New outlet opens 11 years after main store on Terminal Avenue

Bruce Constantineau

Sun

INTERIOR DESIGN FOCUS FOR CAMBIE-BROADWAY CORRIDOR: Home Depot Canada and Asia president Annette Verschuren relaxes with a good book at the company’s newest Vancouver store. The new urban-format store is at Seventh Avenue and Cambie. Photograph by : Glenn Baglo, Vancouver Sun

Home Depot officially put its name on the burgeoning Cambie-Broadway retail corridor Thursday by opening a new urban-format store at Seventh and Cambie.

It’s only the home improvement giant’s second Vancouver store, coming 11 years after it opened its Terminal Avenue location. “The density around this store is unbelievable and growing,” Home Depot Canada and Asia president Annette Verschuren said in an interview.

“We could put many more stores in downtown Vancouver and we’d love to have one on Marine Drive. It’s all about real estate [availability].”

Home Depot urban-format stores emphasize interior design products popular with urban customers — like paint, wall coverings, lighting, moulding and appliances — so the two-level, 77,000-square-foot Cambie store won’t carry lumber or large materials.

Verschuren said the residential densification of Canadian downtown cores has clearly increased the demand for slightly smaller and more interior-design focused Home Depot outlets.

The new Vancouver store is the company’s 23rd in B.C. and 166th in Canada and Verschuren said there’s still room for substantial growth across the country.

Typical Home Depot stores range from about 60,000 to 115,000 square feet but the retail chain is currently developing a 40,000-square-foot format that would fit in smaller Canadian markets.

The first is set to open this summer in Parry Sound, Ont., and Verschuren feels the Canadian market could support 100 to 200 of the smaller stores.

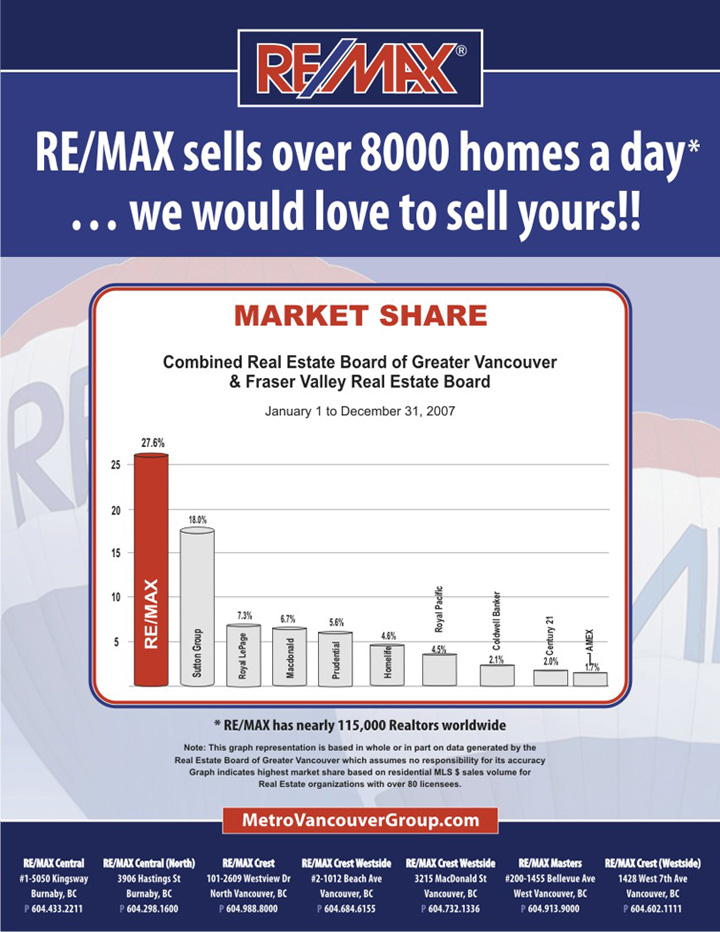

Home Depot and Rona Inc. traditionally run neck and neck for the market share lead in the Canadian home improvement retail sector and Verschuren said Home Depot currently has the lead — at about 17 per cent compared with 15 to 16 per cent for Rona.

She said Home Depot will open 10 new Canadian stores this year, as a relatively strong retail economy still supports ongoing growth.

“Western Canada has been phenomenal for us the last two years, but it will moderate and it’s probably better that it does,” Verschuren said, noting labour shortages make it hard to retain good staff.

“You just can’t compete with other jobs that pay $35 an hour so I’m more comfortable with things settling down, quite frankly.”

But she doubts the Canadian retail market will drop to the levels now being experienced in the U.S.

Home Depot recently reported a 27-per-cent drop in fourth-quarter profits last year as a slowing U.S. housing market led to the company’s first annual sales decline. Sales fell from $79 billion in 2006 to $77.3 billion last year, with profits dropping from $5.76 billion to $4.4 billion.

“The U.S. is probably experiencing its toughest economic downturn in 50 years,” Verschuren said.

“There are places where the housing market has lost 25 per cent of its equity and people have bigger mortgages than their homes are worth.

“So are they going to put in a new kitchen? I don’t think so.”

She said Canadian Home Depot sales are “significantly” better than those in the U.S. now, which is why the parent company continues to invest more than $20 million a store (including inventory costs) for each new Canadian outlet.

Verschuren also runs Home Depot’s Asian operations — currently limited to 12 stores in China that were purchased from an existing retailer — and is taking Mandarin lessons and flying to China at least six times a year to monitor progress in that market.

“I’d really like to explore [new stores] in India and Vietnam and lots of other exciting opportunities there too but we need to get China right first,” she said.

© The Vancouver Sun 2008