Alan Zibel

USA Today

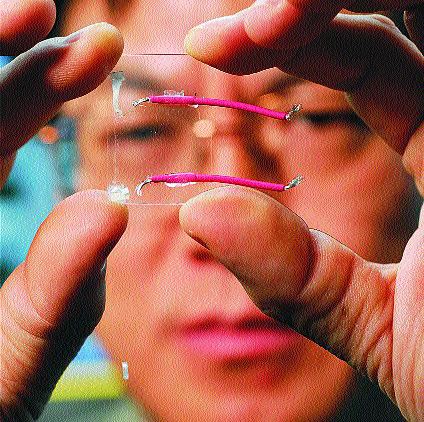

A sign advertises a home for sale is shown in San Carlos, Calif.

WASHINGTON — Sales of existing homes fell in 45 states during the October-December quarter, with the price of an existing single-family home in 150 metro areas falling a record 5.8% in the fourth quarter from the same period in 2006, a real estate trade group said Thursday.

The fourth-quarter data from the National Association of Realtors underscore the breadth of the housing market’s slump.

South Dakota was the lone state to show a sales increase. Existing home sales there rose 8.9% from the same quarter a year ago. Sales were unchanged in North Dakota. No sales figures were available for Idaho, Indiana and New Hampshire. Sales also fell in Washington, D.C.

The quarterly survey of metro region prices showed that prices fell in all regions, with homes in the West tumbling 8.7% and prices in the South off 5.4%.

The median existing single-family home price was down 5.8% to $206,200 in the fourth quarter of last year compared to $219,000 during that same period in 2006.

Median home prices fell in more than half of the 150 metropolitan areas surveyed. Out of the 77 that experienced declines, 16 showed double-digit percentage drops, the trade group said. The largest price declines were found in Lansing, Mich., Sacramento, Jackson, Miss. and Riverside, Calif., which posted price declines of 17 to 19%.

Lawrence Yun, the trade group’s chief economist, attributed the declines in median prices to mortgage market problems that mushroomed last fall, making loans more expensive for borrowers looking to take out “jumbo” mortgages larger than $417,000, the maximum size of mortgages that government-sponsored mortgage companies Fannie Mae and Freddie Mac can purchase and market as securities

“The continuing crunch in the jumbo loan market that began in August has disproportionately reduced the number of transactions in higher price ranges,” Yun said in a statement.

Nationwide, existing homes sold at an annual rate of 4.96 million units in the fourth quarter, down 21% from the sales pace of the fourth quarter in 2006, the Realtors group said.

The states suffering the biggest drop in sales in the third quarter were Nevada, down 44% and Wyoming, down 42%. Other states with big declines were New Mexico, down 39%, Oregon, down 38% and Arizona, down 37.6%.

Mortgage lenders, would-be home buyers and Wall Street investors alike have been grappling over the past year with the impact of rising defaults, the result of lax lending standards that were prevalent during this decade’s housing boom. As defaults have risen, lenders have grown more cautious, which has allowed fewer buyers to qualify for home loans.

Sales in the fourth quarter fell in 45 states.

