Octogenarian owner fearful $300,000 loan may not go through

Kent Spencer

Province

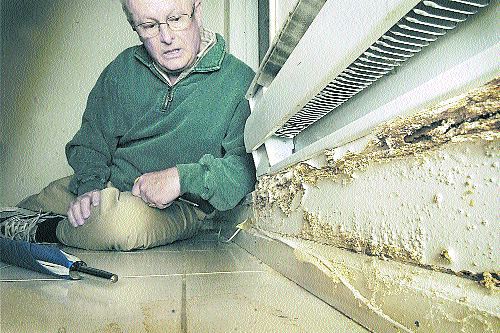

James Balderson inspects rot caused by leaking water behind a baseboard in the kitchen of a neighbour’s leaky Vancouver condo. ‘People are despairing,’ says condo advocate John Grasty, who founded an owners group with Balderson. Photograph by: Wayne Leidenfrost, The Province

Bulging walls, rot in closets and tilting posts — Mary Kagami has seen it all during 17 years of condo ownership.

The elderly Vancouverite is praying the B.C. Housing Ministry has funds available for her pre-approved $300,000 loan in spite of a sudden cash shortage.

“This has been extremely stressful,” said Kagami, a frail octogenarian who speaks three languages.

“It just knocked me out. What a way to end my days. It’s been a nightmare,” she said yesterday on a tour of her rundown unit in the 2300-block Laurel Street.

“It started leaking the day after I bought it in 1992. All my life savings went into it. I should have walked away.”

The building was one of thousands built under faulty designs; rain protection was inadequate, so water leaked through exterior surfaces to the interior.

Water marks can be seen on the ceiling; there is a hole in the kitchen wall where rotten wood falls away.

“No wonder it’s falling apart,” she said.

Engineers say Kagami’s share of the fix in the seven-unit building would cost $300,000 — more than the $281,000 that B.C. Assessment says the property is worth.

Kagami, who lives on an old-age pension, said she is unable to “cough up” the money.

The next bit is problematic. She has a 2007 loan “approval” signed by the manager of the province’s Home Protection Office.

HPO has given out $670 million worth of interest-free loans to leaky-condo owners, but the province now says funds are short.

HPO’s revenues are generated from $750 levies charged on all new units built in B.C. Construction has slowed during the recession and fewer fees have been received.

“Lending depends on the availability of funds,” said a spokesman for Housing Minister Rich Coleman.

Kagami said she hopes “they don’t cancel the loan.”

HPO can’t loan the money until owners of the other units agree on how and when to fix the leaks. Their agreement and a construction contract are necessary for HPO to deliver on its promises.

Meanwhile, leaky-condo advocates believe the problem will affect hundreds of owners.

“People are being turned down for loans. They are despairing,” said condo advocate John Grasty, who founded an owners group with Dr. James Balderson, and who has been advising Kagami.

“Doctors tell me there will be increased mental-health caseloads. There will be bankruptcies as well,” he said. “Experts say this problem will continue for another 10 years. There needs to be justice.”

Coleman was unavailable for comment.

© Copyright (c) The Province