Owner lives in Japan but hands-on operator also owns funky Indian diner Clove

Mia Stainsby

Sun

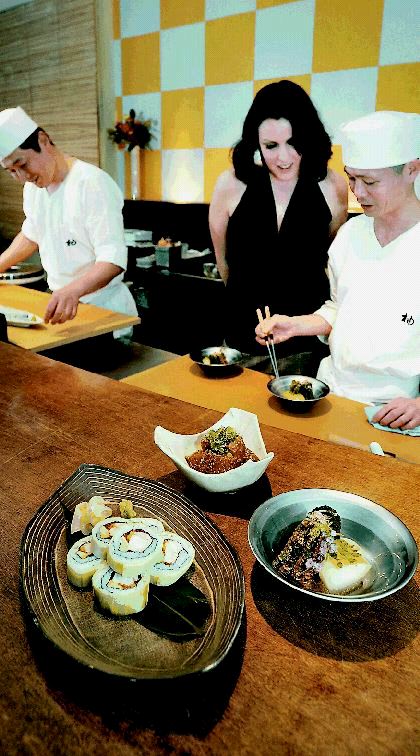

At Lime, Rebecca Lee looks on as chefs Atsu Inomata (left) and Masa Kudo prepare dishes: (foreground, left) lobster roll (rolled with cucumber); vegetable ohitashi (right); and tuna gomae. Photograph by : Stuart Davis, Vancouver Sun

Lime is the name, not a far cry from the name of the former inhabitant, Rime.

In fact, Lime, a Japanese restaurant, did retain something from Rime — not the Turkish food, but the nightly live entertainment. We went early one evening while they were doing sound checks and I must say, it’s not the most pleasing of sounds. Another evening, we caught the front end of a lively Afro-fusian group. The music was great, although it made strange with the Japanese food. And maybe that’s what the owners are thinking because they’re changing the music scene, going lower key and more backgroundy with it.

The owner lives in Japan but the hands-on operator is Hseuh Li, who owns Clove, the funky Indian restaurant a few blocks south on Commercial. “I still cook there three, four times a week. I love it. I can’t quit,” he says. He grew up in Osaka where his parents ran an extra-large Chinese restaurant for 2,000. “I was peeling potatoes when I was six,” he says.

Lime seems to be a hit on Commercial Drive and the clientele is varied, from Japanese-speaking families to the vintage-clad hipsters. The room has been renovated but it’s still dark except for the sushi bar on a raised level with a wall of pale apricot and silver and an ikebana arrangement on the counter brightening up the room.

The sushi is very good. The man in charge is Masa Kudo, who’s worked at Tojo’s and the Blue Water Cafe’s sushi bar, as well as in a Kyoto sushi bar for 10 years. Beside him is Atsu Inomata, who was head chef at Sakai restaurant until it closed. And in the back kitchen, rolling out the hot foods, is Kayo Uki, who hails from Yoshi restaurant. You’ll have to try her soba noodles, which she crafts from scratch. Her family in Japan is well-known for their soba making and she herself is a soba “master,” giving classes on how to make it.

Much of the seafood for the sushi and sashimi is from the Tsukiji Market in Tokyo. A good test of the quality was the uni, which so often disappoints — here it was bright and oceany and fresh. A seafood sunomono with scallops, snow crab and shrimp in a grapefruit bowl was the best sunomono ever. It came adorned with a jelly grapefruit star.

While the sushi didn’t disappoint, the hot foods weren’t consistent. The tempura was good — light and delicate and delicious. Smoked sablefish with soba noodles and crispy tofu, with Uki’s soba noodles rolled inside the fish, was a delicious dish, with a light broth.

“Bif Teki,” medallions of premium beef tenderloin marinated in red wine soy, had lots of company on the plate — marinated vegetables, a tamago (egg) roll around vegetables, enoki mushrooms and horseradish. It wasn’t a strong concept, muddled by elements that didn’t belong together.

A dish that truly didn’t work was “Japanese cabbage roll in cream sauce,” an unlovely dish wthat required a knife and fork. It was difficult, even then, to cut. A shame, because there were scallops, prawns, shiitake mushrooms and asparagus tucked inside the cabbage, wishing it had been put to better use.

Japanese desserts have always struck me as offbeat in a Hello Kitty sort of way. The melted marshmallow and raspberry jelly with Oreo crust and vanilla ice cream was certainly one of those desserts. It was cute and quite edible — the raspberry jelly wasn’t Jell-O kind but a square of gelatin with real raspberries. Anyway, we ate it all up. Mocha ice cream turned out to be matcha ice cream and it was good.

Considering the high quality of sushi, there was a notable lack of sake and not a premium one at that. And the wine list is serviceable but short and unremarkable.

LIME

Overall: 3 1/2

Food: 3 1/2

Ambience: 3

Service: 3

Price: $$

1130 Commercial Dr., 604-215-1130. www.limerestaurant.ca. Open 5 p.m. to 1 a.m., Tuesday to Saturday; to midnight Sunday.

Restaurant visits are conducted anonymously and interviews are done by phone. Restaurants are rated out of five stars.