Calgary-area developer comes up with plan for making first-time home ownership more affordable

Derek Sankey

Sun

When 25-year-old hair stylist Nicole Estrada and her 22-year-old boyfriend Tayo Diening-Verge went looking around Calgary for an apartment to rent, they were shocked that monthly rental rates were almost comparable to the cost of a mortgage.

“It’s too expensive,” says Estrada, whose partner is a heavy-duty mechanic. “You might as well invest and get in the game.”

Although the couple had well-paying, stable jobs, the problem was coming up with the down payment to buy their first home together. “It’s not easy at all [to get into home ownership],” she says.

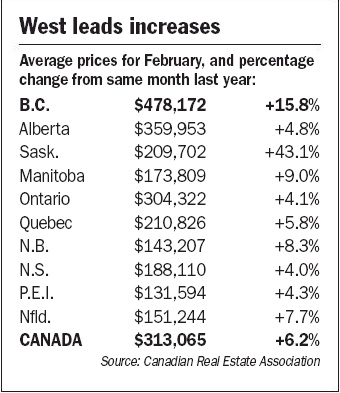

In Calgary, where real estate prices have skyrocketed, leading the country in appreciation over the past two years, the couple thought they were destined to rent. Then they found a developer who is at the leading edge of a new trend in mortgage solutions for first-time home buyers.

“One of the challenges that developers and the industry as a whole faced was how to create an affordability type of response [to escalating home prices],” says Annette Hodgins, assistant marketing manager for Pointe of View Developments, which builds and sells condominiums and townhomes around Calgary.

“Most of our buyers have really good, solid incomes but a lot of us are down-payment poor,” she explains. “They have everything to get them qualified, they just don’t have that $20,000 or $30,000 in the bank that’s required as a down payment.”

So, Pointe of View approached the BMO Financial Group and devised a plan in conjunction with the Canada Mortgage and Housing Corp. under its Flex 100 program, which helps qualified buyers get approval for 100 per cent of the cost of their mortgage.

But instead of facing very high premiums usually associated with 100 per cent financing, Pointe of View stepped in by providing $20,000 to buyers, who must then invest that money into an RRSP with BMO. After 90 days, that money goes right back to Pointe of View as a down payment, making the final interest rates on the mortgage affordable.

“They’re immediately building their equity and their future retirement plans,” says Hodgins.

The program was launched in January and is thought to be the first of its kind in Canada. So far, the response has been very strong.

“Some of my friends are looking into it now, too,” says Estrada.

The federal government’s First Time Home Buyer program allows buyers to invest up to $20,000 in RRSPs and withdraw it — penalty-free and tax-free — for use as a down payment.

The money used can be paid back into the RRSP over a long period of time without any initial payments, freeing up the money for a sizable down payment.

Many potential first-time home buyers don’t fully understand the new range of options available to them to get into the market instead of renting.

“There’s lots of first-time home buyers sitting on the fence trying to figure out whether they can really enter into home ownership,” says Laura Parsons, area manager of business development in Calgary for BMO.

“We’re treading on new ground and so far . . . we’ve seen a lot of people that couldn’t get into home ownership now get into it, so hopefully it will evolve to something that everybody can offer,” Parsons says.

Banks and mortgage lenders have also changed the lending rules in other ways that address the lack of affordability for first-time home buyers across Canada.

Amortization periods — the length of time in which a mortgage is paid back — have gone from a maximum of 25 years to the current limit of 40 years in just the past two years.

While it means paying substantially more interest if paid out over the full 40 years, most buyers simply want affordable payments in their younger years and will then pay lump sum or double-up payments when they can afford it later in their careers.

Banks will also work with first-time home buyers to rewrite outside debt with smaller monthly payments, allowing them to get approved for larger mortgages that allow them entry into home ownership.

Buyers can also get RRSP top-up loans to take full advantage of the First Time Home Buyers program.

There are also rent-to-own options in the market, where a building owner will permit a tenant to pay monthly rent with a portion being saved up as an eventual down payment.

“The problem there is you’re not reaping the financial investment opportunity that money could give you if you had funnelled it through an RRSP program,” Hodgins says.

Parsons advises desperate parents to seek out these new options and consult with financial advisers because there are many new options available.

“One of the issues is parents who have children they can’t get out of the house,” says Parsons, with a chuckle. “We can help them get there.”

© The Vancouver Sun 2008