Yet-to-be built downtown condo smashes lofty price barrier

Bruce Constantineau

Sun

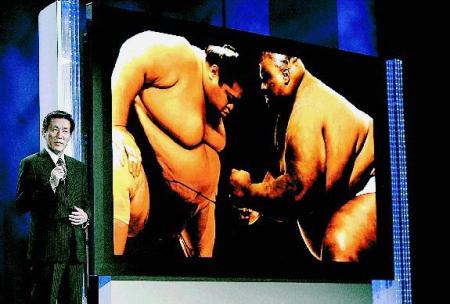

Artist’s rendering of the $ 500- million Ritz- Carlton project on Georgia Street between Thurlow and Bute. Construction is slated to begin in March, with completion expected by the summer of 2011.

Downtown Vancouver’s luxury condo market has shattered the $20-million price barrier, with a yet-to-be-built penthouse at 1133 West Georgia carrying a price tag of more than $28 million.

That’s at least $10 million more than the record $18 million paid by an unnamed U.S. businessman last year for a 48th-floor penthouse in the Private Residences at Hotel Georgia, set for completion by 2011.

The $28-million-plus condo will occupy about 7,400 square feet on the 59th and 60th floors of the Residences at Ritz-Carlton development, also set for occupancy in 2011.

Vancouver condo marketer Bob Rennie said the Ritz-Carlton project was going to have three penthouse suites, but demand for a larger unit prompted developers to combine two suites into one large penthouse.

“We have some serious interest in a large unit, so we decided to put the northwest and northeast penthouses together,” he said in an interview. “With people wanting size, it’s just a good business decision to put the two together.”

Rennie said potential buyers of the luxury condo include “corporate giants,” with two local clients and one overseas client already expressing a strong interest.

He said the penthouse’s current configuration calls for three bedrooms, two dens, a family room, formal dining room, a “massive” kitchen and butler’s pantry.

“But no matter what we pencil in with the architects, whoever buys this is going to add their signature to it,” Rennie said.

The asking price for the Ritz-Carlton condo works out to a whopping $3,800 a square foot, compared with $2,400 a square foot for the $18-million Hotel Georgia penthouse.

Rennie said that beyond $2,000 a square foot, prices almost don’t matter to some buyers.

“At what point does a Rolls- Royce buyer say he’ll only pay $500,000, not $600,000?” he said. “He doesn’t. He just pays for what he wants because you’re dealing with a very privileged buyer.

“So when you’re talking over $20 million, a million dollars is not going to make or break the sale. It’s a discretionary purchase. Nobody has to buy a $20-million condo but if they’re looking, there are very few to choose from.”

Construction of the $500-million Ritz-Carlton project — on Georgia Street between Thurlow and Bute — is slated to begin in March, with completion expected by the summer of 2011.

The site had been a vacant and derelict concrete shell for more than a decade, following failed attempts to develop a private members’ club and a strata-title office building. Vancouver-based Holborn Group bought the property from Cadillac Fairview about three years ago.

The development will contain a 127-room Ritz-Carlton hotel and 123 luxury condos. The entire building will be managed by Ritz-Carlton and condo owners will have access to hotel amenities like 24-hour room service, a concierge, housekeeping services and staffing for special entertainment events.

© The Vancouver Sun 2008