Other

Archive for August, 2008

Demand Cools for recreation properties, selling becomes hard

Friday, August 8th, 2008Posted in Real Estate Related | Comments Off on Demand Cools for recreation properties, selling becomes hard

Proceeds of Crime Legislation is another $445M Federal Fiasco by CRA – Canada Revenue Agency that will inconvenience 600,000 Canadians

Friday, August 8th, 2008Other

Posted in Real Estate Legal Articles | Comments Off on Proceeds of Crime Legislation is another $445M Federal Fiasco by CRA – Canada Revenue Agency that will inconvenience 600,000 Canadians

Proceeds of Crime Legislation is another $445M Federal Fiasco by CRA – Canada Revenue Agency that will inconvenience 600,000 Canadians

Friday, August 8th, 2008Other

Posted in Real Estate Related | Comments Off on Proceeds of Crime Legislation is another $445M Federal Fiasco by CRA – Canada Revenue Agency that will inconvenience 600,000 Canadians

Vancouver Prime Property Deals are largely immune to fears of credit crunch

Friday, August 8th, 2008Other

Posted in Real Estate Related | Comments Off on Vancouver Prime Property Deals are largely immune to fears of credit crunch

Major cities in Western Canada over valued by 10%

Friday, August 8th, 2008Major cities in Saskatchewan, Alberta and B.C. are overvalued by 10 per cent, economists say as key construction indicator tumbles

TAVIA GRANT

Other

As Canada‘s housing market shows fresh signs it has exited the boom phase, Merrill Lynch economists are cautioning homeowners to expect a “sustained downturn” in prices.

Nearly every major city in the West makes the list of most vulnerable markets, in addition to Montreal and Sudbury, according to a pair of Toronto-based economists at the bank.

Soaring prices over much of the past decade have made the country’s homeowners substantially richer. The big question is whether a selloff could echo the wrenching downturn in the United States, where prices in Miami and Los Angeles have fallen as much as 28 per cent from the peak and average national prices are down 18 per cent in the past two years.

The Merrill Lynch Canada study, which predicts a retrenchment, but not of the same magnitude as in the U.S., concludes the country’s housing market is now the most expensive since 1991.

Markets in Regina, Saskatoon, Vancouver, Victoria, Calgary, Edmonton, Sudbury and Montreal are all more than 10 per cent overvalued, as calculated by economists David Wolf and Carolyn Kwan.

Their analysis, which calculates fair value by using variables such as current prices, affordability and long-term average valuations, landed on the same day Statistics Canada said both residential and commercial construction intentions tumbled in June.

In sifting through recent data, the Merrill economists believe the country’s housing market will suffer from excess supply and reduced demand as higher prices deter new buyers. They expect house price appreciation will stall, with western markets “most vulnerable to outright declines.” Other markets exposed to downward pressure include urban condos and suburbs where commuters face higher transportation costs due to rising fuel prices.

This retrenchment won’t be nearly as severe as in the U.S. though, Mr. Wolf emphasized.

“Are prices going to fall 20 per cent the way they did in the U.S.? Probably not,” he said. “But it’s pretty clear that things are weakening and they’re going to continue weakening for some time.”

Credit is the main difference between the two countries. Looser credit conditions south of the border fuelled easy lending, which in turn created excessive demand.

“We never had that kind of credit excess in Canada,” Mr. Wolf said. Plus, much of this country’s boom has been making up for lacklustre activity throughout the 1990s.

Now, after years of ever-pricier homes and aggressive building, scales may have tipped.

The Merrill economists are most concerned about Saskatchewan, where the doubling of house prices in Regina and Saskatoon over the past two years means, they estimate, these markets are almost 50 per cent overvalued.

In B.C., Vancouver’s and Victoria’s housing markets are now as much as 35 per cent overvalued, they believe. Markets in Alberta, meantime, have become slightly less overvalued in the past year.

The rest of the country looks “better balanced,” they said, with housing in Toronto essentially at fair value.

Slowing activity and moderating prices would have broad economic ripples. Mr. Wolf sees cooling residential investment dampening inflation and knocking 0.6 percentage points off real gross domestic product next year.

Builders are already more cautious, with Statscan’s report Thursday showing building permits fell 5.3 per cent in June – the steepest drop this year. Last week, a Canadian Real Estate Association report showed sales activity slumped 13.1 per cent in the first half of the year. National house prices, though, have so far held steady.

The head of construction powerhouse EllisDon is “very concerned” about where the Canadian economy is heading, and what it might mean for building activity.

