Vaughn Palmer

Sun

For boosters of the 2010 Winter Olympic Games, Friday’s online edition of The Vancouver Sun provided the front page from hell.

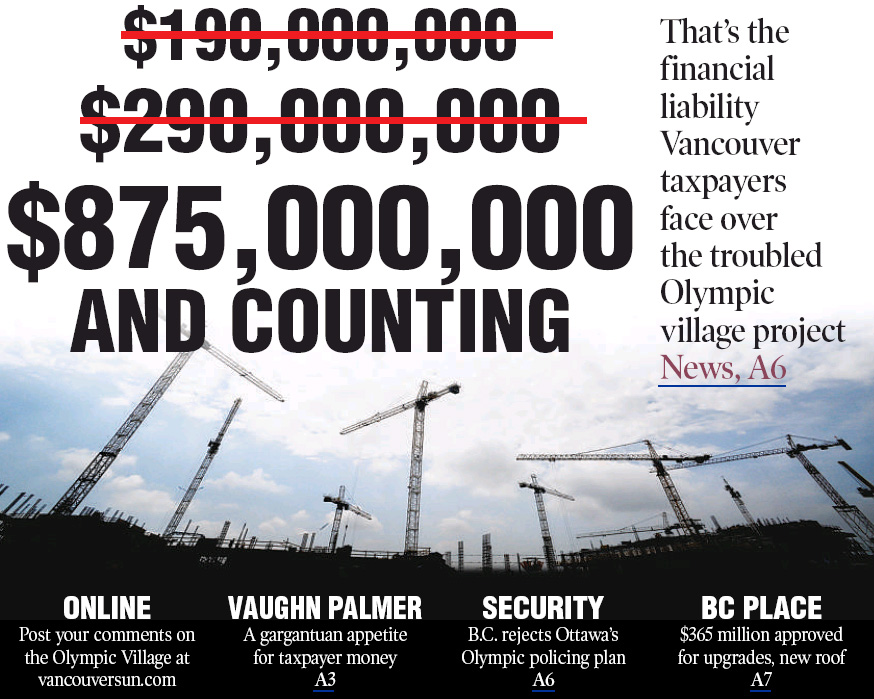

Bang: “Vancouver faces potential $875-million Olympic price tag.”

Bang: “B.C. approves upgrading BC Place stadium for $365 million.”

Bang: “B.C. balking at increased 2010 Olympics security budget.”

A veritable trifecta of bad-news headlines for taxpayers.

The city of Vancouver admits it could be on the hook for the full cost of the Olympic village.

The province commits to a massive (and after the fact) renovation of the venue for the Games’ opening and closing ceremonies.

The province fights being stuck with a bill for hundreds of millions of dollars for providing Olympic security.

In the wake of those stories, various politicians offered assurances to minimize the financial horrors.

The Vancouver guarantees were said to pose a “worst case” scenario. The site can probably be developed and sold, offsetting the outlays by the city.

The BC Place upgrade should also be covered by development of the surrounding lands, subject to (ahem) market conditions.

And provincial taxpayers were supposed to feel good that B.C. is fighting to reduce its share of a security bill approaching $1 billion, never mind that any balance would have to be picked up by federal taxpayers.

“There is only one taxpayer,” to quote various politicians at moments when it suited them.

On that basis, the all-in tab associated with Friday’s three stories could exceed $2 billion.

And counting, one has to add. For taxpayers have repeatedly been given lowball estimates for Games and Games-related facilities, only to discover, too late, that they couldn’t take any of those numbers to the bank.

The Olympic village was supposedly self-financing, apart from a mere $30 million in shared backing from the federal and provincial governments.

BC Place? Three years ago, the B.C. Liberals budgeted a mere $2.5 million for renovations that have turned into a $365-million upgrade. “It is not anticipated that BC Place will need a significant capital infusion,” minister for the Olympics Colin Hansen assured the legislature then.

The security budget provides its own fiscal pathology. The police and other experts have been saying for years that the supposed $175 million budget wouldn’t begin to cover costs.

But senior governments are still refusing to provide an update, other than a federal government suggestion that it will be more than $400 million and less than $1 billion. This is a budget?

Nor does that exhaust the instances of Games-related-budget fudging.

One readily recalls the expansion of the convention centre, ramrodded to ensure it would be ready to serve as the media centre for 2010. Cost, approaching $900 million, almost double the original “budget.”

At year’s end the independent auditor-general delivered a reminder of the provincial government’s failure to acknowledge a further $170 million in Olympic costs.

As to what other surprises might be coming down the road, I would just note that the Olympic sponsors include troubled Nortel and troubled General Motors.

Hansen again, from 2007: “Something that has been the bane of my existence is an obsession that certain members of the media have … that the cost of the Games are out of control and it is going to cost way more than anyone says it is going to cost. There are days when I am absolutely convinced that there is no amount of facts that will dissuade somebody from a good story.”

Well, minister, it remains a fact that when these Games were first pitched to British Columbians in 1998 they were assured that taxpayers would be on the hook for “only” $100 million.

