Archive for January, 2009

City manager to brief public on Olympic Village finances

Monday, January 12th, 2009Presentation being streamed live on Internet

CATHERINE ROLFSEN

Sun

OLYMPICS Vancouver city manager Penny Ballem is today scheduled to give a public presentation, streamed live on the Internet, on the state of financing for the troubled Olympic Village development.

The presentation is expected to be similar to a briefing given to reporters at city hall Friday, when it was revealed that city taxpayers are on the hook for the entire billion-dollar development and that the lender has cut off funding for construction.

Also expected today is a status update on a review of the project by the city’s external auditors, KPMG, Coun. Geoff Meggs said Sunday.

Today’s meeting, beginning at 2 p. m. at city council chambers, can be viewed live at www. vancouver. ca. Members of the public can attend, but there will be no public submissions accepted during the discussion, Meggs said.

Friday’s media briefing was originally planned for today as well, but was bumped forward after The Vancouver Sun reported on Friday that the project’s U. S. financier, Fortress Investment Group, is asking the City of Vancouver to guarantee most of the $ 750 million loan to developers, Millennium Development.

“ On Friday there was a decision to go forward because of a concern about rumours and to make sure the information out there was correct,” Meggs said.

In Friday’s briefing, media were told that the city had signed a “ completion guarantee” making it legally liable for the project’s cost, estimated at $ 875 million. The remainder of the project’s value is in land already owned by the city.

Later this week, Mayor Gregor Robertson will be in Ottawa lobbying the federal government before the federal budget, and Olympic Village financing is expected to be brought up. The mayor has also been discussing the subject with the province.

Printed and distributed by NewpaperDirect | www.newspaperdirect.com, US/Can: 1.877.980.4040, Intern: 800.6364.6364 | Copyright and protected by applicable law.

City quietly seeking Olympic Village bailout

Monday, January 12th, 2009Miro Cernetig

Sun

The City of Vancouver is quietly approaching the federal and provincial governments for assistance in refinancing the city’s Olympic Village. It needs a bailout.

And those more senior governments had better come to the table to help rescue Canada‘s third largest city. If they don’t, this could quickly spiral into something far costlier than taxpayers are being told.

Could it be as embarrassing and debilitating as Montreal‘s 1976 Olympic debt, measured in the billions, which took Montrealers a generation to pay off? Perhaps not in dollar terms. But on a per capita basis, things could get just as ugly.

Do some basic numbers and you can see Vancouver‘s Olympic exposure — already about $1 billion — soaring by hundreds of millions of dollars.

Here’s the scary scenario Mayor Gregor Robertson is facing. (Warning: there are lots of numbers. But it’s your money, so it pays to pay attention.)

The new mayor wants to get out of — or at least renegotiate — the Olympic Village’s $750-million loan with Fortress Investment Group, the Wall Street financial firm. For good reason. Interest costs are 11 per cent a year — about triple the current interest rates. That’s about $83 million a year.

Unless Fortress suddenly gets generous, the penalties for refinancing will be, as people close to the negotiations tell me, “huge.” Penalties and interest owed could be $100 million or more.

That move would bring a smidgen of good news, though. Renegotiated interest rates — with federal and provincial backstopping — might fall to about four per cent.

Still, even that deal is sobering — sort of like going down the Olympic luge. It’s slow at first but things soon get fast and scary.

If the city takes over Olympic Village financing — assuming $875 million in debt, made up of the $750 million in loans and $125 million in cost overruns — the annual interest payments would still be $35 million. This would be the annual payment for 2009 and 2010 on $875 million.

So, let’s add it up. Refinancing the Fortress Olympic loans for the years of 2009 and 2010 brings total costs to $170 million. (That’s the forementioned $100 million on refinancing plus $70 million for two years of interest.)

But there’s more. The value of condos are falling — by the start of 2010, they could be down more than 20 per cent. So the city — reacting like any speculator caught in a falling market — will want to delay the sales, waiting for better prices when the market rebounds.

Let’s be optimistic and say that happens over three or four years — from 2011 to 2014. That would mean carrying the Olympic Village debt longer than the original business plan.

I’ll give the project a break and assume 250 Olympic condo units already spoken for are sold, offering up $250 million. So trim the Olympic Village’s debt to $625 million. At a rate of four per cent a year, that might mean interest payments of $25 million each year — or $100 million over four years.

Time for another subtotal: We’re now at $270 million. (The forementioned $170 million plus $100 million in interest for delaying condo sales.)