“I am worried right across the country that things are tightening up and that a year from now we are going to see a drop-off,” said Geoff Smith, the company’s president and CEO.

Nowhere has the market been more wild in the past year than Saskatoon, which has bubbled with stories of bidding wars and frenzied speculators.

Yet soaring house prices may finally be deterring buyers.

“It’s quiet on the buyers’ side. Listings are up, sales are down,” said Ken Glauser, associate broker at Henry Moulin Realty Inc. “Surprisingly, the overall average price isn’t down though.”

He expects a slight cooling-off in prices, but says a strong local economy means they won’t fall much. And he’s rather relieved the market is losing some of its fevered pitch.

Nowadays, “people can go home and think about their bids overnight,” Mr. Glauser said. “Last year, they could hardly get back to their car to think about it.”

© The Globe and Mail

Posted in Real Estate Related | Comments Off on Major cities in Western Canada over valued by 10%

Material bends, stretches and conducts electricity?

Friday, August 8th, 2008Julie Steenhuysen

Sun

CHICAGO – In the latest twist on electronics, Japanese scientists said on Thursday they have developed a rubbery material that conducts electricity, a finding that could be used to make devices that bend and stretch.

The material, described by Tsuyoshi Sekitani of the University of Tokyo in the journal Science, could be used on curved surfaces or even in moving parts, they said.

Sekitani’s team developed their material using carbon nanotubes, a long stretch of carbon molecules that can conduct electricity.

polymer to form the basic material. Next, they attached a grid of tiny transistors to the material and then put it to the test.

They stretched the sheet of material to nearly double its original size and it snapped back into place, without disrupting the transistors or ruining the material’s conductive properties.

The elastic conductor would allow electronic circuits to be mounted in places that would have been impossible up to now, including “arbitrary curved surfaces and movable parts, such as the joints of a robot’s arm,” Sekitani and colleagues wrote.

Earlier this week, a U.S. team reported developing an elastic mesh material that allowed them to use standard electronics materials to build an electronic eye camera based on the shape and layout of the human eye.

That device could be the basis for the development of an artificial eye implant.

John Rogers of the University of Illinois at Urbana-Champaign, who wrote about the eye camera in the journal Nature, said the development of materials that can be shaped and molded to curved surfaces will allow for a whole new class of electronics devices that can be used to better interact with the human body, such as brain monitoring devices.

© Reuters 2008

Posted in Technology Related Articles | Comments Off on Material bends, stretches and conducts electricity?

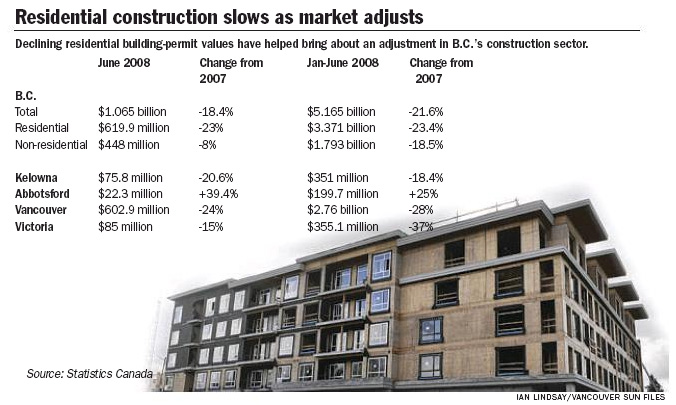

Building boom cools off

Friday, August 8th, 2008Derrick Penner

Sun

Photograph by : Ian Lindsay, Vancouver Sun, Files

The value of building permits issued to contractors in British Columbia dropped by almost 22 per cent over the first half of 2008 compared with 2007, according to figures released Thursday by Statistics…

The value of building permits issued to contractors in British Columbia dropped by almost 22 per cent over the first half of 2008 compared to the same period last year, according to figures released Thursday by Statistics Canada.

It is a story of a slowing in residential construction planning compared with 2007, and also reflects how the industry overheated last year.

Contractors booked almost $5.2 billion in permits during the first six months of 2008 compared with $6.7 billion over the first half of 2007.

A 23-per-cent drop in residential permits, at almost $3.4 billion over the first half of 2008 compared with $4.4 billion in 2007, was the main factor for the decline.

Last year was “a very high watermark [for construction activity], that’s part of it,” said David Hobden, an economist with Credit Union Central B.C., in an interview.

“The other thing is that housing inventories have risen dramatically [during 2008], both on the new and resale side.”

