market, rising by 26 per cent, said Grant. Residential property is up about 12 per cent across the City of Vancouver, a slower pace than last year’s 25-per-cent increase.

Shawna Rogowski, research director for Colliers International, says rents for commercial real estate in the City of Vancouver “have gone through the roof and no new supply is coming on line.”

The commercial vacancy rate fell to a seven-year low in the third quarter of 2007, according to Colliers market research.

“A lot of companies are moving to the suburbs,” Rogowski said. Microsoft didn’t even bother coming downtown; it just set up shop in Richmond, she noted.

Lower costs, lower rent, and free parking top Rogowski’s shopping list for businesses seeking cheaper digs in the suburbs.

The city’s policy of encouraging mixed-use and residential development on the downtown peninsula has worked “too well,” Rogowski said. “Businesses are being crowded out.”

“We now have people living downtown and commuting to the suburbs to work,” she said.

– – –

ASSESSMENTS ONLINE

To check property assessments on the Internet.

1. Go to www.bcassessment.ca

2. Click on Assessments and Sales by Address.

3. Fill out required fields. Be careful to use the Street Type field to indicate whether your address is on a road, avenue, crescent etc.

4. Click on Get Assessments by Address to compare your assessments with your neighbours.

5. Click on Get Sold Properties to locate properties in your neighbourhood that sold during the past year.

For those who do not have Internet access, call your local BC Assessment office. Municipal government offices and libraries will also have paper copies of property assessment rolls.

Source: BC Assessment.

FIGHTING ASSESSMENTS

How to appeal an assessor’s decision.

Homeowners who feel the big increase in their property assessment doesn’t really reflect its true value may be able to have it reconsidered, Mark Katz, the BC Assessment area assessor for the South Fraser region, says.

– Calling your local BC Assessment office is the easiest way to start.

“Talk to us first,” Katz said. “If there is an issue, we may be able to resolve it and it may involve us making a recommendation to change the assessment.”

– If homeowners cannot have the complaint resolved by appealing to the assessor, they can file for an independent review by the Property Assessment Review Panel.

Review request forms are available on the BC Assessment website, www.bcassessment.ca or from your local BC Assessment office. The deadline to file for a review is Jan. 31.

– Katz added that homeowners still unhappy with the valuation can appeal review decisions to the Assessment Appeal Board.

“I would say the majority of issues are resolved without going to the review panel, and the majority [of review-panel cases] are successfully resolved at the panel,” Katz said.