What I’m leaving out, you might forget, is the cost of the city land at False Creek, on which the Olympic Village sits. Taxpayers are supposed to get $200 million for that. I’ve yet to hear a business plan that guarantees taxpayers will recoup that investment by 2010.

This city is facing perhaps its biggest financial crisis in history. At city hall today, Vancouver‘s mayor will begin to fill in more details and outline possible rescue plans. He needs the help of other governments to make sure the Olympic Village is built on time, with as few additional costs as possible.

But to retain credibility, one of Mayor Robertson’s promises needs to be this: City hall will stick to the business of zoning, selling city property and collecting taxes. City bureaucrats and councillors will never again use other people’s money to dabble like amateurs in a condo boom.

© Copyright (c) The Vancouver Sun

Strata can’t duck liability for flood

Sunday, January 11th, 2009Tony Gioventu

Province

Dear Condo Smarts: Our strata corporation is having some emergency excavating done due to a pipe break and flooding of our townhouse. Several owners have been complaining about drainage problems for over two years, and we have had several minor incidents of flooding over that time. This time, our entire basement was flooded, including damage to our personal belongings. Our homeowner insurance is covering our personal items, but the strata said they will not repair the interior of our unit, and they refuse to file a claim on the strata’s insurance.How do we get the damage to the interior repaired?

Dear J.M.: Strata corporations do not have immunity from liability resulting from their neglect. If the strata corporation has been aware of the problem, owners have been filing complaints, and nothing has been done, the strata corporation could find itself not only paying the water leak and repairs to the unit, but for your personal costs as well. When a strata corporation refuses to repair a roof leak, for example, or they ignore an ongoing maintenance problem that results in greater damages, the strata corporation is potentially liable for those costs. Owners and tenants as set out in the Strata Act are deemed to be a named insured on the strata corporation policy. The strata corporation must maintain full replacement value insurance for common property and common assets.

I checked out your development and yes the developer did complete all of the basements as finished living spaces, so those areas are included within the insurance policy. If the area had been an improvement by you or a previous owner, it would be considered a betterment and you would add that coverage to your home owner policy. As an owner you can file the claim directly with the insurer and the deductible is a common expense of the strata corporation. Everyone who lives in or owns a strata lot, needs to insure their personal assets and personal liability. Do yourself a favour in 2009. Buy a tenant, landlord, or homeowner condo policy. Bring a copy of your strata policy to your insurer and make sure they sell you a policy that covers your risks.

Tony Gioventu is executive director of the Condominium Home Owners Association. E-mail: [email protected]

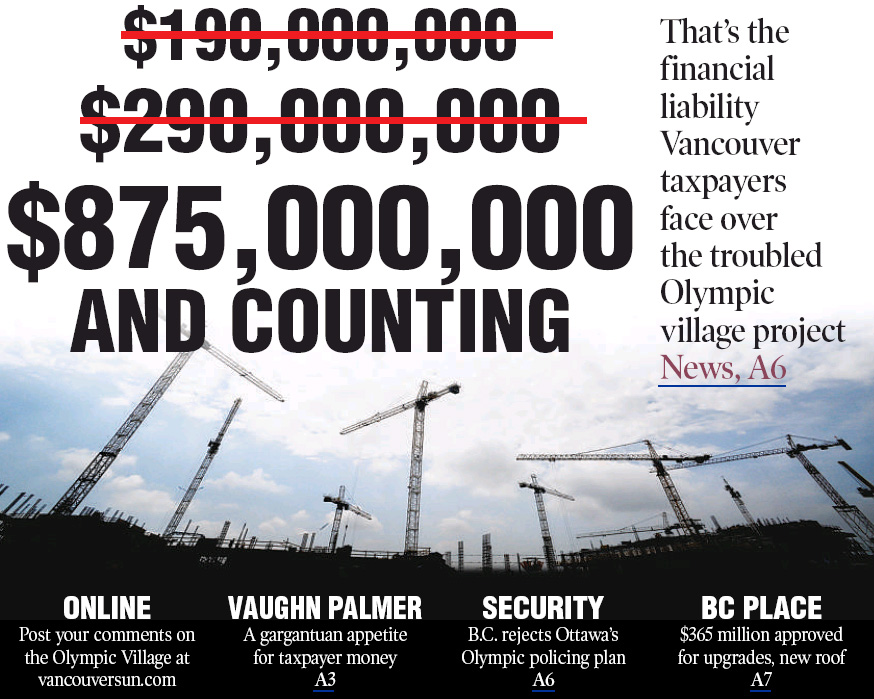

Olympic Village project at $875M and counting

Saturday, January 10th, 2009Vaughn Palmer

Sun

For boosters of the 2010 Winter Olympic Games, Friday’s online edition of The Vancouver Sun provided the front page from hell.

