Sun

Qosmio X300 laptop computer, Toshiba

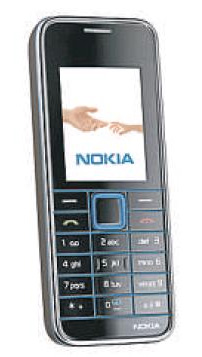

Nokia 3500, available with Fido

Designer Sleeves laptop protection

1. Qosmio X300 laptop computer, Toshiba, $2,000

Pricey but built for gaming purists who are looking for power and great graphics in a portable gaming machine. The X300 is one of three laptops in the latest models in the Qosmio line and it combines a NVIDIA GeForce 9800M GS graphics card with four gigabytes of DDR3 memory and 500 GB of hard disk drive space. It connects to Toshiba’s LCD HD televisions for big-screen play and it has Harman Kardon speakers with a built-in subwoofer. The other two in the line, the Qosmio G50 and the Qosmio F50 are priced at $1,700 and $1,500 respectively. www.toshiba.ca

2. Nokia 3500, available with Fido for $15 with a three-year agreement

There’s good news for other cellphone manufacturers now that Rogers has managed to prompt a wave of anti-iPhone sentiment among Canadians with data plan rates that are way pricier than other countries where Apple’s popular phone is sold. Disgruntled iPhone wannabes could be shopping around and Nokia is adding constantly to its lineup, with the 3500 its most recent summer addition. It’s no iPhone but it’s also $15 with a three-year contract instead of $200 so you can save money. A bar-style handset, it has a 4.6-cm (1.8 inch) smoked screen, it’s Bluetooth-enabled and offers a 2.0 megapixel camera, stereo FM and music player with internal memory of up to 8.5 megabytes and Flash Lite 2.0 for web browsing, with video.

3. Starpex, Peak Products, $180

Hoping to capitalize on the popularity of Guitar Hero and Rockband, Peak Products has just introduced an instrument that has the look and feel of a real guitar to use with these games. Billed as a “handcrafted” authentic guitar controller it is compatible with both PS2 and PS3 and it can be hooked up with a cable or use a 2.4 Ghz wireless connection with both options included. www.Go-Peak.com

4. Designer Sleeves laptop protection, from $35

Give your laptop its own wetsuit this summer with a Designer Sleeve. Not that these sleeves will turn your laptop into diving machine but at least the wetsuit-grade Neoprene material will protect it from some of the abuse that befalls laptops on the go. Colourful, shock and scratch resistant as well as water resistant, the Designer Sleeves will help your laptop stay looking new even you jam it into a backpack. www.designersleeves.com

© The Vancouver Sun 2008