With top rents higher than last year, many firms are scouting space in suburbs

Derrick Penner

Sun

Lots of buildings, little space: While vacancy is down, there are no plans for a large increase in downtown office towers. Photograph by : Stuart Davis, Vancouver Sun files

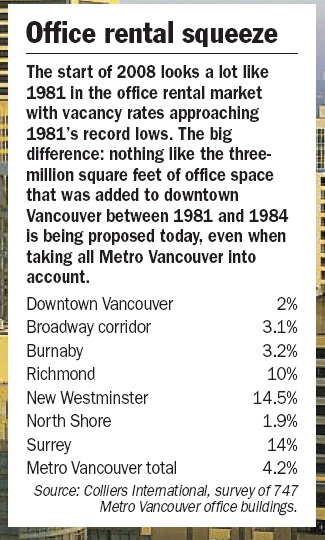

Vancouver‘s downtown office vacancy rate fell to its lowest level in a generation during the first quarter of 2008.

Colliers International estimates downtown office vacancy at two per cent, the lowest since 1981 when vacancy hit 1.8 per cent. Across Metro Vancouver, Colliers estimated vacancy at 4.2 per cent, compared with the all-time low two per cent, which was again in 1981.

Downtown, Colliers said some top Class AAA rents have topped $50 per square foot per year on lease renewals, noticeably higher than a year ago, research analyst Shawna Rogowski said.

However, Jeff Rank, managing director of Cushman & Wakefield LePage, said leasing activity in the tight downtown market has slowed, and landlords “haven’t been able to [increase] their [rents].”

One of the reasons Rank thinks leasing activity has slowed is because companies are holding back on decisions about their real-estate needs unless their leases expire, or they are expanding.

“There are still some in that category,” Rank said.

Computer gaming firms were among the tenants taking up any space they could. Electronic Arts leased 22,000 square feet of additional space at 1110 Hamilton Street and Next Level Games took on 24,550 square feet in the Raffles building at 811 Cambie Street, the Colliers report noted.

Rogowski added that many companies “rushed to do lease renewals and expansion deals” while vacancy rates falling over the past couple of years.

“Now that they’ve done that, [leasing activity] is a bit quieter with not a lot of space to lease.”

Rogowski said many firms are scouting out Metro Vancouver’s suburban markets, where new office buildings are being built.

Rank said most of the companies leasing the new suburban office space being built in Burnaby, Richmond and even the Fraser Valley are firms oriented to those markets rather than companies priced out of downtown.

Metro Vancouver‘s suburban markets, where new office buildings are being built, are where rents are rising.

Rank said Burnaby‘s top rents have reached around $30 per square foot per year in new buildings. In Richmond, new buildings are fetching up to about $25 per square foot.

“New inventory is definitely moving the market up,” he added.

Colliers said the suburbs continue to attract attention because while rents are going up, gross rents can still be half of those charged downtown.

© The Vancouver Sun 2008