House building falls to seven-year low

Garry Marr

Province

A construction worker swings his hammer at a new home development in Ottawa. November’s decline in housing starts was sharper than what economists were expecting. Photograph by : Chris Wattie/Reuters

There were 172,000 housing starts in Canada last month, down from 211,800 units in October, CMHC said. Photograph by : Chris Wattie/Reuters

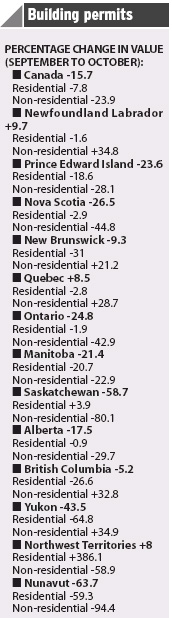

The housing sector, reeling from declining existing home sales, was dealt another blow Monday with news that new home construction hit a seven-year low in November.

Canada Mortgage and Housing Corp. said there were 172,000 units built last month on a seasonally adjusted annualized basis, down from 211,800 in October. It was the lowest level for housing starts since November, 2001.

“The resale market is having an impact [on new home construction],” said Julie Taylor, a senior economist with CMHC. “People have a large supply of choice. Before they were not finding what they wanted in existing homes so they were moving into new homes.”

The Canadian Real Estate Association said 32,048 existing homes were sold in October on a seasonally adjusted basis, a 14% decline from a month earlier. The last time sales fell that sharply was June, 1994.

New home construction appears to be headed for the same decline. Last month’s numbers saw a 29% drop from October for urban multiples, which includes the volatile condominium sector.

There is a sense from builders that this month’s numbers are just the beginning. “Housing starts are a lagging indicator. It will get significantly worse,” said Brian Johnston, president of Monarch Corp.

Mr. Johnston predicts some projects in the condominium sector that were originally counted as starts when ground was broken will end up not counting when the projects are cancelled. “Everybody is waiting with bated breath for that,” he said.

The industry has been bracing for a decline in demand and cutting back construction, according to John Kenward, chief operating officer of the Canadian Home Builders’ Association.

“Builders have been making the necessary adjustments,” said Mr. Kenward. “It is coming down faster than we would have anticipated.”

Derek Holt, senior vice-president of economics at Scotia Capital, said while new home construction is beginning to fall he does not see it as an “implosion” and says it’s probably a healthy reaction to the slowing economy.

“We don’t want what U.S. homebuilders did,” said Mr. Holt, referring to a large buildup of inventory that has gone unsold in many American markets. “We remain of the view that while Canada’s housing market has been in a year-long correction, the magnifying effects of high economy-wide leverage are not as much of an issue in Canada as in the U.S.”

Paul Ferley, assistant chief economist with RBC Economics, also emphasized the decline in construction starts in Canada pales in comparison with the United States.

“Relative to an annual peak in starts of 229,000 in 2006, the level of activity in November is down 24%. In the U.S., the most current level of starts for October 2008 of 791,000 is down a phenomenal 62% from the annual peak of 2.073 million units reached in 2005,” he said.

CMHC is predicting there will be 212,000 new starts this year but by next year they will fall to 178,000, the first time in seven years the figure has dropped below 200,000. Most economists seem to agree with that assessment.

“After showing a great deal of resilience over the past year, the Canadian housing market is cooling. With our expectation that homeowners will be facing tight credit conditions and a softening market over the next two to three quarters, the rapid rate of growth in housing starts seen early in the decade — which was simply not sustainable — is likely to continue to unwind,” said Dina Cover, an economist with TD Bank Financial Group.

© Copyright (c) National Post