Hobden added that the result of all that inventory is a halt to rising house prices, and “a market adjustment is underway [in construction], mainly in the housing sector.”

Hobden said that the non-residential construction sector is still going strong, though building-permit values for the first half of 2008, at almost $1.8 billion, are down 18.5 per cent from 2007.

Hobden said the non-residential sector, for buildings such as hospitals, schools, stores and offices, hit a lull around the turn of the year, but have rebounded to strong levels over the past few months.

“The [Credit Union Central] forecast this year is for non-residential construction to be close to last year’s level by the end of the year,” Hobden said.

Activity, he added, is being driven by high demand for commercial space, particularly retail stores and offices.

Keith Sashaw, president of the Vancouver Regional Construction Association, said the falloff in residential permits was expected given that “we are very long into the [housing] cycle.”

However, in talking to his members, “their order books are full.”

“There’s no doubt permits are off from last year,” Sashaw added, “but last year was just extraordinarily busy. Frankly, it was unsustainable at those levels.”

Philip Hochstein, president of the Independent Contractors and Business Association of B.C., added that the sector is still healthy, although not isolated from what is happening elsewhere.

“The building permit numbers show that B.C. is not immune from what is happening in North America,” Hochstein said in a written statement.

“Building permits are an indicator of people’s feelings about the future, and there is greater caution today, particularly with the economic troubles in the U.S.“

Hobden added that “the boom is definitely off the construction sector. But even so, it was at such high levels that though the peak has been reached, there is still a fair amount of [construction] output.”

B.C. was one of six provinces to record a decline in the value of building permits issued in June compared with May, which drove values on a national basis down by a seasonally adjusted 5.3 per cent, according to the Statistics Canada report.

David Wolf, an economist at Merrill Lynch Canada, said the country’s housing market seems to have entered a “sustained downturn” that could be hampered by a decline in commodity prices.

“It does look like Canadian houses finally got too expensive, and builders too aggressive, for the underlying demand environment,” Wolf added.

He estimated that markets with the strongest price growth in recent years, such as Regina, Saskatoon, Vancouver, Victoria, Calgary, Edmonton, Sudbury, Ont., and Montreal, were all more than 10-per-cent overvalued. On a national basis, Wolf predicts house price growth to remain flat.

Merrill Lynch expects commodity prices to moderate over the medium term, a scenario that would aid in the housing market downturn, but not cause an outright bust.

© The Vancouver Sun 2008

Posted in Real Estate Related | Comments Off on Building boom cools off

City buys land on Kingsway with eye to social housing

Friday, August 8th, 2008Mary Frances Hill

Sun

VANCOUVER – The city has purchased an old auto shop at 1700 Kingsway with an eye to developing it into 70 social housing units, Mayor Sam Sullivan announced Thursday.

The site, bought for $1.3 million, doesn’t yet have a construction start-date attached to it, he said. The city will have to secure funding partnerships with either the private sector or the federal and provincial governments before the building, which will include social services and retail outlets, will be developed.

“This is the golden age of investment in social housing right now,” said Sullivan.

Laura Track, a lawyer with Downtown Pivot Legal Society, which acts as an advocate for people in the Downtown Eastside, said the new project is welcome, particularly since it stands outside the poverty-stricken neighbourhood.

But 70 new units won’t come close to fixing the problem of homelessness, she said. “It’s a drop in the bucket.”

Homeless count figures put the number of people living on the streets at 1,547.

© The Vancouver Sun 2008

Posted in Real Estate Related | Comments Off on City buys land on Kingsway with eye to social housing

Drop in the value of building permits worse than analysts expected

Friday, August 8th, 2008City-by-city comparison ‘fairly ugly’

Province

The Canadian housing market is continuing to cool with the value of building permits down 5.3 per cent nationally and 13.4 per cent in Vancouver. – AFP FILE PHOTO

OTTAWA — The value of building permits in Canada plunged 5.3 per cent to $6.3 billion in June, as plans for both residential and non-residential projects declined from the month before, Statistics Canada reported yesterday.

The most significant decrease occurred in Ontario, where the value of building permits — a key indicator of construction activity — fell 7.9 per cent to $2.3 billion. Six provinces saw declines in their numbers.

Nationally, the residential sector experienced a 4.4-per-cent drop to $3.6 billion, generated by lower values in multi-family permits in all provinces except Saskatchewan.

In non-residential building, permits fell 6.6 per cent to $2.8 billion due to declines in commercial and industrial intentions, the federal agency said.

