Suzanne Beaubien

Province

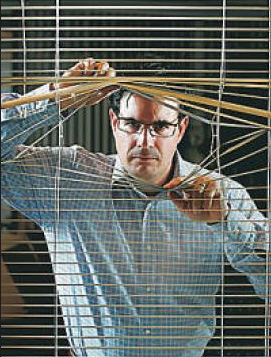

John Russo, Senior Attorney for Equifax Canada Inc., a major credit reporting agency in Canada

Anyone who has been shocked to find a black mark on their credit report will tell you how hard it can be to get your lending record back in order. And even worse than finding a long-forgotten unpaid bill is stumbling upon a credit card or loan supposedly taken out in your name by someone else.

Calgarian Anna Sommer had that experience last August when she and her husband were negotiating the pre-approval process for a loan with Royal Bank.

“They were reading me the stuff that came up on my credit file,” said Sommer, 27. “And he mentioned this CIBC Visa, but I’ve never had anything to do with CIBC.”

The card had a $15,000 limit, and was carrying about $6,000 in debt. The fact that someone was making payments on it didn’t do much to calm Sommer’s fears about identity theft.

Ontario is leading the way with new legislation that aims to stem such surprises by forcing credit lenders to authenticate the identities of their customers if an alert is placed on their file. Since the new law went into effect on Jan. 1, Equifax Canada Inc. — one of the two major credit-reporting agencies in Canada — has placed over 800 such alerts on Ontarians’ credit files, says John Russo, senior attorney for Equifax.

Consumers across Canada can put similar alerts on their credit files, adds Russo. There are two types: “lost and stolen wallet” alerts and “true fraud victim” alerts. On average, Equifax receives over 1,200 true name fraud alerts every month, while lost and stolen wallet alerts range from 4,000-7,000 each month.

But whether those alerts are effective is debatable, says Andrew Inniss, general manager of Solutions Credit Counselling Service Inc., a debt-management company based in Surrey.

“They’re only as effective as the implementation of them,” says Inniss, noting it’s up to the credit lender to take action on the alerts.

In Sommer’s case, TransUnion investigated and removed the card from her file. While she never found out if it was an error, or if someone had truly stolen her identity, Sommer says she’ll be more careful in the future and will check her “It was a good lesson and it came out as best as it could,” she says.

© The Vancouver Province 2008