Bang: “Vancouver faces potential $875-million Olympic price tag.”

Bang: “B.C. approves upgrading BC Place stadium for $365 million.”

Bang: “B.C. balking at increased 2010 Olympics security budget.”

A veritable trifecta of bad-news headlines for taxpayers.

The city of Vancouver admits it could be on the hook for the full cost of the Olympic village.

The province commits to a massive (and after the fact) renovation of the venue for the Games’ opening and closing ceremonies.

The province fights being stuck with a bill for hundreds of millions of dollars for providing Olympic security.

In the wake of those stories, various politicians offered assurances to minimize the financial horrors.

The Vancouver guarantees were said to pose a “worst case” scenario. The site can probably be developed and sold, offsetting the outlays by the city.

The BC Place upgrade should also be covered by development of the surrounding lands, subject to (ahem) market conditions.

And provincial taxpayers were supposed to feel good that B.C. is fighting to reduce its share of a security bill approaching $1 billion, never mind that any balance would have to be picked up by federal taxpayers.

“There is only one taxpayer,” to quote various politicians at moments when it suited them.

On that basis, the all-in tab associated with Friday’s three stories could exceed $2 billion.

And counting, one has to add. For taxpayers have repeatedly been given lowball estimates for Games and Games-related facilities, only to discover, too late, that they couldn’t take any of those numbers to the bank.

The Olympic village was supposedly self-financing, apart from a mere $30 million in shared backing from the federal and provincial governments.

BC Place? Three years ago, the B.C. Liberals budgeted a mere $2.5 million for renovations that have turned into a $365-million upgrade. “It is not anticipated that BC Place will need a significant capital infusion,” minister for the Olympics Colin Hansen assured the legislature then.

The security budget provides its own fiscal pathology. The police and other experts have been saying for years that the supposed $175 million budget wouldn’t begin to cover costs.

But senior governments are still refusing to provide an update, other than a federal government suggestion that it will be more than $400 million and less than $1 billion. This is a budget?

Nor does that exhaust the instances of Games-related-budget fudging.

One readily recalls the expansion of the convention centre, ramrodded to ensure it would be ready to serve as the media centre for 2010. Cost, approaching $900 million, almost double the original “budget.”

At year’s end the independent auditor-general delivered a reminder of the provincial government’s failure to acknowledge a further $170 million in Olympic costs.

As to what other surprises might be coming down the road, I would just note that the Olympic sponsors include troubled Nortel and troubled General Motors.

Hansen again, from 2007: “Something that has been the bane of my existence is an obsession that certain members of the media have … that the cost of the Games are out of control and it is going to cost way more than anyone says it is going to cost. There are days when I am absolutely convinced that there is no amount of facts that will dissuade somebody from a good story.”

Well, minister, it remains a fact that when these Games were first pitched to British Columbians in 1998 they were assured that taxpayers would be on the hook for “only” $100 million.

It is also a fact that about that time my colleague, Ian Mulgrew, predicted in these pages that “hosting the 2010 Winter Games would cost taxpayers a fortune.”

Others, including yours truly, would say much the same thing. But the admission fee for being able to say “I told you so” is steep, given that, as taxpayers, we’re all on the same hook.

When the news broke Friday of Vancouver’s worst case scenario, it was said on radio station CKNW that “somewhere” Jean Drapeau, late author of Montreal’s Olympic overrun, was probably enjoying a good laugh.

But the laughs might have been closer to home, and coming from this world, not the next.

I’m thinking of former premier Glen Clark, who played a key role in lining up the 2010 Games for British Columbia before he left office.

Clark, now an executive with the Jim Pattison group, remains a fan of the Olympics, according to what he recently told reporter Rod Mickleburgh of the Globe and Mail.

Clark even floated the possibility that he would get an invitation to the opening ceremonies.

“Of course I guess Carole James will be premier by then,” he couldn’t resist adding.

Billion- dollar blunder

VANCOUVER Taxpayers responsible for Olympic village tab, mayor warns

BY CATHERINE ROLFSEN and JEFF LEE VANCOUVER SUN

Vancouver taxpayers are on the hook for the entire billion-dollar Olympic Athletes’ Village project after the lender cut off funding to the troubled development, Mayor Gregor Robertson said Friday.

