Sellers adding properties to the market faster than purchasers are snapping them up

Derrick Penner

Sun

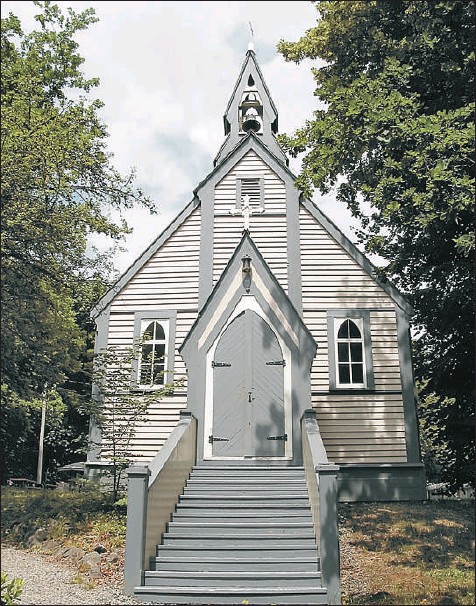

Moshe Cohen-Ravid put his west-side Vancouver home on the market a couple of months ago and has since reduced the price by $82,000 to $1.798 million, in a market in which the tables have turned on vendors. Photograph by : Bill Keay, Vancouver Sun

When Moshe Cohen-Ravid listed his west-side Vancouver house for sale a couple of months ago, more than 100 people viewed the property and seven even put in bids to buy.

There was no bidding war, though, since none came close enough to his $1.88-million asking price — one hint that sellers no longer reign in Metro Vancouver’s real estate market.

“I wanted to be able to sell it sooner,” Cohen-Ravid said, “but I guess this is the market today. It is very hesitant. It’s very unclear for both buyers and sellers, and people are taking time making decisions.”

Being able to think before making a decisions is another sign the Vancouver market may be tipping in favour of buyers.

After seven years of a torrid sales pace, with little inventory of unsold homes, sellers are now adding homes to the market faster than buyers are snapping them up.

Gone are the days when homeowners could list their houses one week, hold an open house for hordes of anxious buyers on the weekend, then beat back the participants in a bidding war the next week.

Cohen-Ravid’s realtor, Lorne Goldman of MacDonald Realtors, said that over the last seven years realtors have been able to simply put up a for sale sign and wait for the offers to roll in. “And it wasn’t as difficult [as it is now] because there would be multiple bids on everything.”

To sell homes these days, many homeowners are being forced to lower their asking prices. And builders and realtors are offering referral fees to past clients to gain new ones, as well as throwing in other incentives to gain sales.

For the first six months of the year, total sales of 16,243 units across the Real Estate Board of Greater Vancouver’s territory represented a 20-per-cent decline from the same period in 2007.

As of June 30, the number of active listings totalled 20,889, a 48-per-cent increase from the same point a year ago.

Goldman estimates that about four months ago there was still a disconnect between sellers and buyers, with sellers believing they could still push prices up, while buyers believing the market had turned in their favour.

“Now, with what’s going on in the media, it’s clear that sellers are well aware it is a buyers’ market and the tables have turned,” he added.

Buyers are hesitant because they don’t feel the need to rush, according to realtor Cindy Parkinson, also of MacDonald Realty.

“There are a lot of people waiting for bargains,” Parkinson said, or simply waiting to see how the market plays out.

Parkinson added that she is starting to see more sales being made conditional on the buyer selling his or her own property first. “You haven’t been able to write a contract with ‘subject to sale’ on it in four or five years,” she said.

David Robertson and his wife Simone Lehman, who are relocating from Toronto, are among those who decided to wait out the shakedown.

They were looking for a condo, preferably close to downtown, and weighed whether to buy or rent. However, Robertson found that even the rents that condo owners were asking were too high compared with the purpose-built rental market. The couple wound up picking a two-bedroom apartment in a rental building for $1,800 a month, compared with the $2,800 a month being sought by the owner of a similar-sized condominium.

“My wife and I talked about it and we said the market is so weird at this point we’re just going to rent for six months or a year and see where this falls,” Robertson added.

The measure of a buyers’ versus sellers’ market is basically whether the supply of unsold homes overwhelms the demand from buyers. But calculating where that point is can get a bit complicated.

By Canada Mortgage and Housing Corp.’s measure, the Metro Vancouver market is still more in the zone of balance, according to senior analyst Robyn Adamache.

A ratio of real estate sales during a given period versus listings added to the inventory of new homes is the simplest measure. For Vancouver, Adamache said sales that account for anywhere between 45 per cent and 60 per cent is balanced. Above 60 per cent, sellers have the upper hand. Below 45 per cent, buyers should have the advantage.

