High-end homes set records this year, but still experience some effects of the housing market slowdown

Derrick Penner

Sun

At first blush, the top end of British Columbia‘s real estate market seems to follow that old observation about the rich being different from the rest of us.

Agents recorded 30 sales of mansions over the $5-million mark during the first seven months of this year, according to research by Landcor Data Corp.

The January sale of 3330 Radcliffe Ave. in West Vancouver for $28.2 million set a record for the highest sale price in the province, and the April sale of 6715 Crabapple Dr. in Whistler at $17.5 million marked a new high for the resort community.

That’s not to say that high-end properties aren’t experiencing some of the slowdown that has hit the overall real estate market.

The number of ultra-high-end sales this year, according to the Landcor count, fell short of the 38 sales over $5 million recorded in the first seven months of 2007. And several of this year’s top property sales closed well below the original asking prices.

“There’s no doubt that there’s been a slowdown,” said Grant Connell, an agent with Sotheby’s International Realty Canada, who has Metro Vancouver’s highest-priced current listing, the Ray Loewen family’s Twin Cedars estate in Burnaby, with a $25-million price tag.

So far, however, Connell has seen it more as a hesitation on the part of buyers. Buyers may be lacking confidence about which direction the market will go, or are bargain-hunting as inventory builds in the middle segment of the upper end of the market.

“[Buyers] are there,” Connell said. “Since Labour Day, my phone has been ringing tons, and I’m showing more things,” including the Loewen property.

Connell has seen a bit of pressure on prices, but only in some segments, such as the $3.5-million to $5-million segment of West Vancouver, where a lot of houses have been built and there is lots of inventory.

“There is a sense [among buyers] that there is time enough … to get a deal,” he said. “And some people [are looking] for a deal based on what’s happening in the market and what they’re reading.”

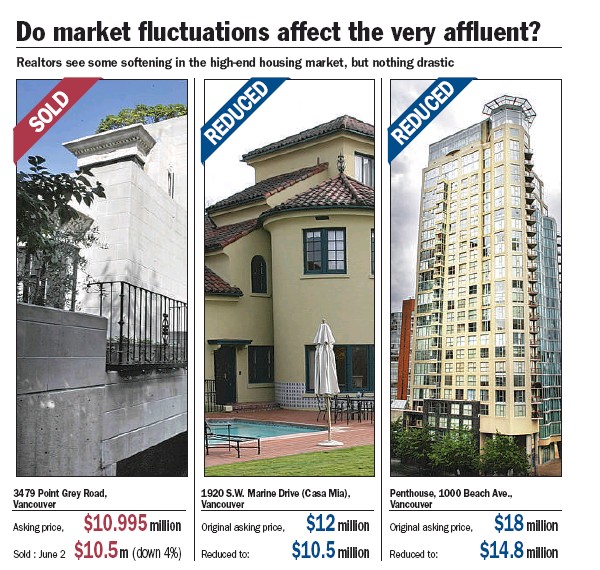

Among top-end sales, 3479 Point Grey Rd., on Kitsilano’s tony waterfront, sold in June for $10.5 million, four per cent below its original asking price of just under $11 million.

In the leafy enclave of Shaughnessy, the home at 1688 37th Ave. sold at the end of August for almost $6.9 million, almost 11 per cent below its $7.7-million original asking price.

The listing price for Casa Mia, the stately 1930s-era Mediterranean-style villa at 1920 SW Marine Dr., has been reduced to $10.5 million from the $12 million it was listed for last fall.

However, Manyee Lui, Casa Mia’s listing agent and one of Vancouver‘s top high-end agents, said the price reduction wasn’t due to a lack of interest in the property.

“We have continued interest [in Casa Mia],” said Lui, with Macdonald Realty. “The price reduction is to encourage people to write offers. It’s not that we don’t have interest.”

Generally, Lui said that while top-end buyers might be showing a bit of hesitation, she has been busier this year with top-end sales than with mid-range sales.

“I don’t think [top-end buyers] are worried about market ups and downs,” she added. “In this price range, people are looking for something very special and unique. They’re not bound by the economy and all these kinds of things.”

The penthouse at 1000 Beach Ave., now on the market for $14.8 million, was listed last September for $18 million.

The current broker for the property, Malcolm Hasman of Angell & Hasman, another of Vancouver‘s most prominent realtors, said his top-end listings remain active.

Hasman noted he has three listings in the $6-million to $10-million range that are “continually being shown, even with the market slowing.”

“So, where the overall numbers in the mid-range of the market have slowed down, there still seems to be interest in high-end properties in Vancouver.”

High-end markets are hard to read, explains Tsur Somerville, director of the centre for urban economics and real estate at the Sauder School of Business at the University of B.C.

Somerville added that he hasn’t looked specifically at B.C., but typically top-end markets are what economists refer to as “thin markets,” with fewer properties and participants than the general market.

For condominiums, for example, there are many similar properties on the market and lots of information to guide buyers on what prices should be, Somerville said.

However, in the mansion market, where each house is unique and there aren’t as many offerings, there are fewer comparables.

“There is just not a lot of information about what a property is worth,” Somerville said. “So you tend to see more variation in the possible prices that a property can get.”

He added that “the negotiation between what a buyer is willing to pay and what a seller is willing to take is a very different dynamic, because there’s not a lot of information that says a property is worth [a particular amount].”

Even if there is a slowing in the overall B.C. market, just as price is less of an object for top-end buyers, top-end sellers don’t face the same pressures to sell at prices they don’t like.

“You’re not seeing enormous drops or anything,” Connell said of Vancouver.

He said sellers of unique homes, such as waterfront properties in West Vancouver, tend to hold out for the value they want to see. Owners put them on the market at high prices because they know there is very little waterfront left.