It is also a fact that about that time my colleague, Ian Mulgrew, predicted in these pages that “hosting the 2010 Winter Games would cost taxpayers a fortune.”

Others, including yours truly, would say much the same thing. But the admission fee for being able to say “I told you so” is steep, given that, as taxpayers, we’re all on the same hook.

When the news broke Friday of Vancouver’s worst case scenario, it was said on radio station CKNW that “somewhere” Jean Drapeau, late author of Montreal’s Olympic overrun, was probably enjoying a good laugh.

But the laughs might have been closer to home, and coming from this world, not the next.

I’m thinking of former premier Glen Clark, who played a key role in lining up the 2010 Games for British Columbia before he left office.

Clark, now an executive with the Jim Pattison group, remains a fan of the Olympics, according to what he recently told reporter Rod Mickleburgh of the Globe and Mail.

Clark even floated the possibility that he would get an invitation to the opening ceremonies.

“Of course I guess Carole James will be premier by then,” he couldn’t resist adding.

Billion- dollar blunder

VANCOUVER Taxpayers responsible for Olympic village tab, mayor warns

BY CATHERINE ROLFSEN and JEFF LEE VANCOUVER SUN

Vancouver taxpayers are on the hook for the entire billion-dollar Olympic Athletes’ Village project after the lender cut off funding to the troubled development, Mayor Gregor Robertson said Friday.

Now, the city is scrambling to renegotiate its deal with Fortress Investment Group before Feb. 15, when the money flow is to evaporate and construction will be halted unless a new deal is in place.

“ The Olympic village is a billiondollar project, and the city taxpayers are on the hook for all of it,” Robertson said. “ We are financially and legally committed to completing this project.”

Robertson and senior city staff revealed details of the deal negotiated by the city, developer Millennium Development and lender Fortress to build the 17-acre village, touted as a model of sustainability.

Fortress stopped in September doling out the monthly money needed to keep construction going after its agreement with Millennium went sour. Since then, the city has been paying to keep construction going, to the tune of $ 79 million over three months.

Next Thursday, the city will give the development another $ 21 million, the last of a controversial $ 100-million loan approved by council last fall. After that, it’s unknown where the rest of the money needed to complete the project will come from, an estimated $ 458 million.

That, combined with the $ 317 million already loaned by Fortress and the $ 100 million being fronted by the city, leaves taxpayers with a combined financial liability of $ 875 million.

The rest of the value of the $ 1,075 billion project is in land already owned by the city, which is why Robertson said the city is on the hook for the whole billion.

The city is legally liable for the $ 875million cost of the project because in mid-2007, the previous council gave Fortress a “ completion guarantee,” meaning the city is responsible for completing it.

“ With that action, [ council] effectively made the City of Vancouver the project developer from that point forward,” Robertson said.

He said the decision was made in a closed meeting and wasn’t made public until the year’s financial statements were released in 2008.

The city has been negotiating with Fortress to restart the flow of money, so far without results.

A senior city official, who briefed reporters on condition of anonymity, said Fortress stopped paying out its $ 750 million loan after concluding Millennium was “ out of balance” on its commitments.

The lender was fully within its legal rights to do so, the official said, since the project had begun to face cost over-runs — which now total $ 125 million — and other technical defaults.

The official said Fortress has paid out $ 317 million of the $ 750-million loan, but now wants to renegotiate the remaining amount.

Robertson said the city is in “ delicate and quite urgent” negotiations with Fortress, but so far, has been unable to convince it to resume payouts to Millennium. Neither he nor staff would give further details, other than to say they were acting in the interests of taxpayers.

Robertson said his focus was on negotiating with Fortress rather than looking for other sources of financing. But he said the city is also talking to Vanoc and the federal and provincial governments.

The city faces a tight deadline to keep construction going to complete the village by November but Robertson insisted it will be completed.

“ We will meet this challenge and we will excel as proud hosts to the world’s greatest athletes,” he said. “ And we’ll be doing it under the most difficult economic circumstances in more than a generation.”

The tanking real estate market means the project may be much less lucrative than originally thought, with 70 per cent of its market units left unsold.

“ The potential liability of the project hinges on the market in the future,” Robertson said. “ That, at this point, is unpredictable.”

Robertson, who campaigned on a promise to make details of the project public, said he will hold a special council meeting Monday to share more information with taxpayers.

He put much of the blame on the previous NPA-led city council. “ The decisions taken by the previous city government have put the city at enormous financial risk, even as we were told in 2006 by our elected leaders at the time that the Olympic Village would be developed at, and I quote, ‘ no risk to the taxpayers,’ ” he said.

Coun. Suzanne Anton, the lone NPA member now on council, defended the previous council’s actions.

“ When you talk about the cost of it, remember that there is a product at the end of the day,” she said. “ This is a beautiful project with 1,000 units of housing in it and a lot of inherent value.”

Vanoc vice-president Dan Doyle said he was confident the city will deliver on the village.