The 5.3-per-cent drop was much worse than the one-per-cent monthly drop markets had been expecting, and the biggest monthly change since November of last year, according to TD Securities economics strategist Millan Mulraine.

June’s sharp drop places the value of permits 9.1 per cent lower than in the corresponding period last year, Mulraine said.

“On a city-by-city comparison, the report was fairly ugly,” Mulraine said, “with Montreal [down 12.1 per cent], Calgary [down 15.2 per cent], Vancouver [down 13.4 per cent] and Saskatoon [down 16.7 per cent] all posting double-digit declines.

“On the whole, it is now becoming clear that the Canadian housing market is continuing to cool, as the level of activity moderates to more sustainable levels. And we expect this correction to continue at a measured and orderly pace,” Mulraine said.

Municipalities were hurt by a 13.8-per-cent drop, to $1.3 billion, in multi-family housing in June, the second-consecutive monthly decrease, with most of them occurring in Ontario and Alberta.

Single-family permits edged up 1.8 per cent to $2.3 billion.

The non-residential sector declined after two consecutive months of gains with advances in institutional permits, up 17.4 per cent to $765 million, unable to offset sharp declines in industrial and commercial permits.

Industrial permits fell 31.1 per cent to $389 million after a 70.3-per-cent jump in May. Commercial permits fell 7.7 per cent to $1.6 billion due to lower construction intentions for hotels and recreation buildings.

Saskatchewan was the only western province to post gains, up five per cent to $192 million. Alberta posted a 7.5-per-cent decline to $1.193 billion thanks to a 19.6-per-cent decrease in the residential component, Statistics Canada said.

B.C. was off 6.1 per cent to $1.065 billion. Manitoba was down 11.6 per cent to $121.2 million, while Alberta fell 7.5 per cent to $1.193 billion.

Quebec was up 3.5 per cent to $1.147 billion.

© The Vancouver Province 2008

Posted in Real Estate Related | Comments Off on Drop in the value of building permits worse than analysts expected

Telus, Bell to go ahead with fees for incoming texts

Friday, August 8th, 2008Widespread cries of ‘ripoff’ fail to move the 2 telecom giants

Meagan Fitzpatrick

Province

OTTAWA — Bell Mobility’s plan to charge some cellphone customers for incoming text messages takes effect Friday, despite the consumer backlash, a lawsuit, and an intervention by the federal industry minister.

Customers whose cellphone bundles don’t include text messaging will be charged 15 cents every time they receive a text message, and Telus users will face the same fate Aug. 24.

The companies already charged 15 cents for outgoing messages sent by users not on a text plan, and they say the added charge for incoming messages will affect a minority of customers.

“About 95 per cent of text messages on Bell‘s network are sent and received by clients on text bundles. Anyone who plans to send and receive a significant number of text messages really should be on a plan,” said Bell‘s associate director of media relations, Jason Laszlo.

The company has adjusted its text bundles and, starting at an extra $5 a month, subscribers can get unlimited incoming texts and 250 outgoing ones. For $15 per month, customers receive unlimited outgoing and incoming messages.

Laszlo said Bell customers have been most concerned about paying to receive unsolicited spam messages, but he said the company has top-notch anti-spam protection on its networks. If spam somehow slips through, the charges will be adjusted.

Since news of the fee started spreading in May, however, customers and critics have vented their frustrations on blogs, signed an online petition initiated by the New Democratic Party, and joined a Facebook group –which has more than 35,000 members –and two Quebec residents have each launched a lawsuit against the telecom giants.

The uproar caught the ear of the federal industry minister, Jim Prentice, who in early July described the new fee as an “ill-thought-out decision.”

Prentice said he had no desire to interfere with the day-to-day business decisions of two private companies, but he said he had a duty to protect consumers. He asked the CEOs of Bell Mobility and Telus to meet with him before Friday to explain their pricing “with a view to finding a solution that provides the best service to consumers at the best price.”

Prentice’s efforts, even if they were genuine, failed to produce such a solution, said NDP Leader Jack Layton.

“It was weak and completely ineffectual,” Layton said. “Clearly, Mr. Prentice is not on the side of the ordinary Canadian who is wondering why these companies are being allowed to get away with gouging.”

Layton said the minister did some “huffing and puffing” but, ultimately, the Conservative government is failing to defend Canadian consumers.

One of Canada‘s other major cellphone providers, Rogers, has no plans to charge for incoming text messages.

© The Vancouver Province 2008

Posted in Technology Related Articles | Comments Off on Telus, Bell to go ahead with fees for incoming texts