Now, the city is scrambling to renegotiate its deal with Fortress Investment Group before Feb. 15, when the money flow is to evaporate and construction will be halted unless a new deal is in place.

“ The Olympic village is a billiondollar project, and the city taxpayers are on the hook for all of it,” Robertson said. “ We are financially and legally committed to completing this project.”

Robertson and senior city staff revealed details of the deal negotiated by the city, developer Millennium Development and lender Fortress to build the 17-acre village, touted as a model of sustainability.

Fortress stopped in September doling out the monthly money needed to keep construction going after its agreement with Millennium went sour. Since then, the city has been paying to keep construction going, to the tune of $ 79 million over three months.

Next Thursday, the city will give the development another $ 21 million, the last of a controversial $ 100-million loan approved by council last fall. After that, it’s unknown where the rest of the money needed to complete the project will come from, an estimated $ 458 million.

That, combined with the $ 317 million already loaned by Fortress and the $ 100 million being fronted by the city, leaves taxpayers with a combined financial liability of $ 875 million.

The rest of the value of the $ 1,075 billion project is in land already owned by the city, which is why Robertson said the city is on the hook for the whole billion.

The city is legally liable for the $ 875million cost of the project because in mid-2007, the previous council gave Fortress a “ completion guarantee,” meaning the city is responsible for completing it.

“ With that action, [ council] effectively made the City of Vancouver the project developer from that point forward,” Robertson said.

He said the decision was made in a closed meeting and wasn’t made public until the year’s financial statements were released in 2008.

The city has been negotiating with Fortress to restart the flow of money, so far without results.

A senior city official, who briefed reporters on condition of anonymity, said Fortress stopped paying out its $ 750 million loan after concluding Millennium was “ out of balance” on its commitments.

The lender was fully within its legal rights to do so, the official said, since the project had begun to face cost over-runs — which now total $ 125 million — and other technical defaults.

The official said Fortress has paid out $ 317 million of the $ 750-million loan, but now wants to renegotiate the remaining amount.

Robertson said the city is in “ delicate and quite urgent” negotiations with Fortress, but so far, has been unable to convince it to resume payouts to Millennium. Neither he nor staff would give further details, other than to say they were acting in the interests of taxpayers.

Robertson said his focus was on negotiating with Fortress rather than looking for other sources of financing. But he said the city is also talking to Vanoc and the federal and provincial governments.

The city faces a tight deadline to keep construction going to complete the village by November but Robertson insisted it will be completed.

“ We will meet this challenge and we will excel as proud hosts to the world’s greatest athletes,” he said. “ And we’ll be doing it under the most difficult economic circumstances in more than a generation.”

The tanking real estate market means the project may be much less lucrative than originally thought, with 70 per cent of its market units left unsold.

“ The potential liability of the project hinges on the market in the future,” Robertson said. “ That, at this point, is unpredictable.”

Robertson, who campaigned on a promise to make details of the project public, said he will hold a special council meeting Monday to share more information with taxpayers.

He put much of the blame on the previous NPA-led city council. “ The decisions taken by the previous city government have put the city at enormous financial risk, even as we were told in 2006 by our elected leaders at the time that the Olympic Village would be developed at, and I quote, ‘ no risk to the taxpayers,’ ” he said.

Coun. Suzanne Anton, the lone NPA member now on council, defended the previous council’s actions.

“ When you talk about the cost of it, remember that there is a product at the end of the day,” she said. “ This is a beautiful project with 1,000 units of housing in it and a lot of inherent value.”

Vanoc vice-president Dan Doyle said he was confident the city will deliver on the village.

$365-million plan for BC Place roof, upgrades approved

Saturday, January 10th, 2009PavCo will wait until conditions improve to develop land around site to pay costs

Bruce Constantineau

Sun

The B.C. government has approved a $365-million plan to update BC Place with interior improvements, seismic upgrades and a retractable roof to open by the summer of 2011.

It cost $126 million ($243 in today’s dollars) to build BC Place when it opened in 1983.

The $365-million price tag announced Friday includes $65 million in interior improvements that have already begun, a $43-million seismic upgrade, maintenance system improvements, a contingency fund and the roof project, which is widely estimated at about $200 million.

“I’m very confident in the project and I think it’s a very prudent investment for the city because, otherwise, you’d be replacing this facility somewhere else at probably triple the cost,” PavCo chair David Podmore said.

BC Place will play host to the the 2010 Olympics opening and closing ceremonies and installation of a new roof will begin after the Olympics end.

