Higher number of homes on the market means buyers can take more time, realtor says

Gillian Shaw

Sun

Real estate sales in Greater Vancouver and in the Fraser Valley dipped more than 25 per cent in May compared to the same month a year ago while the number of new listings climbed.

The increase in listings combined with the slowing sales has cooled price increases which are now mostly in the single digit range across the two real estate boards. Abbotsford is the exception, where the average price for single-family detached homes rose more than 11 per cent in May compared to May 2007.

In the greater Vancouver area sales in May dropped more than 30 per cent to 3,002 from May 2007 when they totaled 4,331.

New listings for greater Vancouver were up 20.2 per cent in May to 7,390 compared to last year at the same time when there were 6,149 new listings for detached, attached and apartment properties.

The Real Estate Board of Greater Vancouver says price increases now are in the single digit range.

“With more property listings and a decline in the number of sales, prices are not increasing as rapidly, now down to single digits overall, which is good news from an affordability standpoint,” REBGV president Dave Watt said in a release. “The housing market is at a balanced state, sellers have more competition and buyers have more selection to choose from.”

Detached property sales dropped more than 33 per cent in May of this year, down to 1,203 from 1,805 in May, 2008.

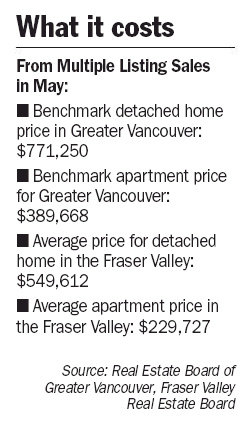

Despite the decline, the benchmark price for detached homes in greater Vancouver was up 8.4 per cent over the same period last year to $771,250

Apartment sales dropped more than 30 per cent last month from the same period a year ago with the benchmark price climbing 8.7 per cent to $389,668 compared to May of 2007.

Two areas bucked the trend in May, with attached home sales in Coquitlam up 45 per cent and apartment sales in New Westminster up almost 14 per cent.

In the Fraser Valley, sellers are also facing more competition with sales down 26 per cent in May to 1,599 compared to 2,152 sales in May 2007.

New listings jumped 33 per cent in the valley to 3,941, up from 8,381 in May 2007.

“We’re experiencing a return to more normal market conditions,” Kelvin Neufeld, president of the Fraser Valley Real Estate Board said in a release. “In a balanced market, we can generally advise our clients to take a little longer, look at a wider variety of properties and negotiate harder when it comes to price.”

Neufeld said there are some areas though where buyers are facing more competition for available properties. Abbotsford single home prices were up more than other areas.