Jeff Lee and Derrick Penner

Sun

The project

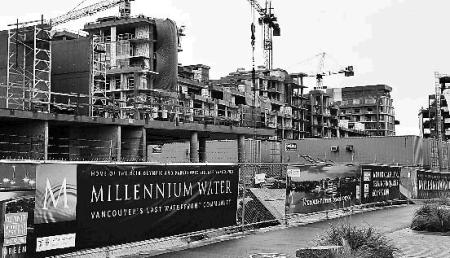

The Olympic Village is the first portion of a major redevelopment of the city’s last significant piece of False Creek waterfront. The entire redevelopment is scheduled to take place over two decades. The village is a $1.1-billion, 1,100-unit development with a mix of market and non-market housing, commercial space, parks and community centre.

Where

Southeast corner of False Creek. The city values the Olympic Village portion at $193 million, the price it got from Millennium Development Corp. in 2006.

The players: Vancouver, which owns the land; the Vancouver Organizing Committee (Vanoc), which will use the development for housing athletes during the 2010 Winter Games; Millennium Development Corp, the purchaser of the land; and Fortress Investment Group, Millennium’s commercial financial backer.

When

Millennium bought the site in mid-2006 for $193 million, with $29 million down and the balance to come at the end of 2010.

Building schedule/completion date: Construction is scheduled to be completed in October 2009, with Vancouver Olympic organizing officials taking over the following month. The site is to be returned to Millennium on March 31, 2010.

PEFs

Much of the public infrastructure is being funded through the city’s Property Endowment Fund, a $2.7-billion account that holds city leases, land and cash.

Millennium

A Vancouver-based privately owned company owned by Peter and Shahram Malek.

Fortress

A New York-based investment management firm.

Vanoc

The organizer of the 2010 Games. It supplied $30 million to the city as its contribution to 250 units of non-market housing. It has a completion guarantee from the city that states the village will be ready in October 2009. The city has retained ownership of the site until after the Games in order to protect the completion guarantee.

City spending so far

Vancouver has spent roughly $120 million of a $250-million plan to build roads, utilities, non-market housing, a community centre and a neighbourhood energy utility on the entire southeast False Creek property, which extends from the Cambie Bridge to Quebec Street.

Further city risks

Vancouver is on the hook for a $190-million loan guarantee to Fortress, and is said to be in negotiations to loan Millennium and/or Fortress another $100 million with interest to cover a roughly $70-million construction cost overrun. The deal includes a contingency of about $30 million.

Where we’re at now

Millennium has sales agreements on 265 of the 420 units it has put up for sale so far. It has not yet put to market another 300 units in what the developer and the city say are the prime locations. Millennium had expected to put those units on sale later this year but those plans may be in jeopardy in light of the falling real estate market.

The worst-case scenario

If Millennium defaults between now and October 2009, the city, as owner, takes over construction and completes the work. If Millennium defaults on the final payments — including any additional loan it may receive from the city — Vancouver takes over as owner. The property is not transferred to Millennium until all debts to the city are paid.

If all goes well …

Millennium makes a lot of money, the city gets a new source of property tax revenue, a new community centre, social housing and a new park.

© The Vancouver Sun 2008