With a sales-to-new-listings ratio of 31 per cent in June in the Real Estate Board of Greater Vancouver’s reporting area (which excludes Surrey, but includes the Sunshine Coast and Squamish), the region could be considered firmly within buyers’ territory.

However, Adamache added that CMHC also examines the sales-to-total-listings ratio, months of supply, and the rate of price growth as other measures to determine who the market favours.

Adamache said that over a six-month period, sales have averaged 21 per cent of the total listings, falling within the CMHC balanced zone of 18 to 25 per cent.

The inventory of unsold homes across the region, Adamache added, sits at about a six-month supply, which is also below the buyers’ market measure of seven months or more.

Year-over-year price growth across Metro Vancouver is still running at above seven per cent, Adamache noted. Any price growth that is higher than the rate of inflation is considered a sellers’ market.

“We haven’t seen [prices] catch up to supply and demand,” she said.

Sellers, however, are starting to notice that they can’t push prices up like they once did.

Tino Dhinsa, a house builder in Maple Ridge, has two new spec homes that have been on the market since January.

“Over the last few years, we were selling houses by the time we got the insulation or drywall in,” Dhinsa said. “Now, all of a sudden, things are slowing down a little bit. The market is getting tested.”

He characterized prices as “stabilizing,” with builders realizing that they can’t add big price increases to homes to accommodate rising prices for material and labour.

He even cut the list price on the two houses he is holding to $499,900 from $515,000 about a month ago. Each is a 2,100-square-foot single-family home with nine-foot ceilings, crown mouldings, granite counters and 60-foot-by-100-foot landscaped yard.

Interest in the homes has picked up since.

“Things are moving,” he added. “It’s not like houses aren’t selling.”

Ron Antalek, Dhinsa’s realtor with Re/Max Ridge Meadows, describes the market as “about 70 per cent of our old market,” which “is still a good market.”

But with inventories rising, he added that sellers have to be prepared for their homes to sit longer on the market, and they have to pay closer attention to decluttering and staging the presentation of their homes.

In addition, they have to be more aware of the market, get to know what homes have recently sold — not just comparable listings on the market — and price accordingly, Antalek added. Those who are “overly aggressive” about a high asking price aren’t obtaining them, Antalek said.

In some locations, particularly Surrey where a lot of new units have come on the market, Antalek has seen prices for new units being discounted below last year’s levels.

Another of Antalek’s clients, Lee Wiltshire, caught a break, earning a $20,000 discount on a $499,000 new house in the Albion area of Maple Ridge for being one of the first five buyers in a new subdivision.

Wiltshire, in an interview, said he and his wife, Jamie, weren’t exactly looking for a new home. However, this past May, it was more or less coincidence that they drove past the new Albion subdivision’s presentation centre on the day it was opening.

“I said to the missus, ‘Let’s just go in for a quick look,’ ” Lee said. “I thought the houses looked pretty good from the outside.” For the size, 3,200 square feet with big front and backyards and higher-end finishings, Wiltshire was also attracted to the $499,000-plus-GST price tag.

The $20,000 discount motivated the couple to put down a $5,000 deposit to allow them to research a possible purchase.

Wiltshire said they will move into their new home in mid-September. He even earned $1,000 in free upgrades for referring his sister-in-law to the development; she also bought.

However, when it came to selling their existing home, which they bought in 2003 for about $216,000, Wiltshire said they had nervous moment when the first, quick offer they received fell through.

“I was a little bit shaken after the first few weeks. . . . There were more sellers and less buyers. I started thinking, ‘OK, maybe we need a backup plan.’ “

However, Wiltshire said he was willing to be conservative and flexible on their price since the home had already earned the couple substantial equity. He listed at just over $387,000, although other houses in the area were listed for more than $400,000.

“That [equity gain] gives you a little bit of play,” he added. “Your neighbours don’t like the fact that you’ve priced it a little bit lower, but you know what? I want it to sell.”

About four weeks after the listing, another offer came in, which Wiltshire countered and the prospective buyer accepted.

Meanwhile, Cohen-Ravid has repriced his spacious west-side Vancouver home, which boasts a spectacular view, reducing it $82,000 to $1.798 million. And he relisted it with Goldman with some confidence he will sell it so the Cohen-Ravids can downsize now that their children have grown.

“It’s just a matter of to what extent I’m willing to compromise on my price,” Cohen-Ravid said. “I’m still getting, verbally, offers close to what I’m asking. Hopefully somebody will put [their offer] in writing and it will sell.”

As of Friday, Goldman reported that Cohen-Ravid had received an offer that was “under negotiation.”

© The Vancouver Sun 2008