Richmond man can’t pay property taxes because he doesn’t legally own his house

Gillian Shaw

Sun

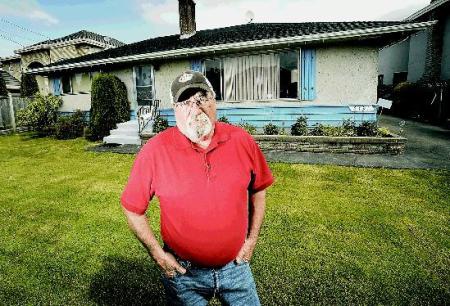

Norman Gettel stands in front of his Richmond bungalow that — unknown to him — was sold and mortgaged. He didn’t find out until he made some phone calls to ask why he hadn’t received this year’s annual assessment. Photograph by : Bill Keay, Vancouver Sun

When the annual assessment for Norman Gettel’s home didn’t arrive in the mail this year, he phoned the BC Assessment Authority.

“They said, ‘You don’t own the property any more,’ ” said Gettel, a printer who retired from his job at Pacific Press in the late 1990s, a few years after he had paid off the mortgage on his Richmond bungalow.

“I went to the land titles office. They pulled it up and said, ‘You don’t own the property any more.’

“I said, ‘I hate to differ with you, but I didn’t sell it.’ “

The title told a different story.

According to the property documents, not only had Gettel sold his property, assessed at $600,000-plus last July, but the buyer had also immediately put a $400,000 mortgage from CIBC on it.

The buyer never showed up to claim the property.

The mortgage, at $2,600 a month, is in default, and Gettel can’t even pay his property taxes because, according to legal records, he doesn’t own the place.

So far Gettel, who is in his 70s and suffers from chronic obstructive pulmonary disease, has paid his lawyer $10,000, and the case hasn’t even made it to court, although Gettel’s lawyer has filed a notice of pending litigation.

It’s all part of an elaborate scheme that has surfaced recently in B.C. in which con artists are attempting to sell homes without the owner’s knowledge, leaving the homeowner off the title but with hundreds of thousands in new mortgage debt against the property.

In the latest variation of the scheme in B.C., a would-be seller contacts a notary or lawyer to carry out the sale of a home.

A buyer, who is thought to be in on the deal, applies for a mortgage on the property and if the transfer is successfully carried out, the mortgage funds are paid to the seller. The buyer and seller disappear and so does the money, often leaving the homeowner to discover the ruse only when the bank notices the mortgage payments aren’t being made and comes looking for its money.

While such fraud is not new, title insurance company First Canadian Title said B.C. has seen a jump in suspicious cases this year. And a B.C. Supreme Court decision this month ruled that while a true owner could regain title to a property if it was fraudulently transferred, mortgages taken out on the property — even if fraudulently obtained — still stand.

In that case, a plaintiff asked for restoration of title, which had been fraudulently transferred to an imposter. The plaintiff also sought the removal of two mortgages placed by the fraudster against the property.

The court directed land titles to issue a new title reflecting the plaintiff’s ownership. However, it dismissed the plaintiff’s action seeking cancellation of mortgages.

The latest cases have prompted an alert from the Law Society of B.C. to its members.

“As far as I’m aware there have been two or three attempts in B.C. in the recent past to perpetrate frauds of this nature and our notice was to be proactive in raising the awareness of the profession so lawyers could play a role in stopping the attempted frauds,” said Susan Forbes, director of insurance with the Law Society.

“In the cases we have recently become aware of, the fraud is happening at the level where there is an actual transfer of title; it is not simply a mortgage. A fraudster is posing as an owner and conveying the property to another, who is a partner in the fraud.”

Gettel has been told someone claiming to be him showed up at a Surrey law office to sign the property transfer papers.

The property transfer lists the market value of his home at $607,600.

The next line, “consideration” — the transfer price — reads: “$1.00 AND NATURAL LOVE AND AFFECTION.”

The person listed as the buyer, Oleg Balan, took out a $400,000 mortgage on the property, but that appears to be the last the bank heard of him.

Gettel received a copy of a lawyer’s letter to Balan dated Feb. 1, 2008, in which a lawyer for CIBC Mortgages Inc. demanded payment in full of $403,034.95 plus interest at $53.18 a day plus legal expenses of $375. The letter gave notice that CIBC Mortgages “intends to enforce its security” on Balan’s property.

CIBC spokesman Rob McLeod said the CIBC is in contact with Gettel’s lawyer and no foreclosure proceedings have been commenced or are currently contemplated. He said the RCMP is aware of the file.

Such schemes constitute a lucrative sideline to identity theft and have been carried out in other parts of Canada. A 90-year-old Ontario man ended up in court with a bank demanding he pay the $300,000 mortgage that fraud artists had taken out on his property, which was sold without his knowledge. A court eventually ruled that he didn’t owe the money.

Balan’s name has also surfaced in the sale of a Vancouver home that was recently blocked when real estate lawyer Ron Usher doubted its authenticity. In that case, another man was listed as the buyer, but the mortgage proceeds were to be paid to a company, VP Custom Trading Inc., that lists Balan as a director.

A man phoned Usher recently asking if he would act for his father on the sale of the family home. The father arrived at Usher’s office with all the details of a $665,000 offer on his east Vancouver home, for which he said he had received a $66,500 deposit.

His client gave him a phone number, but Usher checked the address of the property and called the house.

“I’m Ron Usher, the lawyer acting on the sale of your house,” Usher said, recounting the conversation. “He said, ‘I’m not selling, and who are you?’ “

The perpetrators had filed a change of address with the post office to intercept mail linked to the fraudulent dealings.

The would-be buyer in that case also turned up as the buyer of a Burnaby property that land title records show was sold recently for $565,000. The buyer got a $518,670 mortgage on the property.

The BC Land Title and Survey Authority put a caveat on the property title after the notary who witnessed the seller’s signature on the deal notified the authority she has been told by police the person who signed the deal was not the true owner.

Gettel’s case also included instructions to the postal service to have mail redirected to a Burnaby address.

Gettel said he went to Richmond RCMP when he found out about the redirected mail, but said he was told it wasn’t something the police would look into. He said he has since talked to Richmond RCMP about his case.

Sgt. Susan Green, of the B.C. RCMP’s commercial crime section in Surrey, said the RCMP can’t release any information about specific investigations.

Ian Smith, director of land titles for B.C. and registrar in the Land Title and Survey Authority’s New Westminster land title office, said such cases are very rare in B.C., but there had been several similar attempts in 2003 and 2004. This year there have been about five others that appear linked to the same perpetrators.

Smith said B.C. has safeguards in place to protect property owners from title and mortgage fraud.

He said B.C. property owners are protected through an assurance fund that compensates them if they are deprived of their title either because of an error in the administration of the land title system or through identify theft and fraud.

“With respect to the mortgage, if it was proved that it was a fraudulent mortgage as well, the bank would be left holding the bag.”

Usher also said he doesn’t know of any cases where the victims lost money in paying off mortgages that were fraudulently obtained.

“I have never seen anybody in all these cases in Ontario — and certainly I’ve never heard of it here — basically an innocent owner having to pay the mortgage of the fraudster.

“It gets solved in some way. What the lawyers are arguing about here is what is the right process.”

© The Vancouver Sun 2008