Derrick Penner

Sun

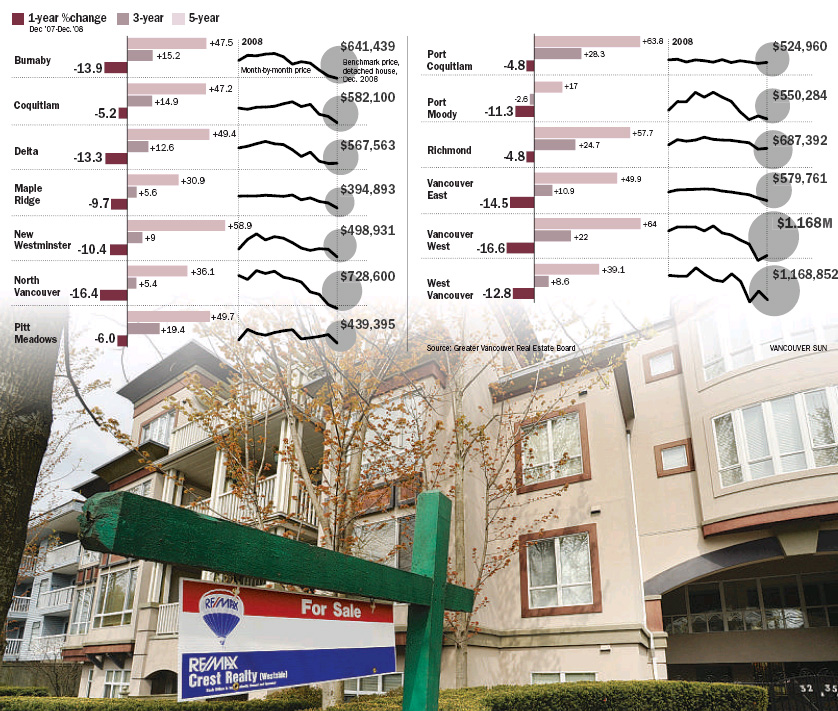

Realtors recorded 24,626 Multiple-Listing-Service sales during 2008, down substantially from more than 38,000 in all of 2007. Photograph by : Steve Bosch

Lower Mainland real estate markets got off to a roaring start in 2008, but faltered after buyers were caught in the growing economic malaise and took a step back.

In Metro Vancouver, real estate sales fell by 35 per cent in 2008 to 24,626, units compared with 38,000 the previous year, the Real Estate Board of Greater Vancouver reported Monday, putting sales at their lowest level since 2000, according to Canada Mortgage and Housing Corp. records.

The so-called benchmark price for a typical home within Metro Vancouver fell by almost 15 per cent from its peak, hitting $484,211 in December, down from $568,411 in May.

Robyn Adamache, an analyst for Canada Mortgage and Housing, added that Metro Vancouver’s inventory of unsold homes at the end of 2008 stood at a 12-month supply, its highest level since about 1985.

In the Fraser Valley, 2008 sales dropped 30 per cent to 13,194 units compared with 18,862 in 2007.

The so-called benchmark price of a typical detached house in the Fraser Valley fell almost 10 per cent from May to hit $496,391.

Tsur Somerville, director of the centre for urban economics and real estate at the Sauder School of Business at the University of B.C., said the sales figures reflect that “the downturn didn’t get really serious until midway through the year.”

Following a longer-than-average seven-year upswing, prices hit their peak in the first half of the year, Somerville said. Then the market ran into the global credit crisis and economic decline that delivered a wallop to consumer confidence.

“This is not a situation where low interest rates are going to solve the problem,” Somerville said in an interview. “This is a situation where people have to feel better about the economy. We’re waiting for the economy to get better before anything [in real estate markets] really improves”

Adamache said B.C. has done better than other provinces, including Ontario, “so it just comes down to the uncertainty affecting people’s [decision-making].”

However, Somerville said there is a wait-and-see element to just how badly the provincial economy might be stung by a downturn in the commodity sector that took hold near the end of the year.

He said B.C. housing prices did overshoot their equilibrium more than those in other markets such as Ontario.

“What we gain by perhaps not having as hard an economic hit as other areas of Canada we lose because we were more out of line in terms of our underlying housing market [being] more overvalued than places like Toronto,” Somerville said.

Dave Watt, president of the Real Estate Board of Greater Vancouver, said in a news release that “lower prices haven’t been a concern [for buyers] as much as the perception that prices are falling.”

“It’s difficult to identify the bottom of the market,” Watt said. “The reality is that people tend to buy when prices are going up, not when they’re going down.”

Greater Vancouver capped off 2008 with 924 MLS sales in December, which was a 51-per-cent decline from the same month in 2007.

However, those 924 sales represented an increase from 874 transactions recorded in November, the first time in 27 years that December sales beat November.

Kelvin Neufeld, president of the Fraser Valley Real Estate Board, said realtors in the valley also saw December sales surpass November’s, perhaps signaling “buyers recognize the current advantages of price reductions.”

However, Somerville said that while the decline in sales in the region may stabilize over the first part of the year, people shouldn’t expect “anything good to happen” before the start of summer.

“We’re in a place where any [economic] surprises are going to be bad surprises,” Somerville said, “they’re not going to be good surprises.”

© Copyright (c) The Vancouver Sun