Tight credit leads to firms seeking creditor protection or projects going into receivership

Fiona Anderson

Sun

The number of real estate sales may have bounced back in March compared to February, but they are still well below levels of a year ago, and so are prices. What is clearly up, however, is the number of condominium developers seeking creditor protection or going into receivership.

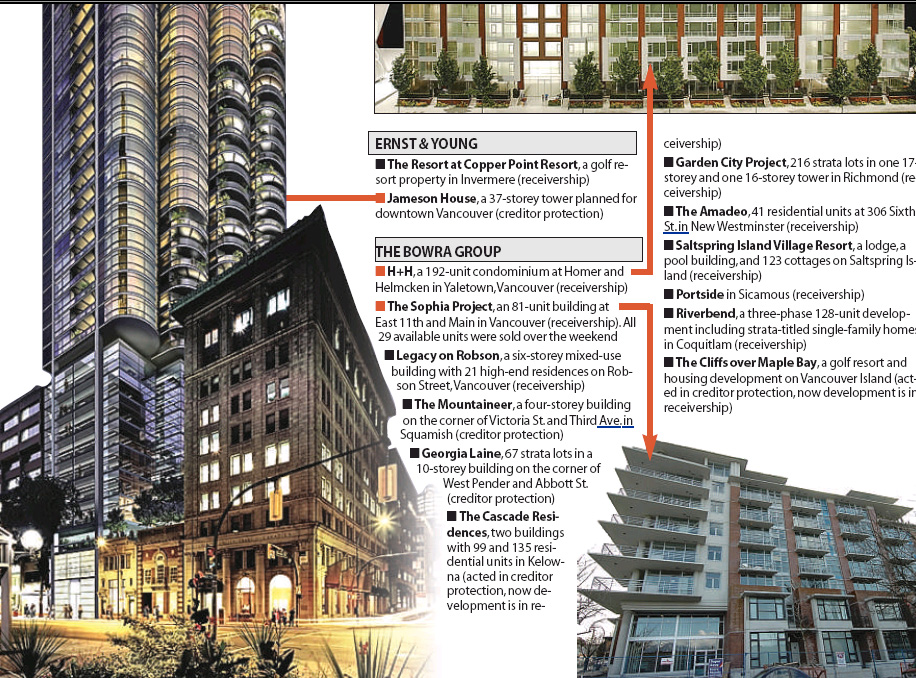

It started in June 2007, when the Riverbend condominium project in Coquitlam was the first to succumb and the Bowra Group was appointed receiver. Since then the Bowra Group has been involved in 11 more developments that are struggling and in creditor protection until they can restructure or have gone into receivership.

“I think it’s just a sign of the economy. The forest industry has been in trouble for some time and has its casualties, and the real estate industry has been challenged for a while now,” Bowra group president David Bowra said in an interview.

Most of the developments follow the same pattern. The developer runs out of money, the lender goes to court and has a receiver appointed and the receiver finishes the building and gets the best price it can for the units. Others seek creditor protection, asking the court for time to get their financial houses in order before the lender comes knocking.

Many developers got into trouble when credit markets seized up in 2008, said Larry Prentice, senior vice-president at Ernst & Young Inc., which is acting as receiver for the Resort at Copper Point in Invermere.

Money just wasn’t available, or those who had money were being choosier about who they lent to, he said. And some developers “were reliant on there being more money to keep it afloat.”

“[It’s] like the Warren Buffett quote that you don’t know who’s swimming naked until the tide goes out,” Prentice said. “The tide kind of went out towards the end of 2008.”

The Sophia condominium project on East 11th Avenue in Vancouver was pushed into bankruptcy when cost overruns of $4 million meant the pre-sale prices asked when the units were marketed in 2005 and 2006 — between $364,000 and $689,000 — wouldn’t cover costs. When the Bowra Group stepped in, purchasers were given two options: pay more for their units or get their deposits back. About half chose to stay, half chose to go, Bowra said.

Earlier this week, the remaining units went on sale for prices starting as low as $295,000. At that price, most of the units have already sold.

“If I can buy a one-bedroom condo in the Lower Mainland for under $300,000 including GST, I think that’s a great price,” Bowra said.

Prices charged in receiverships have to be approved by the court, so they can’t be too low.

“At the end of the day, we price them to sell,” Bowra said.

“I think often receiverships do represent opportunities,” he added.

And more opportunities are just around the corner with a number of developments in receivership just a few months from completion, including the Mountaineer in Squamish and the Amadeo in New Westminster.

There are some things to think about if buying a condo from a receiver. First, the Bowra Group requires offers to be subject-free, so buyers have to do their homework and get pre-approved for a mortgage before they make the offer, Bowra said.

Also, there is no real estate commission, but the Bowra Group does pay a referral fee of $5,000 to realtors, so realtors are welcome.

One thing that isn’t different is the quality of the building, Bowra said. Under B.C. law, all developments have to provide a warranty and whatever company agrees to do that is going to ensure the quality is sound, he said.

“I think the real difference [between condos in and not in receivership] is the price,” Bowra said.

“Some people think a receivership’s a gimmick, that it’s deliberate to let people think they’re getting a deal,” Bowra said.

“The one piece of advice I would suggest to a buyer is, if you’re not sure, talk to your realtor.”

© Copyright (c) The Vancouver Sun