Pressure mounts on Vancouver city council to come clean on deal

Christina Montgomery and Damian Inwood

Province

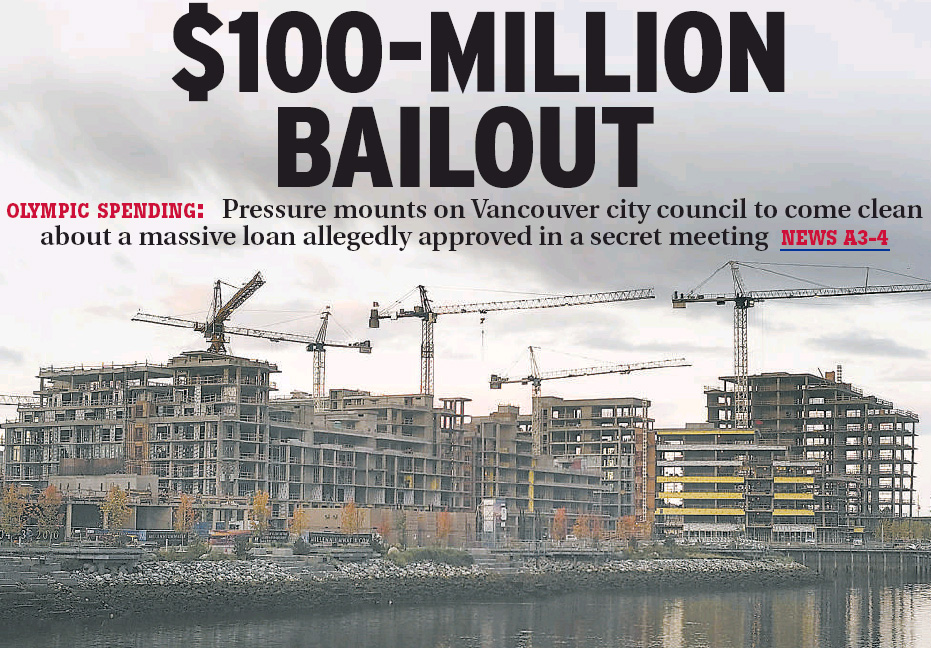

Construction cranes rise above the athletes village for the 2010 Winter Olympics yesterday as questions arise over a secret $100-million loan from Vancouver city council. — REUTERS

Vancouver’s Olympic Village under construction

Vision Vancouver mayoral hopeful Gregor Robertson Thursday called for an emergency council session to allow public debate on reports the city will loan $100 million to developers of the troubled Olympic Village.

He also challenged Coun. Peter Ladner, mayoral candidate for the Non-Partisan Association, to spill what he knows about the deal, apparently made at an in-camera meeting on Oct. 14.

Ladner is chairman of the city’s finance committee.

Robertson, who stepped down as an NDP MLA to run for mayor, is not a councillor and is not privy to what goes on at the in-camera sessions.

Councillors are sworn to keep the proceedings confidential.

On Oct. 16, two days after the in-camera session, Vision Vancouver Coun. Tim Stevenson tabled a motion asking that “any decision requiring the city to commit funding to the southeast False Creek development be made in public.”

Mayor Sam Sullivan ruled the motion out of order.

He did not return calls Thursday.

Robertson said Thursday — and the party’s councillors confirmed it — that none of them have told him what went on in-camera.

Robertson said it was only when the story broke in the press Thursday that he learned the city had apparently agreed to loan $100 million to Millennium Development.

He said he was also alarmed to read that Estelle Lo, the city’s chief financial officer, had resigned after voicing concerns about the city’s financial role in the project.

Lo did not return calls.

Media reports said variously that she was on vacation in Hong Kong or had resigned while on vacation.

City manager Judy Rogers, who would have received the resignation, did not return e-mails.

Rogers is on the board of directors of the Olympic organizing committee and would be intimately familiar with any deal on the project.

The city’s communications office issued a statement saying the public would be informed “when appropriate.”

It also said there had been no changes to its “financial and schedule risks” on the project.

City officials at a hastily called press conference refused to answer questions related to the loan, its implications for city finances, or about Lo.

Ladner said news of the apparent resignation caught him by surprise, since he had spoken with Lo Wednesday and the subject did not come up.

Premier Gordon Campbell said he couldn’t comment on particulars of the city’s arrangements but said he knew “the city wants to be sure the project goes through and the affordable housing gets completed.”

MLA Harry Bains, the NDP’s Olympic critic, criticized Campbell for not dipping into B.C.’s surplus to help with cost overruns.

“Why are Vancouver taxpayers being asked to pay $100 million?” Bains asked.

“Campbell has called this B.C.’s Games and Canada‘s Games. It shows sheer arrogance on the part of the premier.”

Dan Doyle, Vancouver 2010’s boss of construction, said he’s “entirely confident” the village will be handed over as planned in 2009.

He would not comment on the city’s loan. The risk to the city would arise when it comes time to sell the units.

If real estate prices are lower — and prices are dropping — sales may not raise enough money to satisfy the loans.

Shahram Malek, a director of Millennium Development Corp., said the taxpayer-backed loan is safe.

“The Olympic village is a private development and the taxpayers are not exposed in any sense whatsoever,” Malek told Global News.

“And any loans that are on the project are our obligations to pay.”

Asked what would happen if the company went bankrupt, he said: “That’s a good question. That’s a point I should make that loans on the project are fully secured. So there is security fully backing the loans.

“So in the unlikely event, and I know everyone has to look at a doomsday scenario, in the unlikely event anything happened to our company or any other company, there is more than sufficient security to back those loans up. Again, there would be no exposure to anyone in such a scenario.”

Financial problems with the project surfaced months ago, as economic conditions dipped globally and developers began to have trouble securing loans.

In early October, city councillors were told at an in-camera briefing that the project was $60 million — six per cent — over budget.

Michael Flanigan, the city’s director of real estate services, said the amount was being covered by Millennium Development, the project’s developer, and that the city was not concerned about the project’s viability.

He also said the city’s $190-million financial guarantee to Fortress Investment Group, which provided the $750-million loan to Millennium, was not in danger of being exercised.

Concerns arose when U.S.-based Fortress had a $1.7-billion loan of its own come due. It eventually made a last-minute deal to cover the money.