The BC Place air-supported fabric roof collapsed on Jan. 5, 2007, after heavy snow caused a large tear in one panel. A report later said staff didn’t follow proper procedures to clear snow from the roof, but also said existing damage to the roof fabric and weather caused the tear.

Podmore said most of the project will be financed through the development of lands near BC Place, existing cash reserves of about $25 million, sponsorships, expanded event business and energy savings. The plan calls for more than $100 million to be recovered through the sale and lease of development sites near the stadium. Podmore said the release of the sites can be delayed until the market recovers from the recession.

“This is a business and we’ll pick the timing we think is optimum to realize the value we need,” he said.

Development plans for two major land parcels near the stadium call for up to 1.4 million square feet of residential and commercial space to be built.

Podmore declined to divulge an expected final price tag for the roof project, which many expect to be in the $200-million range.

“If I give all of the budget breakdowns, then we’re basically telling the contracting community exactly what we’ve allocated,” he said. “I want to make sure we have the best pricing come in on a competitive basis.”

A final roof design is expected by the end of January, with tendering to begin by mid-February. PavCo has hired PCL Constructors to work on the next phase of the upgrade project.

The roof project is crucial to the Vancouver Whitecaps’ bid to win a Major League Soccer franchise to begin play in 2011. Six North American cities are vying for two franchises and the MLS is expected to decide on the winning bids early this year.

The MLS season begins in March, but Podmore said the roof probably won’t be finished until the summer of 2011. He said the Whitecaps and BC Lions could play in BC Place while the new roof is being completed.

“We expect to have the roof operational before the summer,” Podmore said. “Then there’s all kinds of finishing work to be done, but that won’t stop them from using the facility.”

NDP tourism and sport critic Rob Fleming said the cost of the upgrade is an “eye-opening number” that has only gone up after three years of indecision about replacing the stadium’s roof.

“If this had happened three years ago, there would have been a much stronger [real estate market] so more risk and responsibility would have been transferred from taxpayers,” he said.

© Copyright (c) The Vancouver Sun

How to get the most from your cruise: Tips from first-timers

Saturday, January 10th, 2009Little things can add up, even with everything that is included, so you have to pay close attention

Phil Reimer

Sun

A cruise can make for a great vacation, but for first-time cruisers it can be a little overwhelming.

Friends of mine, Ruth Atherley and Paul Holman, recently took two back-to-back Caribbean cruises on Carnival. They are inexperienced cruisers, so I asked them to share some of the things they learned.

Here are some of their newbie insider tips:

– Research your ports of call.

It’s incredibly helpful to learn a little bit about each port before you go. Spend a couple of hours online before you leave and print out some key things about each port. It will make deciding on an excursion or choosing a local restaurant or bar much easier.

– Find the right tour at the right price

You don’t have to book an excursion through the cruise line to have a great experience. You can find an excellent local tour guide waiting for your arrival at the pier. While they can be much less expensive, keep in mind that you are taking a chance since they are not vetted by the cruise lines. We found a great tour at the pier in St. Thomas and had a less than good experience (can you say boring?) in St. Maarten

– Don’t always play by the (onboard) rules

There are some onboard rules that no one pays attention to. The biggest one is that if you want a deck chair by the pool, you need to save it. There are signs everywhere saying that you can’t, but everyone does. On a sea day, toss your towel on the chair in the morning; when the ship is busy you will be glad you did.

– Ask the price of those daily drink specials in the fancy glasses

They are fun and funky, and look like they will make a great souvenir, but while a daily drink special might be $6.95, ask what the cost is in the coconut cup or a container shaped like the ship that they are showcasing. It could run you up to $15 per drink. That’s an expensive pina colada in a cheap-looking cup when you get it home.

Take advantage of the free stuff

Even on an inexpensive cruise, the extras add up. Take advantage of some of the free, fun things to do. Most cruise lines publish a daily newsletter that tells you the day’s activities. There are often trivia events, card games, talent shows, and karaoke. Watch for the captain’s reception where the drinks are free and they serve great appetizers. Many ships also offer contests where you can win a dinner at the specialty restaurant or shipboard credit. Go and participate, it’s fun!

– Staying wired can cost you

We saw lots of people on their cellphones as the ship left the port in Miami. It turns out that as soon as the ship hits international water (within a few miles) they were getting roaming charges.

The same goes for the Internet. Even if you buy a package, it costs about 50 cents per minute to go online and logging off is tricky if you’re using a portable. If you have problems with the Internet still running after you have shut down, see the Internet manager right away.

– Regularly check your onboard account to make sure you’re staying within your budget. Little things add up.

© Copyright (c) The Vancouver Sun