|

State |

Sales (in the thousands) |

% change |

|

|

Q4 2006 |

Q4 2007 |

||

|

|

|||

|

ALABAMA |

119.2 |

102.0 |

-14.4% |

|

|

|||

|

ALASKA |

27.2 |

25.2 |

-7.4% |

|

|

|||

|

ARIZONA |

129.2 |

80.8 |

-37.5% |

|

|

|||

|

ARKANSAS |

80.4 |

76.0 |

-5.5% |

|

|

|||

|

CALIFORNIA |

434.8 |

305.2 |

-29.8% |

|

|

|||

|

COLORADO |

112.4 |

109.2 |

-2.8% |

|

|

|||

|

CONNECTICUT |

66.0 |

51.6 |

-21.8% |

|

|

|||

|

DELAWARE |

16.4 |

13.2 |

-19.5% |

|

|

|||

|

District of Columbia |

8.4 |

8.0 |

-4.8% |

|

|

|||

|

FLORIDA |

337.6 |

239.6 |

-29.0% |

|

|

|||

|

GEORGIA |

243.6 |

185.6 |

-23.8% |

|

|

|||

|

HAWAII |

27.2 |

23.2 |

-14.7% |

|

|

|||

|

IDAHO |

N/A |

39.5 |

N/A |

|

|

|||

|

ILLINOIS |

266.8 |

212.0 |

-20.5% |

|

|

|||

|

INDIANA |

N/A |

131.6 |

N/A |

|

|

|||

|

IOWA |

70.8 |

58.8 |

-16.9% |

|

|

|||

|

KANSAS |

73.6 |

66.8 |

-9.2% |

|

|

|||

|

KENTUCKY |

98.8 |

84.8 |

-14.2% |

|

|

|||

|

LOUISIANA |

85.2 |

65.6 |

-23.0% |

|

|

|||

|

MAINE |

27.2 |

22.4 |

-17.6% |

|

|

|||

|

MARYLAND |

101.6 |

67.6 |

-33.5% |

|

|

|||

|

MASSACHUSETTS |

120.8 |

108.4 |

-10.3% |

|

|

|||

|

MICHIGAN |

180.0 |

175.2 |

-2.7% |

|

|

|||

|

MINNESOTA |

104.0 |

87.6 |

-15.8% |

|

|

|||

|

MISSISSIPPI |

63.2 |

58.0 |

-8.2% |

|

|

|||

|

MISSOURI |

126.8 |

106.0 |

-16.4% |

|

|

|||

|

MONTANA |

24.8 |

21.2 |

-14.5% |

|

|

|||

|

NEBRASKA |

36.4 |

30.0 |

-17.6% |

|

|

|||

|

NEVADA |

61.6 |

34.4 |

-44.2% |

|

|

|||

|

NEW HAMPSHIRE |

N/A |

N/A |

N/A |

|

|

|||

|

NEW JERSEY |

141.3 |

128.4 |

-9.1% |

|

|

|||

|

NEW MEXICO |

54.8 |

33.6 |

-38.7% |

|

|

|||

|

NEW YORK |

302.0 |

275.6 |

-8.7% |

|

|

|||

|

NORTH CAROLINA |

225.6 |

185.6 |

-17.7% |

|

|

|||

|

NORTH DAKOTA |

14.4 |

14.4 |

Unch |

|

|

|||

|

OHIO |

260.4 |

234.0 |

-10.1% |

|

|

|||

|

OKLAHOMA |

103.2 |

96.8 |

-6.2% |

|

|

|||

|

OREGON |

84.4 |

52.0 |

-38.4% |

|

|

|||

|

PENNSYLVANIA |

228.8 |

198.0 |

-13.5% |

|

|

|||

|

RHODE ISLAND |

16.0 |

13.2 |

-17.5% |

|

|

|||

|

SOUTH CAROLINA |

102.4 |

88.0 |

-14.1% |

|

|

|||

|

SOUTH DAKOTA |

18.0 |

19.6 |

8.9% |

|

|

|||

|

TENNESSEE |

160.4 |

137.2 |

-14.5% |

|

|

|||

|

TEXAS |

572.8 |

514.4 |

-10.2% |

|

|

|||

|

UTAH |

52.0 |

34.4 |

-33.8% |

|

|

|||

|

VERMONT |

14.8 |

12.8 |

-13.5% |

|

|

|||

|

VIRGINIA |

125.6 |

100.4 |

-20.1% |

|

|

|||

|

WASHINGTON |

137.2 |

115.2 |

-16.0% |

|

|

|||

|

WEST VIRGINIA |

29.2 |

27.2 |

-6.8% |

|

|

|||

|

WISCONSIN |

114.0 |

95.6 |

-16.1% |

|

|

|||

|

WYOMING |

13.2 |

7.6 |

-42.4% |

|

|

|||

|

Source: National Association of Realtors |

|||